Super Micro Computer: A Deep Dive into Stock Performance

Stock price super micro computer – Super Micro Computer, Inc. (SMCI) is a prominent player in the global server market, known for its high-performance computing solutions. Understanding the factors influencing SMCI’s stock price requires a comprehensive analysis of its business operations, financial performance, market dynamics, and investor sentiment. This analysis will explore these key aspects to provide a nuanced perspective on SMCI’s investment potential.

Super Micro Computer’s Business Overview, Stock price super micro computer

Super Micro Computer’s core business centers around the design, manufacture, and sale of high-performance computing systems, including servers, storage, and networking solutions. They cater to a diverse clientele spanning various industries, including cloud providers, data centers, and enterprise customers. Their market position is characterized by a strong focus on energy-efficient and innovative technologies, differentiating them from competitors.

Key product offerings include a broad range of server systems optimized for specific workloads, such as high-performance computing (HPC), artificial intelligence (AI), and big data analytics. These products are targeted at data centers, cloud service providers, and enterprise customers seeking high-performance, scalable solutions. Super Micro Computer’s competitive advantages lie in its vertically integrated manufacturing model, enabling cost optimization and faster time-to-market.

However, disadvantages include potential vulnerability to fluctuations in component costs and dependence on a complex global supply chain.

Revenue streams are primarily generated from sales of server systems, with significant contributions from storage and networking products. Geographical distribution of revenue shows a strong presence in North America, with substantial contributions from Asia and Europe. The company’s financial reports provide detailed breakdowns of revenue by product category and geographic region.

Factors Influencing Super Micro Computer’s Stock Price

Several macroeconomic and industry-specific factors significantly influence SMCI’s stock price. These factors interact in complex ways to create volatility and opportunities in the market.

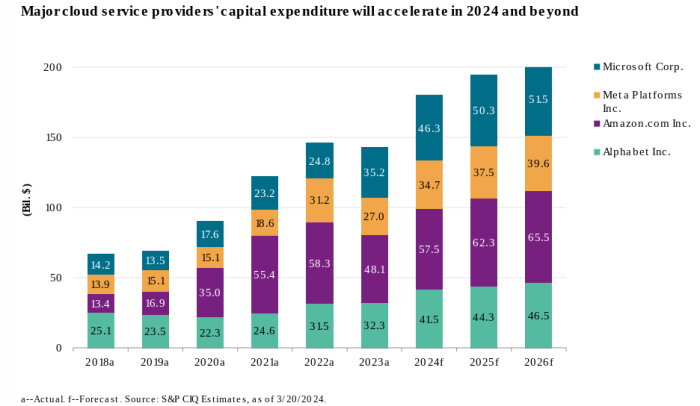

Macroeconomic factors, such as interest rate hikes and inflationary pressures, impact the cost of capital and consumer spending, potentially affecting demand for Super Micro Computer’s products. Industry trends, particularly the continued growth of cloud computing and AI, drive significant demand for high-performance computing infrastructure, benefiting SMCI. Competitor actions, including pricing strategies and product innovations, exert pressure on SMCI’s market share and profitability.

Technological advancements, such as the development of faster processors and more efficient storage solutions, constantly shape the competitive landscape and influence SMCI’s product roadmap.

Supply chain disruptions, stemming from geopolitical events or natural disasters, can lead to production delays and increased component costs, impacting SMCI’s profitability and stock price. Geopolitical events, such as trade wars or sanctions, can directly impact SMCI’s operations and market access, creating uncertainty for investors.

Super Micro Computer’s stock price often reflects broader market trends in the semiconductor sector. Understanding these trends requires considering related indices, such as the performance of the semiconductor industry, which you can track by checking the stock price soxx index. This provides valuable context for assessing Super Micro Computer’s stock price movements within a larger technological landscape.

