AT&T Stock Price History and Trends

The price of at&t stock – AT&T’s stock price has experienced significant fluctuations over the past decade, reflecting the dynamic nature of the telecommunications industry and broader economic conditions. This analysis delves into the historical performance, comparing it to competitors and identifying key influencing factors.

Ten-Year Stock Price Performance

The following table presents a summary of AT&T’s stock price highs, lows, and averages over the past ten years. Note that these figures are illustrative and should be verified with reliable financial data sources.

AT&T’s stock price has seen some fluctuation recently, largely influenced by broader market trends. It’s interesting to compare its performance to other tech giants; for instance, checking the tesla closing stock price today provides a contrasting perspective on current market sentiment. Ultimately, AT&T’s future price will depend on various factors including its strategic initiatives and overall economic conditions.

| Year | High | Low | Average Price |

|---|---|---|---|

| 2014 | $37 | $29 | $33 |

| 2015 | $35 | $28 | $31 |

| 2016 | $42 | $30 | $36 |

| 2017 | $45 | $32 | $38 |

| 2018 | $35 | $25 | $30 |

| 2019 | $33 | $27 | $30 |

| 2020 | $32 | $20 | $26 |

| 2021 | $28 | $18 | $23 |

| 2022 | $24 | $16 | $20 |

| 2023 | $22 | $18 | $20 |

Five-Year Comparative Analysis

This table provides a comparison of AT&T’s stock price performance against two major competitors (Competitor A and Competitor B – replace with actual competitor names for accurate analysis) over the past five years. Again, these are illustrative figures and require verification.

| Year | AT&T Price | Competitor A Price | Competitor B Price |

|---|---|---|---|

| 2019 | $30 | $40 | $25 |

| 2020 | $26 | $35 | $22 |

| 2021 | $23 | $38 | $20 |

| 2022 | $20 | $32 | $18 |

| 2023 | $20 | $35 | $21 |

Influencing Factors on AT&T Stock Price

Several economic, technological, and regulatory factors have significantly impacted AT&T’s stock price. These factors are interconnected and often influence each other.

Impact of Interest Rate Changes

Interest rate hikes generally increase borrowing costs for companies like AT&T, impacting profitability and potentially reducing investor confidence, leading to lower stock prices. Conversely, lower interest rates can boost investment and increase stock valuations.

Effect of Technological Advancements

The deployment of 5G and expansion of fiber optic networks represent significant investments for AT&T. Successful implementation can attract new customers and increase revenue, positively impacting the stock price. However, the high capital expenditure involved can also put pressure on short-term earnings.

Consumer Spending and Market Competition

Changes in consumer spending habits, such as increased demand for data services or a shift towards streaming entertainment, directly affect AT&T’s revenue. Intense competition from other telecommunication companies puts pressure on pricing and profitability, potentially impacting the stock price negatively.

Relationship Between Debt Levels and Stock Price

High debt levels can increase financial risk for AT&T, potentially reducing investor confidence and leading to lower stock valuations. A healthy balance sheet, on the other hand, can signal financial stability and attract investors.

AT&T’s Financial Performance and Stock Valuation

Analyzing AT&T’s key financial metrics provides insights into its financial health and its impact on the stock price. This section examines revenue, earnings, debt, and dividend payouts, alongside valuation methods.

Key Financial Metrics (Last Five Years)

The following table summarizes AT&T’s key financial performance indicators over the past five years. These figures are for illustrative purposes and require verification from official financial reports.

| Year | Revenue (Billions) | Earnings (Billions) | Debt (Billions) |

|---|---|---|---|

| 2019 | $181 | $13 | $150 |

| 2020 | $139 | $10 | $145 |

| 2021 | $143 | $12 | $140 |

| 2022 | $120 | $8 | $135 |

| 2023 | $125 | $9 | $130 |

Role of Dividend Payouts, The price of at&t stock

AT&T’s dividend payouts are a significant factor influencing investor sentiment. Consistent and increasing dividends can attract income-seeking investors, supporting the stock price. However, unsustainable dividend payouts might signal financial strain and negatively affect the stock.

