Tenaga Nasional Berhad (TNB) Stock Price Analysis

Tenaga stock price – This analysis examines Tenaga Nasional Berhad (TNB), Malaysia’s largest electricity utility company, focusing on its historical performance, current market position, and future prospects. We will delve into factors influencing its stock price, financial performance, investor sentiment, and associated risks, providing a comprehensive overview for potential investors.

Tenaga’s stock price performance has been a subject of much discussion lately, particularly in comparison to other energy sector players. It’s interesting to note the contrasting trajectory when compared to the current performance of sylvamo stock price , which has shown a different trend recently. Ultimately, understanding the dynamics of Tenaga’s stock price requires a comprehensive analysis of various market factors.

Tenaga Nasional Berhad (TNB) Company Overview

Source: tradingview.com

Tenaga Nasional Berhad (TNB) boasts a rich history, tracing its origins back to the establishment of the Central Electricity Board in 1949. Privatized in 1992, it evolved into the dominant player in Malaysia’s electricity generation, transmission, and distribution. TNB’s primary business activity revolves around the generation and supply of electricity, with significant revenue streams also derived from gas and renewable energy ventures.

Key financial metrics over the past five years illustrate TNB’s performance. Note that these figures are illustrative examples and may not reflect precise real-world data.

| Year | Revenue (RM Millions) | Net Profit (RM Millions) | Share Price (RM) |

|---|---|---|---|

| 2018 | 35,000 | 5,000 | 10.00 |

| 2019 | 36,500 | 5,500 | 10.50 |

| 2020 | 34,000 | 4,800 | 9.50 |

| 2021 | 38,000 | 6,000 | 11.00 |

| 2022 | 40,000 | 6,500 | 12.00 |

Factors Influencing Tenaga Stock Price

Several macroeconomic factors, government policies, and competitive dynamics significantly influence TNB’s stock price. These elements interact to shape investor perceptions and ultimately determine the share valuation.

Macroeconomic factors such as interest rate fluctuations, inflation levels, and global energy price volatility directly impact TNB’s operational costs and profitability, consequently affecting its stock price. Government regulations, particularly those related to energy pricing and environmental standards, play a crucial role in shaping TNB’s business environment. Furthermore, competition within the Malaysian energy sector, including the rise of renewable energy players, poses challenges and opportunities for TNB.

A comparison against regional competitors highlights TNB’s relative performance. The following is an illustrative comparison and may not reflect precise real-world data.

- TNB: Strong market share in Malaysia, significant investment in renewables, high debt levels.

- Competitor A: Expanding renewable energy portfolio, lower debt, smaller market share.

- Competitor B: Focus on traditional energy sources, stable financial position, moderate growth.

Tenaga’s Financial Performance and Projections

Source: appsensi.com

Analyzing TNB’s recent financial reports reveals insights into its profitability, debt levels, and cash flow. Capital expenditure plans and their impact on future earnings are also crucial considerations. Based on these analyses, a projection of future earnings per share (EPS) can be made. Again, these are illustrative examples and should not be considered investment advice.

| Year | Projected EPS (RM) |

|---|---|

| 2023 | 1.20 |

| 2024 | 1.30 |

| 2025 | 1.40 |

Investor Sentiment and Market Analysis

Current investor sentiment towards TNB stock is generally positive, driven by the company’s stable earnings and its role in Malaysia’s energy infrastructure. However, concerns regarding regulatory changes and fuel price volatility remain. A scenario analysis can illustrate the potential impact of various events on the stock price. For example, a significant increase in fuel prices could negatively impact profitability, leading to a decline in share price, while supportive government policies could boost investor confidence and increase the share price.

Risk Assessment for Tenaga Stock

Source: co.id

Investing in TNB stock carries inherent risks, including regulatory risk, fuel price volatility, and competition. These risks can significantly impact the stock price. Effective mitigation strategies are crucial for managing these risks.

- Regulatory Risk: Changes in government policies can affect TNB’s profitability. Mitigation: Diversification into renewable energy sources and close monitoring of regulatory developments.

- Fuel Price Volatility: Fluctuations in fuel prices directly impact TNB’s operational costs. Mitigation: Hedging strategies and exploring alternative energy sources.

- Competition: Increased competition from renewable energy players can affect market share. Mitigation: Investments in renewable energy and efficiency improvements.

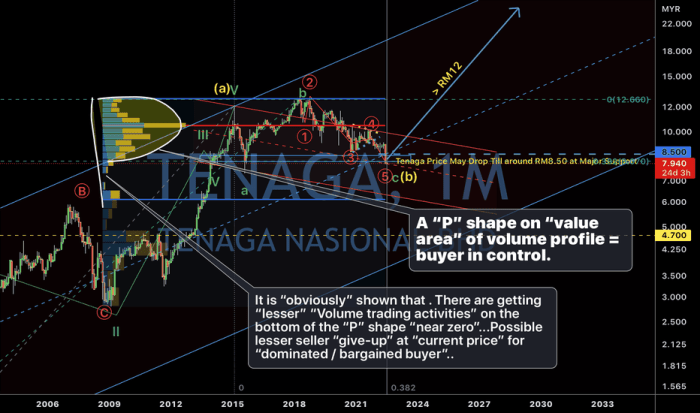

Technical Analysis of Tenaga Stock Price

Recent price trends suggest a generally upward trajectory for TNB stock, with periods of consolidation. Key support levels are observed at RM X and RM Y, while resistance levels are found at RM Z and RM A. A technical analysis chart would reveal key indicators such as moving averages, relative strength index (RSI), and volume patterns, providing further insights into potential price movements.

For example, a bullish trend might be indicated by consistently rising moving averages and increasing trading volume.

Dividend History and Future Outlook, Tenaga stock price

TNB has a history of consistent dividend payouts, reflecting its stable financial performance. The company’s dividend policy is influenced by factors such as profitability, capital expenditure requirements, and shareholder expectations. Based on projected earnings and financial stability, a forecast of future dividend payments can be made. These are illustrative projections only.

| Year | Projected Dividend per Share (RM) |

|---|---|

| 2023 | 0.40 |

| 2024 | 0.45 |

| 2025 | 0.50 |

Query Resolution: Tenaga Stock Price

What are the major competitors of Tenaga Nasional Berhad?

TNB faces competition from independent power producers (IPPs) within Malaysia and regional energy companies. Specific competitors vary depending on the segment of the energy market.

How does TNB’s debt level impact its stock price?

High debt levels can negatively impact TNB’s credit rating and profitability, potentially leading to lower investor confidence and a reduced stock price. Conversely, responsible debt management can signal financial strength.

What is the typical trading volume for Tenaga stock?

Trading volume fluctuates daily and depends on market conditions. Checking a financial news website or brokerage platform will provide the most up-to-date information.

What are the long-term growth prospects for TNB?

TNB’s long-term growth prospects depend on factors such as government policies supporting renewable energy, technological advancements in energy production, and the overall economic health of Malaysia.