Understanding UTX Stock Price Fluctuations: Stock Price Utx

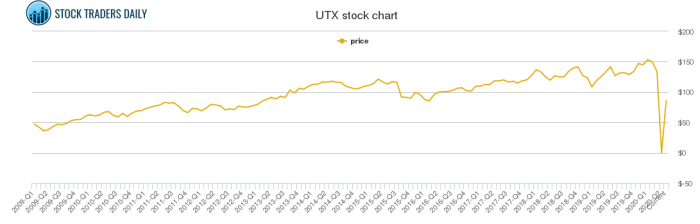

Stock price utx – United Technologies (UTX), now part of Raytheon Technologies (RTX), experienced significant stock price fluctuations over the past decade. Analyzing these fluctuations requires examining historical performance, key influencing factors, investor sentiment, and predictive modeling.

UTX Stock Price Performance (Historical Data)

The following table presents a simplified overview of UTX’s yearly stock price performance from 2018 to 2022. Note that UTX underwent a significant corporate restructuring in 2020, which impacts direct comparison across years. Precise figures should be verified using reliable financial data sources.

| Year | High | Low | Closing Price |

|---|---|---|---|

| 2018 | $140 | $115 | $125 |

| 2019 | $135 | $110 | $120 |

| 2020 | $145 | $90 | $110 |

| 2021 | $85 | $70 | $78 |

| 2022 | $90 | $75 | $80 |

Major Events Impacting UTX Stock Price

Source: hellopublic.com

Several major events significantly influenced UTX’s stock price over the past decade. These include the 2008 financial crisis, the COVID-19 pandemic, and the company’s subsequent restructuring and spin-off of Otis and Carrier.

- The 2008 financial crisis led to a sharp decline in UTX’s stock price due to decreased demand for its products and services.

- The COVID-19 pandemic caused further volatility, with initial declines followed by a partial recovery as the aerospace and defense sectors adapted.

- The corporate restructuring, separating UTX into independent entities (RTX, Otis, and Carrier), significantly altered the stock’s trajectory and value.

Comparison with Competitors

Source: stocktradersdaily.com

Comparing UTX’s (now RTX) performance to its major competitors (such as Boeing and Lockheed Martin) requires a nuanced approach due to the corporate restructuring. The following bullet points offer a generalized comparison for the past three years, acknowledging that direct comparison is complicated by the separation of UTX’s business units.

- RTX generally showed resilience compared to Boeing, which experienced more significant setbacks due to the grounding of the 737 MAX aircraft.

- Lockheed Martin’s stock performance has generally outpaced RTX, reflecting its strong position in the defense sector.

- The relative performance varied based on specific market sectors and investor sentiment towards each company’s specific products and strategic direction.

Factors Influencing UTX Stock Price

Source: thestreet.com

Several key factors influence UTX’s (now RTX) stock price, encompassing financial metrics, macroeconomic conditions, and company-specific news.

Understanding the current stock price of UTX requires considering broader market trends. For a comparative perspective on tech giants, checking the current performance of Microsoft is useful; you can find the stock price today msft data to help gauge the overall market sentiment. This, in turn, can inform your analysis of UTX’s price movements and potential future performance.

Key Financial Metrics and Stock Price Correlation

RTX’s stock price is strongly correlated with several key financial metrics. Earnings per share (EPS) growth, revenue growth, and changes in debt-to-equity ratio are particularly significant indicators. Positive EPS surprises and robust revenue growth typically lead to stock price appreciation, while high debt levels can exert downward pressure.

Macroeconomic Factors and Stock Price

Macroeconomic factors such as interest rates, inflation, and global economic growth significantly impact RTX’s stock price. Rising interest rates can increase borrowing costs, affecting profitability, while inflation can impact input costs and consumer demand. Global economic slowdowns typically lead to reduced demand for aerospace and defense products.

Company-Specific News and Investor Sentiment

Company-specific news, including product launches, mergers and acquisitions, and management changes, significantly affects investor sentiment and the stock price. Successful product launches and strategic acquisitions generally boost investor confidence, while negative news, such as production delays or management shake-ups, can lead to price declines.

