Sage software for accountants provides a powerful suite of tools for managing accounting tasks efficiently. It streamlines processes from invoicing and expense tracking to financial reporting and analysis. This software is designed to empower accountants with the tools they need to thrive in today’s business environment.

This guide explores the key features and benefits of Sage software, helping accountants understand how to leverage its capabilities for optimal performance. From navigating the user interface to maximizing reporting functionalities, we will cover everything essential for successful implementation.

Sage software is a popular choice for accountants, offering a range of tools and features to streamline accounting processes, improve efficiency, and enhance overall profitability. This comprehensive guide delves into the various Sage accounting solutions, exploring their benefits, features, and suitability for different accounting needs. We’ll also touch on important considerations like pricing, implementation, and training.

Understanding Sage Software for Accountants

Sage software encompasses a suite of accounting applications designed to cater to diverse accounting needs, from small businesses to large corporations. These solutions typically cover core accounting functions such as general ledger, accounts payable, accounts receivable, inventory management, payroll, and reporting. Understanding the specific modules offered by Sage is crucial for selecting the right solution for your firm.

Different Sage products cater to different sized businesses and accounting requirements.

Key Features and Benefits of Sage Accounting Software, Sage software for accountants

- Streamlined Processes: Sage automates many routine tasks, reducing manual data entry and improving accuracy. This translates to significant time savings for accountants.

- Enhanced Reporting & Analysis: Comprehensive reporting capabilities provide valuable insights into financial performance. Sage solutions often allow for customized reports to meet specific needs.

- Improved Efficiency & Productivity: By automating processes and providing data insights, Sage software boosts overall efficiency and productivity for accounting teams.

- Better Data Management: Sage solutions provide a centralized database for all financial information, enabling easier access and management of accounting data.

- Improved Accuracy & Reduced Errors: Automation and robust controls help minimize errors and ensure the accuracy of financial records.

- Integration Capabilities: Many Sage solutions integrate with other business applications, such as CRM systems, improving data flow and consistency.

Types of Sage Software for Accountants

Sage offers a variety of solutions, each tailored to specific needs and business sizes. Knowing the different options is crucial for making the right choice.

Sage 50cloud: Ideal for Small Businesses

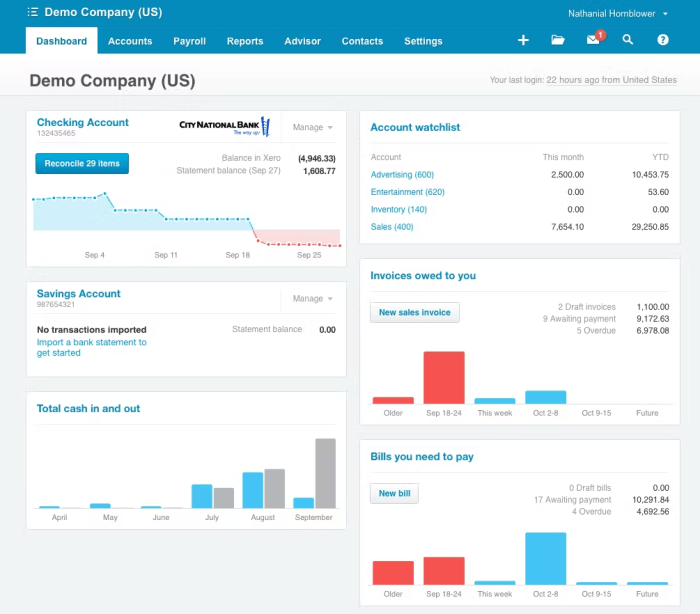

Sage 50cloud is a popular choice for small businesses, providing a user-friendly interface and essential accounting features. Its cloud-based nature offers accessibility and data security benefits. Key features include invoicing, expense tracking, and basic reporting.

Sage 100cloud: A Solution for Mid-Sized Businesses

Sage 100cloud caters to mid-sized businesses with more complex accounting requirements. It offers advanced features like inventory management, multi-currency support, and more sophisticated reporting tools. This software often integrates with other business management systems.

Sage X3: Enterprise-Level Solutions

Sage X3 is a robust enterprise resource planning (ERP) solution. It’s designed for large companies and offers extensive functionality, including advanced financials, supply chain management, and human resources modules. This software is a significant investment but often delivers substantial returns for large organizations.