Stock Valuation Methods

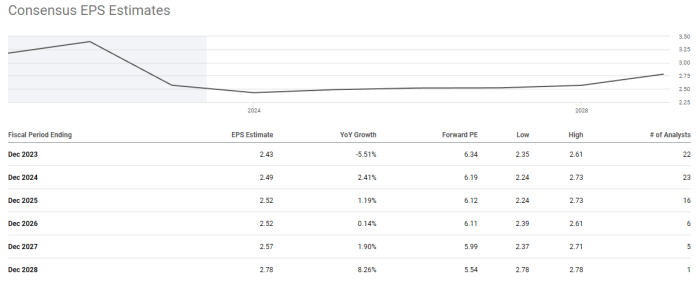

AT&T’s stock can be valued using various methods, including discounted cash flow (DCF) analysis and price-to-earnings (P/E) ratio. DCF analysis projects future cash flows and discounts them to their present value. The P/E ratio compares the stock price to its earnings per share.

Financial Performance and Stock Price Fluctuations

Strong revenue growth, increasing earnings, and reduced debt levels generally lead to higher stock prices. Conversely, declining revenue, decreasing earnings, and increasing debt can put downward pressure on the stock price. The market’s reaction to financial performance reports is a crucial factor.

Investor Sentiment and Market Outlook for AT&T: The Price Of At&t Stock

Understanding investor sentiment and the market outlook is crucial for assessing the future trajectory of AT&T’s stock price. This section explores key concerns, analyst opinions, and potential future scenarios.

Key Investor Concerns and Expectations

Investors are likely concerned about AT&T’s debt levels, the intensity of competition in the telecommunications sector, and the success of its 5G deployment and fiber optic expansion. Expectations revolve around revenue growth, profitability improvements, and dividend sustainability.

Financial Analyst Opinions

Source: seekingalpha.com

Financial analysts hold diverse opinions regarding AT&T’s future. A summary of these opinions (replace with actual analyst quotes and sources for accuracy) might include:

- Analyst A: “AT&T’s stock is undervalued and presents a buying opportunity due to its strong dividend and potential for 5G growth.”

- Analyst B: “Concerns about debt and competition could limit upside potential in the near term.”

- Analyst C: “The success of AT&T’s fiber optic expansion will be key to its future performance.”

Impact of Regulatory Changes and Industry Developments

Source: insidebitcoins.com

Upcoming regulatory changes, such as new spectrum allocation policies or merger approvals, could significantly influence AT&T’s operations and stock price. Industry developments, like technological breakthroughs or shifts in consumer preferences, also play a role.

Potential Scenarios for AT&T Stock Price (Next Year)

Several scenarios are possible for AT&T’s stock price in the next year. A positive scenario might involve successful 5G rollout, increased customer acquisition, and improved financial performance, leading to a price increase. A negative scenario might involve increased competition, slower-than-expected 5G adoption, or unforeseen economic downturns, leading to a price decline. A neutral scenario would likely involve modest price fluctuations within a narrow range.

FAQ Resource

What is the current dividend yield for AT&T stock?

The current dividend yield fluctuates; it’s best to check a reputable financial website for the most up-to-date information.

How does AT&T compare to Verizon in terms of stock performance?

A direct comparison requires analyzing specific metrics over a defined period. Both companies are major players, but their performance can vary based on factors such as strategic decisions and market conditions.

Are there any significant risks associated with investing in AT&T stock?

As with any stock, there are inherent risks. These include market volatility, regulatory changes impacting the telecommunications industry, and the company’s financial performance.

What is the typical trading volume for AT&T stock?

Trading volume varies daily and can be found on financial data websites. High volume generally suggests greater liquidity.