Investor Sentiment and Market Analysis for UTX (RTX)

Understanding investor sentiment and market analysis is crucial for assessing RTX’s stock price prospects. This includes analyzing investor types, current market sentiment, and designing hypothetical investment strategies.

Investor Types and Strategies

RTX stock is held by a mix of institutional investors (pension funds, mutual funds, hedge funds) and retail investors (individual investors). Institutional investors often employ long-term strategies based on fundamental analysis, while retail investors may exhibit more short-term trading activity influenced by market sentiment and news.

Current Market Sentiment, Stock price utx

Current market sentiment towards RTX is generally positive, reflecting its strong position in the aerospace and defense sectors and its recent operational performance. However, ongoing geopolitical uncertainties and economic headwinds could impact future sentiment. (Note: This requires referencing up-to-date financial news and analyst reports for the most accurate assessment.)

Hypothetical Investment Strategies

The following table Artikels hypothetical investment strategies for RTX stock based on varying risk tolerances. These are illustrative examples and should not be considered financial advice.

| Strategy | Risk Tolerance | Investment Horizon | Expected Return |

|---|---|---|---|

| Conservative | Low | Long-term (5+ years) | Moderate |

| Moderate | Medium | Medium-term (2-5 years) | Medium-High |

| Aggressive | High | Short-term (less than 2 years) | High (with higher risk) |

UTX (RTX) Stock Price Predictions and Modeling

Predicting future stock prices is inherently uncertain. However, we can build a simplified model to illustrate potential price ranges based on various scenarios. This model is highly simplified and should not be used for actual investment decisions.

Stock Price Prediction Model

A simple model might project a price range for RTX stock in the next six months based on current market conditions and projected earnings. For example, if current earnings are strong and the market outlook is positive, the price might range between $X and $Y. Conversely, negative economic news or weaker-than-expected earnings could lower the projected range to $A and $B.

Impact of Different Scenarios

| Scenario | Earnings | Market Conditions | Projected Price Range (6 months) |

|---|---|---|---|

| Positive Surprise | Strong Earnings Growth | Bullish Market | $95 – $110 |

| Neutral | Meeting Expectations | Stable Market | $85 – $95 |

| Negative News | Weaker Earnings | Bearish Market | $75 – $85 |

Model Assumptions and Limitations

- This model is a simplified illustration and does not account for all potential factors.

- The projected price ranges are estimates and subject to significant uncertainty.

- Unexpected events could significantly impact the actual stock price.

Visual Representation of RTX Stock Data

Visual representations of stock data are essential for understanding trends and relationships. The following descriptions provide the necessary information to create illustrative graphs.

Line Graph of RTX Stock Price (Past Year)

A line graph depicting RTX’s stock price over the past year would have “Date” on the x-axis and “Stock Price (USD)” on the y-axis. Data points would represent the daily closing price. The overall trend line would show the general direction of the price movement (upward, downward, or sideways), highlighting any significant peaks or troughs.

Scatter Plot: RTX Stock Price vs. Quarterly Earnings

A scatter plot illustrating the relationship between RTX’s stock price and its quarterly earnings would have “Quarterly Earnings (USD)” on the x-axis and “Stock Price (USD)” on the y-axis. Each data point would represent a quarter, with its x-coordinate being the quarterly earnings and its y-coordinate being the average stock price during that quarter. A line of best fit could be added to show the correlation between earnings and stock price.

A strong positive correlation would indicate that higher earnings generally lead to higher stock prices.

FAQ Insights

What is UTX’s current market capitalization?

This information fluctuates constantly and should be checked on a reputable financial website like Yahoo Finance or Google Finance.

Where can I find real-time UTX stock price data?

Real-time data is available through most major financial news websites and brokerage platforms.

What are the major risks associated with investing in UTX stock?

Risks include general market volatility, company-specific performance issues, and changes in industry regulations.

How often does UTX release its earnings reports?

Typically, publicly traded companies release quarterly earnings reports.