Fixed asset register software offers a streamlined approach to managing valuable assets. It simplifies tracking, maintenance, and depreciation, freeing up valuable time and resources for other crucial business functions. This powerful tool ensures accurate records and facilitates efficient decision-making.

By centralizing all asset data in a single, accessible platform, businesses can gain a comprehensive overview of their holdings. This enables better control over asset lifecycles and enhances overall financial reporting.

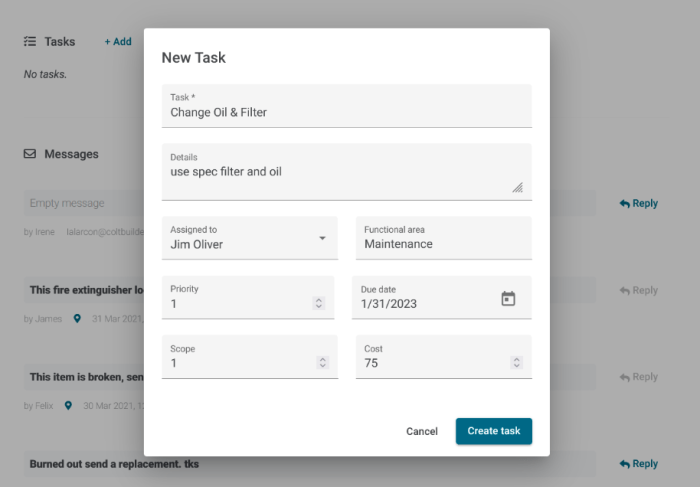

Source: nitsotech.com

In today’s dynamic business environment, efficient asset management is crucial for profitability and long-term success. A well-maintained fixed asset register is the cornerstone of this process. This comprehensive guide dives deep into fixed asset register software, exploring its functionalities, benefits, and crucial considerations for businesses of all sizes.

What is Fixed Asset Register Software?

Fixed asset register software is a specialized tool designed to manage and track a company’s fixed assets. These assets, which typically have a lifespan of more than one year, include machinery, equipment, vehicles, and property. The software streamlines the entire lifecycle of these assets, from acquisition to disposal, providing a centralized database for crucial information. This contrasts with inventory management software, which focuses on short-term assets and day-to-day operations.

Key Features of Effective Fixed Asset Register Software

- Asset Acquisition and Recording: The software should allow easy input of asset details, including purchase date, cost, description, serial number, and depreciation method.

- Depreciation Tracking: Accurate calculation and tracking of depreciation are essential for financial reporting and tax purposes. The software should support various depreciation methods.

- Maintenance Scheduling and Tracking: Integration with maintenance management systems allows for scheduled maintenance and record-keeping, preventing costly breakdowns and extending asset lifespan.

- Asset Location and Inventory Control: For businesses with extensive assets, tracking locations and monitoring asset utilization is critical for efficient operations.

- Reporting and Analytics: Comprehensive reports on asset value, depreciation, maintenance costs, and other relevant metrics are vital for informed decision-making.

- Integration with Accounting Software: Seamless integration with existing accounting systems reduces manual data entry and ensures data accuracy.

- User-Friendly Interface: A well-designed interface enhances user adoption and minimizes training time.

Benefits of Using Fixed Asset Register Software

Implementing fixed asset register software offers numerous advantages, including:

- Improved Asset Visibility and Control: Real-time tracking of assets, their location, and status enhances control and minimizes loss or theft.

- Accurate Financial Reporting: Precise depreciation calculations and asset valuation contribute to accurate financial statements.

- Reduced Operational Costs: Effective maintenance scheduling and asset utilization tracking can significantly reduce operational costs.

- Enhanced Compliance: The software can help businesses comply with regulatory requirements related to asset management and depreciation.

- Increased Efficiency: Streamlining asset management processes leads to increased efficiency and productivity across the organization.

- Data-Driven Decision Making: The comprehensive data provided by the software enables informed decisions related to asset acquisition, maintenance, and disposal.

Choosing the Right Fixed Asset Register Software

Selecting the appropriate software requires careful consideration of several factors, including:

Source: gocodes.com

- Business Size and Needs: Small businesses may benefit from simpler solutions, while larger corporations may require more robust features.

- Budget Constraints: Software options vary significantly in price, so budget constraints should be considered.

- Integration Requirements: Ensure compatibility with existing accounting and other business management software.

- Vendor Reputation and Support: Choose a vendor with a proven track record and reliable customer support.

Frequently Asked Questions (FAQ)

- Q: How much does fixed asset register software cost?

A: Software costs vary significantly depending on features, functionality, and vendor. Contact potential vendors for pricing information.

- Q: Can fixed asset register software be integrated with other business systems?

A: Many modern solutions offer seamless integration with accounting software, ERP systems, and other business tools.

- Q: What are the common challenges in implementing fixed asset register software?

A: Challenges often include data migration, user training, and ensuring data accuracy.

- Q: How does fixed asset register software improve financial reporting?

A: Accurate depreciation calculations and asset valuation contribute to more precise and reliable financial statements, ultimately aiding in better financial reporting.

Conclusion

Fixed asset register software is a powerful tool for optimizing asset management within any business. Its benefits in terms of increased efficiency, accurate financial reporting, and enhanced compliance are undeniable. By carefully considering your business needs and selecting the right software, you can unlock significant advantages and drive greater success.

Resources:

Call to Action:

Ready to streamline your fixed asset management? Explore our recommended fixed asset register software solutions today! [Link to product/service]

In conclusion, fixed asset register software is a critical component for any organization seeking to optimize asset management. Its ability to automate tasks, improve accuracy, and provide valuable insights into asset performance ultimately leads to increased efficiency and profitability. By adopting such a system, businesses can significantly improve their financial management and gain a competitive edge.

FAQ Explained: Fixed Asset Register Software

How does fixed asset register software help with depreciation calculations?

The software typically utilizes pre-set depreciation methods (straight-line, declining balance, etc.) and automatically calculates depreciation expense over the asset’s lifespan. This eliminates manual calculations and ensures compliance with accounting standards.

Source: radiantrfid.com

What security measures are in place for sensitive asset data?

Robust security protocols, such as encryption and user access controls, protect sensitive asset information. These measures ensure data confidentiality and compliance with industry regulations.

Can I integrate this software with existing accounting systems?

Many fixed asset register software solutions are designed for seamless integration with common accounting platforms, allowing for a unified view of financial data.

What are the typical costs associated with implementing this software?

Implementation costs vary based on the software’s features, the number of assets being managed, and the level of customization required. Contacting potential vendors for pricing information is essential.