Oracle netsuite accounting software – Oracle NetSuite is a robust cloud-based accounting software solution designed for businesses of all sizes. This in-depth guide explores its features, benefits, and key considerations for businesses looking to streamline their financial operations. We’ll cover everything from its core accounting functions to its integrations and scalability options.

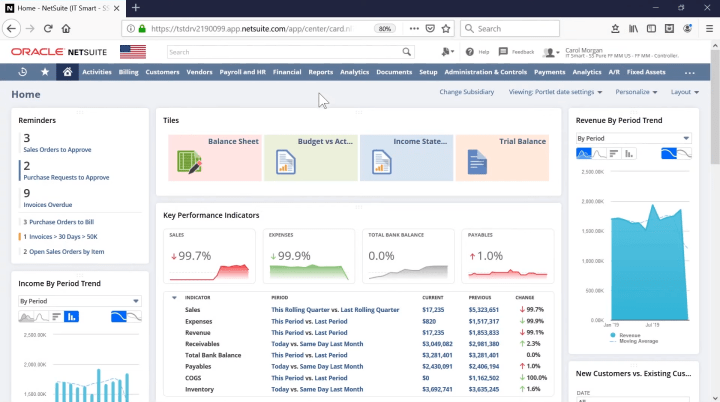

Source: co.uk

Understanding Oracle NetSuite’s Functionality: Oracle Netsuite Accounting Software

NetSuite’s accounting module is a powerful suite of tools that go beyond basic bookkeeping. It offers a complete financial management system, including general ledger, accounts payable, accounts receivable, inventory management, and more. This comprehensive approach allows businesses to maintain a holistic view of their financial health.

Core Accounting Features

- General Ledger: Tracks all financial transactions, providing a detailed view of income and expenses. This feature is crucial for financial reporting and analysis.

- Accounts Payable & Receivable: Streamlines invoice processing, payment management, and customer billing. Automation significantly reduces manual effort and potential errors.

- Inventory Management: Manages inventory levels, costs, and stock movements. Critical for businesses with significant inventory holdings, ensuring optimal stock levels and reducing waste.

- Fixed Assets Management: Tracks and depreciates fixed assets, providing accurate financial reporting for these important assets.

- Multi-Currency Support: Handles transactions in various currencies, making it suitable for international businesses.

Beyond the Basics: Advanced Capabilities

NetSuite offers more than just accounting. It integrates with other modules like CRM, e-commerce, and project management, creating a unified platform for business operations. This allows for seamless data flow and improved decision-making.

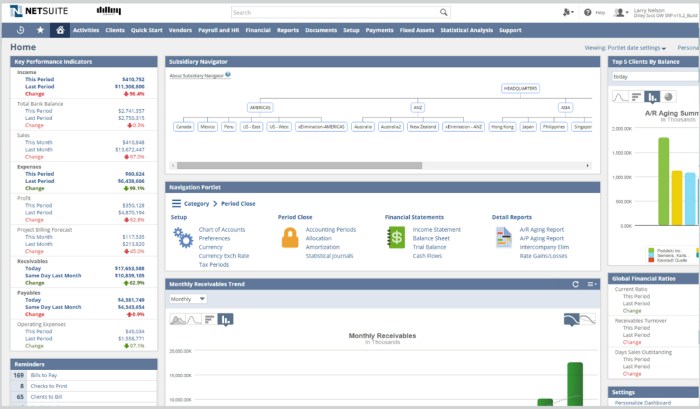

Source: softwareconnect.com

- Reporting and Analytics: Provides customizable dashboards and reports, allowing users to gain insights into key performance indicators (KPIs). This feature is crucial for strategic decision-making.

- Customization Options: NetSuite offers customization options, allowing businesses to tailor the system to their specific needs and workflows. This is essential for companies with unique accounting processes.

- Integration with Other Systems: Seamless integration with other business applications, such as CRM and e-commerce platforms, is a significant advantage. This minimizes data entry and enhances data accuracy.

Oracle NetSuite Accounting Software: Benefits and Considerations

NetSuite offers significant advantages for businesses looking for a robust accounting solution. Its cloud-based nature allows for remote access and scalability, making it suitable for growing businesses.

Benefits, Oracle netsuite accounting software

- Scalability: Easily scales to accommodate growing business needs.

- Real-time Data: Provides real-time access to financial information, crucial for informed decision-making.

- Automation: Automates many accounting tasks, reducing manual effort and errors.

- Security: Robust security measures protect sensitive financial data.

- Improved Efficiency: Streamlines financial processes and improves overall efficiency.

Considerations

- Implementation Costs: Initial implementation costs can be significant.

- Training Requirements: Staff may require training to effectively use the system.

- Customization Complexity: Customizations might be complex for certain businesses.

Choosing the Right NetSuite Plan

NetSuite offers various pricing plans to cater to different business needs and budgets. Careful consideration of the required features and scalability is crucial.

Frequently Asked Questions (FAQ)

- Q: What are the key differences between NetSuite and other accounting software?

A: NetSuite is a comprehensive cloud-based ERP system, while other solutions may focus on specific areas like bookkeeping or inventory. NetSuite’s integration capabilities and comprehensive suite of tools are its key differentiators.

- Q: How much does NetSuite cost?

A: Pricing varies depending on the chosen plan and features. Contact NetSuite for specific pricing details.

- Q: Is NetSuite suitable for small businesses?

A: Yes, NetSuite can be adapted to suit small businesses, although the larger plans might be overkill. The key is to carefully assess the required features.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a financial professional for personalized recommendations.

Source: comparecamp.com

Conclusion

Oracle NetSuite offers a powerful and comprehensive accounting solution. Its robust features, scalability, and integrations make it an attractive option for businesses seeking a complete financial management system. Careful consideration of specific needs and budget will guide the selection process.

Sources:

Ready to streamline your financial processes? Contact us today for a personalized NetSuite consultation.

Frequently Asked Questions

What are the typical pricing models for Oracle NetSuite accounting software?

Oracle NetSuite pricing is based on a subscription model, with varying tiers offering different features and functionalities. Specific pricing depends on the chosen modules and the size of the business.

How does NetSuite integrate with other business applications?

NetSuite boasts extensive integration capabilities, allowing seamless connection with various applications like CRM, e-commerce platforms, and inventory management systems. This ensures data consistency and a holistic view of business operations.

What kind of customer support is available for NetSuite users?

Oracle provides various support options, including online resources, dedicated account managers, and comprehensive documentation. Users can access assistance through different channels to resolve issues and utilize the software effectively.