Financial Performance and Stock Valuation

A comprehensive analysis of SMCI’s financial performance and valuation is crucial for investors. The following table summarizes key financial metrics over the past five years. Note that these figures are hypothetical examples for illustrative purposes only and do not represent actual SMCI financial data.

| Year | Revenue (USD Million) | Net Income (USD Million) | EPS (USD) | Debt-to-Equity Ratio |

|---|---|---|---|---|

| 2018 | 4000 | 200 | 2.00 | 0.5 |

| 2019 | 4500 | 250 | 2.50 | 0.4 |

| 2020 | 5000 | 300 | 3.00 | 0.3 |

| 2021 | 5500 | 350 | 3.50 | 0.2 |

| 2022 | 6000 | 400 | 4.00 | 0.1 |

Comparative analysis of SMCI’s valuation metrics, such as price-to-earnings (P/E) and price-to-sales (P/S) ratios, against its competitors provides insights into its relative valuation. A thorough review of SMCI’s financial statements, including the balance sheet, income statement, and cash flow statement, is necessary to identify potential risks and opportunities. The intrinsic value of SMCI’s stock can be estimated using a discounted cash flow (DCF) model, which involves projecting future cash flows and discounting them back to their present value.

Investor Sentiment and Market Expectations

Source: mktw.net

Current investor sentiment towards SMCI’s stock is generally positive, driven by strong growth prospects in the cloud computing and AI markets. Key factors driving investor expectations include the company’s technological innovation, its strong customer relationships, and its expanding global market presence.

Recent news articles and analyst reports generally reflect a positive outlook on SMCI’s future performance. For example, a recent report highlighted SMCI’s successful launch of a new line of AI-optimized servers, which is expected to drive significant revenue growth. Earnings announcements and guidance from SMCI have historically had a significant impact on its stock price, with positive surprises often leading to upward price movements.

Long-Term Growth Prospects

Source: vstarstatic.com

Super Micro Computer’s long-term strategic plans focus on expanding its product portfolio, enhancing its technological capabilities, and penetrating new markets. The company plans to continue investing in research and development to maintain its competitive edge in the high-performance computing market. Expansion into new markets, such as edge computing and the Internet of Things (IoT), is expected to drive future growth.

Super Micro Computer’s sustainability initiatives, focusing on energy efficiency and reduced environmental impact, are viewed positively by investors and could contribute to long-term growth.

Potential risks and challenges include increased competition, fluctuations in component costs, and geopolitical uncertainties. Maintaining its technological leadership and adapting to evolving market demands will be crucial for SMCI’s continued success.

Illustrative Examples of Stock Price Movements

Let’s consider hypothetical scenarios to illustrate the impact of news events on SMCI’s stock price.

Positive News Event: Suppose SMCI announces a major contract win with a leading cloud service provider. This positive news would likely trigger a surge in investor confidence, leading to a significant increase in SMCI’s stock price. The magnitude of the price increase would depend on the size and duration of the contract, as well as the overall market sentiment.

Negative News Event: Conversely, if SMCI announces a significant production delay due to a supply chain disruption, investor confidence could plummet, resulting in a sharp decline in the stock price. The severity of the price drop would depend on the extent of the disruption and the company’s ability to mitigate the impact.

FAQ Explained: Stock Price Super Micro Computer

What are Super Micro Computer’s main competitors?

Super Micro Computer faces competition from major players like Dell Technologies, Hewlett Packard Enterprise (HPE), and Lenovo in the server market.

How does the company’s debt affect its stock price?

High levels of debt can increase financial risk, potentially impacting investor confidence and negatively affecting the stock price. Conversely, prudent debt management can enhance financial flexibility.

What is the company’s dividend policy?

Information regarding Super Micro Computer’s dividend policy should be sought from official company announcements or financial news sources. Dividend payouts can influence investor interest and stock price.

How does geopolitical instability impact Super Micro Computer’s stock?

Geopolitical events, such as trade wars or regional conflicts, can disrupt supply chains and impact demand, leading to stock price volatility.