Manufacturing and inventory software solutions are crucial for businesses of all sizes navigating the complexities of modern production. These systems help manage every aspect of the process, from raw materials to finished goods, optimizing efficiency and profitability. This comprehensive guide explores the key features, benefits, and considerations when selecting the right software for your needs.

Understanding the Importance of Manufacturing and Inventory Management Software

In today’s competitive landscape, efficient inventory management and streamlined manufacturing processes are paramount. Software solutions offer a powerful way to achieve these goals. By automating tasks, providing real-time data, and enhancing collaboration, these systems can significantly impact your bottom line.

Key Features of Effective Manufacturing Software, Manufacturing and inventory software

- Inventory Tracking: Real-time visibility into stock levels, location, and movement of raw materials, work-in-progress (WIP), and finished goods. This helps prevent stockouts and overstocking, optimizing inventory turnover.

- Production Planning and Scheduling: Creating detailed production schedules, optimizing resource allocation, and tracking progress against deadlines. This is crucial for maintaining production flow and meeting customer demands.

- Quality Control: Integrating quality checks and testing procedures into the manufacturing process, enabling early identification of defects and minimizing waste.

- Order Management: Managing customer orders, tracking shipments, and generating invoices, ensuring smooth and efficient order fulfillment.

- Financial Management: Tracking costs, generating reports, and analyzing profitability across different production stages and product lines. This facilitates informed decision-making.

- Data Analytics and Reporting: Providing comprehensive reports and insights into key performance indicators (KPIs) to help monitor and improve efficiency, productivity, and profitability.

Types of Manufacturing and Inventory Software

Different types of manufacturing software cater to various needs and industry specifics. Some popular categories include:

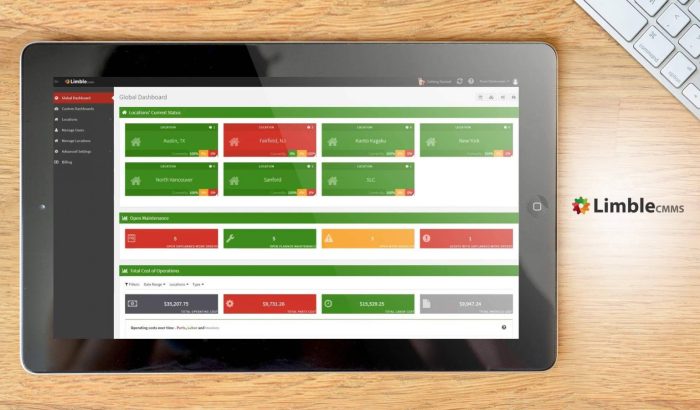

Source: meetanshi.com

- Enterprise Resource Planning (ERP) Systems: These comprehensive systems integrate manufacturing, inventory, and other business functions, providing a holistic view of the entire operation.

- Manufacturing Execution Systems (MES): These systems focus specifically on the production floor, managing real-time data, tracking processes, and ensuring adherence to standards.

- Material Requirements Planning (MRP) Systems: These systems help determine the required materials for production based on predicted demand and inventory levels.

Benefits of Implementing Manufacturing and Inventory Software

The benefits of implementing manufacturing and inventory software are numerous and extend beyond simple process automation. Improved efficiency, reduced costs, enhanced accuracy, and increased profitability are just a few key advantages. Better data management, improved communication, and the ability to react quickly to changing market demands are also critical.

Reduced Operational Costs

By automating tasks and minimizing errors, manufacturing and inventory software can significantly reduce operational costs associated with labor, materials, and storage.

Improved Efficiency and Productivity

Streamlined processes, optimized resource allocation, and real-time visibility lead to improved efficiency and productivity across the entire manufacturing cycle.

Source: allthatsaas.com

Enhanced Accuracy and Data Management

Minimized manual data entry, automated processes, and comprehensive reporting ensure accurate data management and decision-making.

Choosing the Right Manufacturing and Inventory Software

Selecting the right software is crucial for your success. Consider factors like your business size, industry, specific needs, budget, and scalability requirements.

Factors to Consider When Choosing Software

- Integration Capabilities: Ensure the software integrates seamlessly with your existing systems.

- Scalability: The software should be able to grow with your business.

- User-Friendliness: A user-friendly interface is essential for efficient operation.

- Support and Training: Reliable support and training are essential for successful implementation and ongoing use.

Frequently Asked Questions (FAQ)

- Q: How much does manufacturing and inventory software cost?

A: Software costs vary greatly depending on the features, vendor, and deployment model (on-premise vs. cloud).

- Q: What are the implementation timelines for manufacturing software?

A: Implementation timelines depend on the complexity of your business processes and the chosen software. A typical implementation can take several weeks to several months.

- Q: How can I find the right software for my business?

A: Research different software options, compare features and pricing, and consider consulting with industry experts.

Conclusion

Manufacturing and inventory software is a powerful tool for businesses looking to streamline operations, optimize efficiency, and boost profitability. By carefully considering your needs and selecting the right solution, you can significantly enhance your competitiveness in today’s market.

Call to Action (CTA)

Ready to transform your manufacturing and inventory processes? Contact us today for a free consultation and discover how our solutions can help you achieve operational excellence. We’re happy to discuss your specific requirements and help you find the perfect fit for your business.

Source: [Link to a reputable manufacturing software review website, e.g., Capterra, Gartner]

Helpful Answers

What are the common challenges in implementing manufacturing and inventory software?

Implementing new software often involves challenges like data migration, employee training, and system integration. Careful planning and thorough preparation are key to a smooth transition.

How can this software improve my business’s profitability?

Improved inventory management, reduced waste, and optimized production schedules can lead to significant cost savings and increased revenue, thus enhancing profitability.

What types of industries benefit most from this software?

Manufacturing and inventory software benefits numerous industries, from automotive and electronics to food processing and pharmaceuticals. Its adaptability makes it valuable for various production types.