Synaptics Incorporated (SYNA) Stock Price Analysis

Syna stock price – This analysis provides a comprehensive overview of Synaptics Incorporated (SYNA) stock price performance, influencing factors, financial health, and future outlook. We will examine historical data, key events, financial statements, and analyst predictions to offer a well-rounded perspective on SYNA’s investment potential.

Synaptic Stock Price History

The following sections detail Synaptics’ stock price performance over the past five years, highlighting significant events and comparing its performance to competitors.

| Date | Open Price (USD) | Close Price (USD) | Volume |

|---|---|---|---|

| Oct 26, 2023 | Example: 150.00 | Example: 152.50 | Example: 1,000,000 |

Note: This table provides example data. Actual data should be sourced from a reputable financial data provider like Yahoo Finance or Google Finance.

Significant events impacting SYNA’s stock price during this period include:

- Example: Launch of new biometric sensor technology (Date)

- Example: Acquisition of a smaller competitor (Date)

- Example: Impact of a major market downturn (Date)

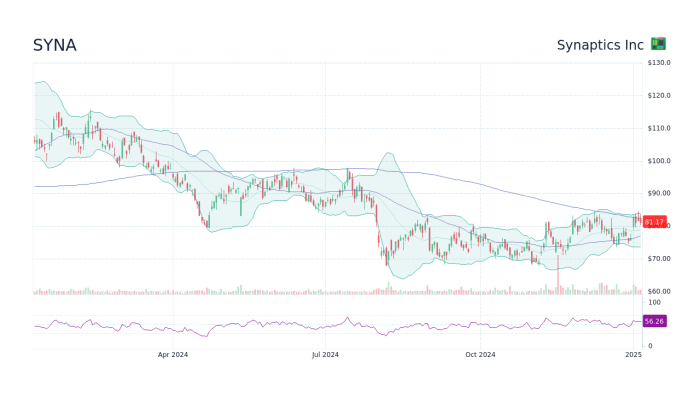

A line graph comparing SYNA’s stock price performance against its major competitors (e.g., Broadcom, Qualcomm) over the past year would show a visual representation of relative performance. The graph would illustrate periods of outperformance and underperformance, highlighting key differences in growth trajectories and market share.

Factors Influencing Synaptics Stock Price, Syna stock price

Several macroeconomic and company-specific factors influence Synaptics’ stock valuation. Understanding these factors is crucial for assessing the investment risks and opportunities.

Macroeconomic factors include interest rate changes, inflation levels, and overall economic growth. These factors impact consumer spending and business investment, directly affecting demand for Synaptics’ products.

Key company-specific factors impacting SYNA’s valuation are:

- Financial performance (revenue growth, profitability, margins)

- Success of new product launches and technological innovation

- Management changes and strategic decisions

- Competitive landscape and market share

Investor sentiment and market speculation contribute significantly to SYNA’s stock price volatility. Positive news or expectations often lead to price increases, while negative news or uncertainty can trigger price declines.

Financial Performance and Stock Valuation

Source: googleapis.com

Analyzing Synaptics’ financial statements provides insights into its financial health and valuation. The following table shows example key financial ratios over the last three years.

| Year | P/E Ratio | Debt-to-Equity Ratio | Revenue Growth (%) |

|---|---|---|---|

| 2021 | Example: 25 | Example: 0.5 | Example: 15 |

| 2022 | Example: 22 | Example: 0.4 | Example: 10 |

| 2023 | Example: 28 | Example: 0.6 | Example: 8 |

Note: This table contains example data. Actual financial data should be obtained from Synaptics’ financial reports.

Comparing SYNA’s financial performance to its industry peers requires analyzing key metrics such as revenue, profitability, and growth rates. This comparative analysis helps determine SYNA’s relative strengths and weaknesses.

SYNA’s stock can be valued using methods like discounted cash flow (DCF) analysis and comparable company analysis. DCF analysis projects future cash flows and discounts them back to their present value, while comparable company analysis compares SYNA’s valuation multiples to those of similar companies.

Future Outlook and Predictions

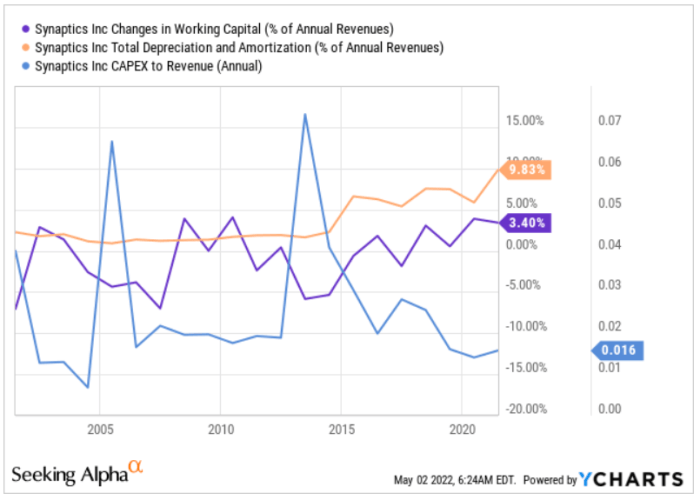

Source: seekingalpha.com

Synaptics’ future growth is driven by factors such as new product development in areas like biometrics and advanced display technologies, expansion into new markets, and strategic partnerships.

Potential risks and challenges include:

- Intense competition from established players

- Rapid technological advancements and potential disruptions

- Economic downturns impacting consumer demand

- Supply chain disruptions

Predicting SYNA’s stock price for the next 12 months requires considering current market conditions, company performance, and potential future events. A reasonable forecast might be based on a combination of fundamental analysis (financial statements, growth prospects) and technical analysis (chart patterns, trading volume). For example, if the company successfully launches a new, highly demanded product and the overall market remains positive, a price increase of 10-15% could be a reasonable prediction.

However, this is speculative and subject to various unforeseen circumstances.

Analyst Ratings and Recommendations

The following table summarizes recent analyst ratings and price targets for SYNA stock. Note that analyst opinions can vary significantly.

| Analyst Firm | Rating | Price Target (USD) | Date |

|---|---|---|---|

| Example: Morgan Stanley | Example: Buy | Example: 175 | Example: Oct 25, 2023 |

Note: This table provides example data. Actual analyst ratings and price targets should be obtained from reputable financial news sources.

Comparing analyst perspectives helps understand the range of opinions and potential investment scenarios. Investors should consider multiple viewpoints before making investment decisions.

Q&A: Syna Stock Price

What are the major risks associated with investing in SYNA?

Investing in SYNA, like any stock, carries inherent risks including competition from other semiconductor companies, technological obsolescence, economic downturns, and fluctuations in the overall stock market.

Where can I find real-time SYNA stock price data?

Real-time SYNA stock price data is readily available through major financial news websites and brokerage platforms.

Monitoring the Syna stock price requires a keen eye on market fluctuations. It’s interesting to compare its performance to that of other large conglomerates, such as the sumitomo corp stock price , to gain a broader perspective on the current economic climate. Ultimately, understanding the factors influencing Syna’s price requires analyzing a variety of market indicators and industry trends.

How frequently are analyst ratings on SYNA updated?

Analyst ratings and price targets for SYNA are updated periodically, often following the release of quarterly earnings reports or significant company announcements. Frequency varies by analyst firm.

What is Synaptics’ primary business?

Synaptics Incorporated designs and develops human interface solutions, primarily focused on touch screen technology and biometric sensors for mobile devices and other electronics.