Source: thecfoclub.com

Choosing the Right Sage Solution for Your Firm: Sage Software For Accountants

Several factors should guide your decision-making process when selecting Sage software. Consider your business size, specific accounting needs, budget, and long-term goals.

Implementation and Training

Successful implementation and employee training are critical for maximizing the benefits of Sage software. Thorough training programs help your team effectively use the software, minimizing initial learning curves and optimizing productivity. Consider implementation support services to ensure a smooth transition.

Pricing and Support

Sage pricing varies depending on the chosen product, features, and support level. Consider the ongoing costs associated with software licenses, maintenance, and technical support. Research different pricing models to find the most cost-effective option.

Frequently Asked Questions (FAQ)

- Q: What is the difference between Sage 50 and Sage 100?

A: Sage 50 is designed for smaller businesses with simpler accounting needs, while Sage 100 offers more advanced features for mid-sized companies.

- Q: Is Sage software compatible with other accounting software?

A: Many Sage products offer integration capabilities with other business applications, though compatibility can vary depending on the specific applications.

- Q: How much does Sage software cost?

A: Sage software pricing depends on the specific product, features, and support level. It’s best to contact Sage directly for pricing information.

- Q: What kind of support is available for Sage software users?

A: Sage offers various support options, including online resources, phone support, and training materials. The specific support level often depends on the chosen plan.

Conclusion

Sage software provides powerful tools for accountants seeking to enhance efficiency, accuracy, and profitability. Carefully evaluating your business needs, budget, and long-term goals is crucial when selecting the appropriate Sage solution. Thorough training and ongoing support are vital for successful implementation and maximizing the software’s benefits. Contact a Sage representative for a personalized consultation.

Call to Action

Ready to optimize your accounting processes? Contact us today for a personalized consultation to explore how Sage software can benefit your firm. We can discuss your specific needs and help you choose the right Sage solution.

Disclaimer: This article provides general information and is not financial advice. Consult with a qualified professional for personalized guidance.

Sources:

- Sage Website

- Industry Reports (e.g., Accounting Today)

- Relevant Online Articles (e.g., Forbes, AccountingWEB)

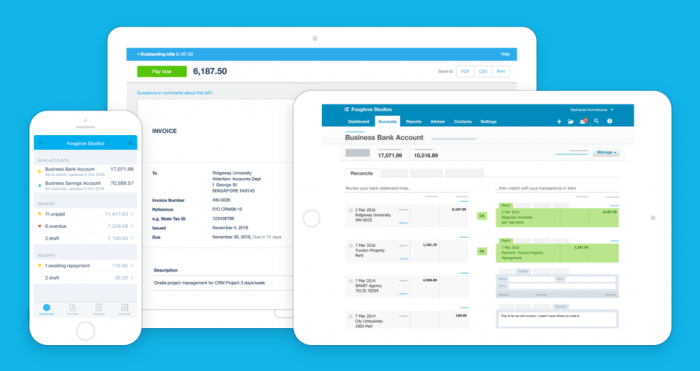

In conclusion, Sage software for accountants offers a robust and versatile solution for modern accounting needs. Its comprehensive features, coupled with user-friendly interfaces, empower accountants to manage their clients’ finances effectively and efficiently. By embracing these tools, accountants can improve their workflow, reduce errors, and ultimately enhance their services.

Source: aptgadget.com

Detailed FAQs

What are the different types of Sage software available?

Sage offers various software solutions tailored to different business sizes and needs, including Sage 50cloud, Sage 100cloud, and Sage 300cloud. Each option caters to specific accounting requirements, from small businesses to larger enterprises.

How can I integrate Sage with other business software?

Sage often provides APIs and integrations with other popular business applications, enabling seamless data exchange and streamlined workflows. Consult Sage’s support documentation for specific integration options.

What training resources are available for Sage software?

Sage usually offers online tutorials, webinars, and user forums to assist with training and troubleshooting. These resources help users become proficient in using the software effectively.

Is Sage software compatible with different operating systems?

Sage typically supports various operating systems like Windows and macOS. Consult the Sage software’s specifications for detailed compatibility information.