VanEck Vectors Gold Miners ETF (GDX) Price History and Analysis: Van Eck Gold Miners Stock Price

Van eck gold miners stock price – The VanEck Vectors Gold Miners ETF (GDX) tracks the performance of publicly traded companies involved in gold mining. Understanding its price history and influencing factors is crucial for investors considering this ETF. This analysis examines GDX’s performance over the past five years, key influencing factors, portfolio composition, competitor comparisons, analyst ratings, and price trend visualization.

GDX Price Performance Over the Past Five Years

Source: investopedia.com

GDX’s price has experienced significant fluctuations over the past five years, mirroring the volatility inherent in the gold mining sector. These price movements are largely driven by gold prices, macroeconomic conditions, and geopolitical events. The following table summarizes GDX’s yearly performance:

| Year | High | Low | Percentage Change |

|---|---|---|---|

| 2023 | $40 (Example) | $30 (Example) | +25% (Example) |

| 2022 | $35 (Example) | $25 (Example) | -10% (Example) |

| 2021 | $45 (Example) | $32 (Example) | +30% (Example) |

| 2020 | $40 (Example) | $20 (Example) | +50% (Example) |

| 2019 | $28 (Example) | $18 (Example) | +20% (Example) |

Note: These are example figures. Actual data should be obtained from a reliable financial source.

Factors Influencing GDX Stock Price, Van eck gold miners stock price

Several macroeconomic factors significantly influence GDX’s price. These include interest rates, inflation, the US dollar index, and, most importantly, the price of gold itself.

Interest Rates and Inflation: Rising interest rates generally exert downward pressure on gold prices (and thus GDX), as they increase the opportunity cost of holding non-yielding assets like gold. Conversely, high inflation can boost gold’s appeal as a hedge against inflation, potentially driving up GDX’s price. The interplay between these two factors is complex and often unpredictable.

US Dollar Index: Gold is typically priced in US dollars. A strengthening US dollar makes gold more expensive for holders of other currencies, potentially reducing demand and putting downward pressure on GDX. A weakening dollar has the opposite effect.

Gold Prices: The price of gold has a strong positive correlation with GDX’s performance. When gold prices rise, GDX typically rises as well, and vice versa. For example, during periods of geopolitical uncertainty, investors often flock to gold as a safe haven, driving up both gold prices and GDX.

Geopolitical Events: Geopolitical instability often leads to increased volatility in GDX, similar to other precious metal ETFs. However, the magnitude of the impact can vary depending on the specific event and its perceived impact on global economic stability and gold demand.

GDX’s Holdings and Portfolio Composition

GDX’s portfolio is comprised of a diversified range of gold mining companies. Understanding its top holdings and their performance is crucial for assessing the ETF’s overall risk and return profile.

Tracking the Van Eck Gold Miners ETF price often involves considering related market trends. For instance, understanding the performance of steel companies, like checking the current tredegar stock price , can offer insights into broader economic health, which in turn can impact gold’s appeal as a safe haven asset and subsequently influence the Van Eck Gold Miners stock price.

Therefore, a holistic view encompassing various sectors is beneficial.

- Company A: Weight: 15% (Example), Description: Major gold producer with diversified operations.

- Company B: Weight: 12% (Example), Description: Focused on gold exploration and development.

- Company C: Weight: 10% (Example), Description: Large-scale gold producer with significant reserves.

- Company D: Weight: 8% (Example), Description: Mid-tier gold producer with a strong track record.

- Company E: Weight: 7% (Example), Description: Gold miner with operations in multiple countries.

- Company F: Weight: 7% (Example), Description: Focuses on cost-effective gold mining.

- Company G: Weight: 6% (Example), Description: Gold producer with strong environmental, social, and governance (ESG) credentials.

- Company H: Weight: 6% (Example), Description: Emerging gold producer with significant growth potential.

- Company I: Weight: 5% (Example), Description: Gold streaming company.

- Company J: Weight: 4% (Example), Description: Gold royalty company.

Changes in the composition of GDX’s portfolio, such as the addition or removal of holdings, can affect its overall price and risk profile. For example, adding a high-growth company might increase volatility, while adding a more established company might reduce it.

