Understanding Stock Price Pins

Stock price pins, a significant price action pattern, offer valuable insights into market sentiment and potential future price movements. This comprehensive guide delves into the definition, identification, interpretation, and contextual considerations of stock price pins, equipping traders with the knowledge to effectively utilize this powerful analytical tool.

Defining “Stock Price Pins”

A stock price pin is a candlestick pattern characterized by a long body and a relatively short wick (shadow). The long body indicates a significant price move during the trading period, while the short wick suggests a temporary reversal or hesitation in the prevailing trend. This pattern signifies a potential battle between buyers and sellers, with one side temporarily dominating before the other takes over.

Several types of stock price pins exist, including bullish pins (where the long body is on the bottom, and the small wick is on top), bearish pins (where the long body is on top, and the small wick is on the bottom), and doji pins (with almost no body, suggesting strong indecision). The formation can appear at various price levels, such as near support or resistance, indicating potential trend reversals or continuations.

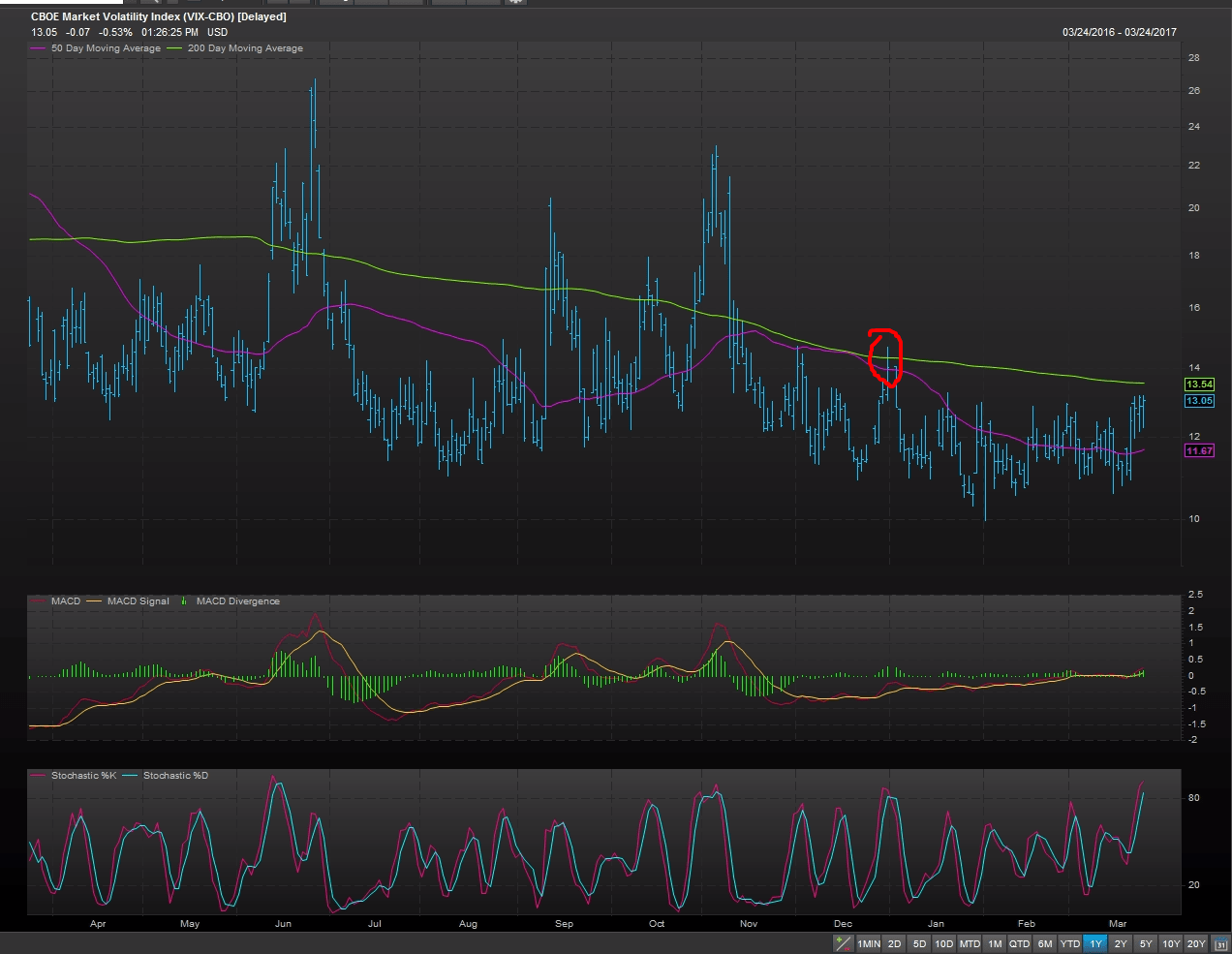

Factors contributing to stock price pin formations include sudden news events, significant order imbalances, or the exhaustion of a prevailing trend. Technical indicators, such as RSI or MACD, can sometimes precede or accompany the formation of a pin, further reinforcing its significance.