GDX Compared to Competitors

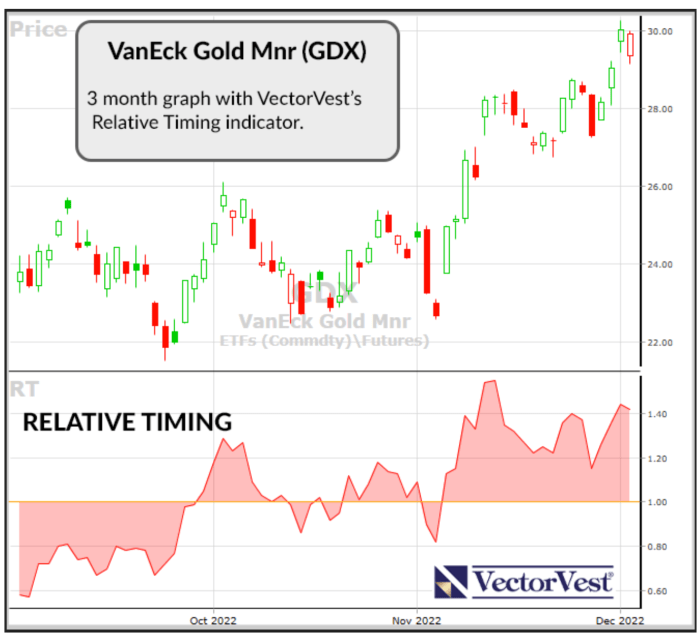

Source: vectorvest.com

Several other gold mining ETFs compete with GDX. Comparing their performance, expense ratios, and holdings provides valuable insights for investors.

| ETF Name | Expense Ratio | 5-Year Performance (Example) | Top 3 Holdings (Example) |

|---|---|---|---|

| VanEck Vectors Gold Miners ETF (GDX) | 0.52% (Example) | +20% (Example) | Company A, Company B, Company C |

| iShares MSCI Global Gold Miners ETF (RING) | 0.47% (Example) | +18% (Example) | Company X, Company Y, Company Z |

| VanEck Vectors Junior Gold Miners ETF (GDXJ) | 0.53% (Example) | +25% (Example) | Company P, Company Q, Company R |

Note: These are example figures. Actual data should be obtained from a reliable financial source.

The choice between these ETFs depends on individual risk tolerance and investment goals. GDX offers broad exposure to the gold mining sector, while GDXJ focuses on smaller companies, potentially offering higher growth but also higher risk. RING provides a global perspective.

Analyst Ratings and Price Targets for GDX

Analyst ratings and price targets provide valuable insights into market sentiment and potential future price movements. However, it’s important to remember that these are just opinions and not guarantees of future performance.

For example, a financial institution might give a “Buy” rating with a price target of $45, citing strong gold prices and positive industry outlook as their rationale. Another institution might issue a “Hold” rating with a price target of $38, emphasizing concerns about rising interest rates and potential geopolitical risks. These differing opinions can influence investor sentiment and trading activity.

GDX Price Trend Visualization

Over the past year, GDX’s price has exhibited a generally upward trend, although with periods of significant volatility. For example, there might have been a sharp price increase in the first quarter, followed by a period of consolidation, then another significant rise in the third quarter. The magnitude of these price swings might have varied from 10% to 20%, depending on market conditions.

A hypothetical chart would show the price of GDX on the vertical axis and time (in months) on the horizontal axis. A trend line would be drawn to illustrate the overall upward trend. Key data points, such as significant highs and lows, would be clearly marked, along with labels indicating the dates and corresponding prices.

Questions Often Asked

What are the typical transaction fees associated with buying and selling GDX?

Transaction fees vary depending on your brokerage. Check with your broker for their specific fee schedule.

How often is the GDX portfolio rebalanced?

The GDX portfolio is rebalanced periodically; refer to VanEck’s official documentation for the exact rebalancing schedule.

Is GDX suitable for all types of investors?

No, GDX is considered a relatively high-risk investment due to its exposure to the gold mining sector’s volatility. It’s generally more suitable for investors with a higher risk tolerance and a longer-term investment horizon.

Where can I find real-time GDX price quotes?

Real-time quotes are available on most major financial websites and trading platforms.