| Feature | Stock Price Pin | Hammer | Hanging Man | Shooting Star |

|---|---|---|---|---|

| Body Length | Long | Long | Long | Long |

| Wick Length | Short | Short (upper wick minimal) | Short (lower wick minimal) | Short (lower wick minimal) |

| Location | Variable | At support | At resistance | At resistance |

| Implication | Potential reversal or continuation | Bullish reversal | Bearish reversal | Bearish reversal |

Identifying Stock Price Pins

Visual identification of stock price pins involves analyzing candlestick charts. A pin is characterized by a long body and a very short wick on the opposite side. Confirmation often requires considering volume. High volume accompanying a pin reinforces its significance, suggesting a substantial shift in market sentiment. Low volume, however, might indicate a less reliable signal.

A checklist for verifying a potential stock price pin includes assessing the length of the body relative to the wick, examining the volume accompanying the candlestick, and considering the pin’s location relative to existing support and resistance levels.

- Long body relative to the wick

- Short wick on the opposite side of the body

- Significant volume (usually higher than average)

- Placement near support or resistance levels

- Confirmation from other technical indicators (optional)

Interpreting Stock Price Pins

Source: marketwatch.com

The implications of a stock price pin for traders depend heavily on its context. A bullish pin near support suggests a potential bottom, while a bearish pin near resistance may signal a top. Trading strategies vary depending on the pin’s location and confirmation signals. For instance, a bullish pin near support might signal a long position, while a bearish pin near resistance might trigger a short position.

Risk management is crucial when trading based on stock price pins. Stop-loss orders should be placed to limit potential losses. Diversification and position sizing are essential for managing overall portfolio risk. Incorporating pin analysis into a broader trading strategy involves integrating it with other technical and fundamental analysis methods for more robust decision-making.

Stock Price Pins and Market Context

Source: roccasisters.ca

Broader market conditions significantly influence the interpretation of stock price pins. A bullish pin in a strong bull market might simply be a minor pullback, while the same pin in a bear market could signal a more significant reversal. News events and announcements can also affect the significance of a pin; a positive news event might invalidate a bearish pin, while negative news might reinforce it.

Stock price pins behave differently in bull and bear markets. In bull markets, bullish pins are more likely to be followed by upward movements, while bearish pins might represent temporary corrections. The opposite is true in bear markets. A hypothetical scenario illustrating misinterpretation involves a bullish pin forming in a bear market, leading a trader to incorrectly assume a reversal, resulting in losses.

Illustrating Stock Price Pins

Source: foolcdn.com

A bullish stock price pin might show a closing price of $50, opening price of $48, high of $52, and low of $47, with high volume compared to previous days. The long body represents the upward price movement, and the small upper wick shows buyers’ hesitation near $52. Conversely, a bearish pin could display a closing price of $60, opening price of $62, high of $63, and low of $58, with high volume.

The long body reflects the downward movement, and the small lower wick indicates sellers’ hesitation near $58.

A strong pin is characterized by a longer body and a significantly shorter wick, while a weak pin has a shorter body and a relatively longer wick. A situation where a stock price pin fails to provide a reliable signal could involve a pin forming with low volume, followed by a continuation of the existing trend rather than a reversal.

For instance, a bullish pin might form with low volume near support, and the price continues to decline, suggesting the pin was not a reliable indicator of a trend reversal.

Common Queries

What is the difference between a bullish and a bearish stock price pin?

A bullish pin has a long lower wick (shadow) and a small body, suggesting strong buying pressure overcame initial selling. A bearish pin has a long upper wick and a small body, indicating strong selling pressure countered initial buying.

How reliable are stock price pins as trading signals?

Stock price pins are not foolproof signals. Their reliability depends on various factors, including volume confirmation, market context, and the overall strength of the pattern. Confirmation from other technical indicators is often advisable.

Can I use stock price pins in conjunction with other trading strategies?

Absolutely. Stock price pin analysis complements other strategies, such as support/resistance trading, trend following, or moving average crossovers. Integrating them can provide a more comprehensive trading approach.

What are some common mistakes traders make when interpreting stock price pins?

Ignoring volume confirmation, misinterpreting the pin in the context of the broader market trend, and failing to incorporate proper risk management are common pitfalls. Over-reliance on a single signal without confirmation is also a frequent mistake.