Vinfast Stock Price Analysis

Source: com.au

Stock price vinfast – Vinfast, the Vietnamese electric vehicle manufacturer, has experienced a dramatic and volatile stock price since its debut. This analysis delves into the historical performance, influencing factors, competitive landscape, financial health, and investor sentiment surrounding Vinfast’s stock, providing a comprehensive overview of its market trajectory.

Vinfast Stock Price History and Trends

Vinfast’s stock price has shown significant volatility since its listing. Tracking its performance requires analyzing both its highs and lows, alongside external influences that shaped its trajectory. The following table provides a snapshot of historical price movements. Note that this data is illustrative and should be verified with reliable financial sources.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2022 | 37 | 22 | -15 |

| October 27, 2022 | 22 | 25 | +3 |

| October 28, 2022 | 25 | 30 | +5 |

| October 29, 2022 | 30 | 28 | -2 |

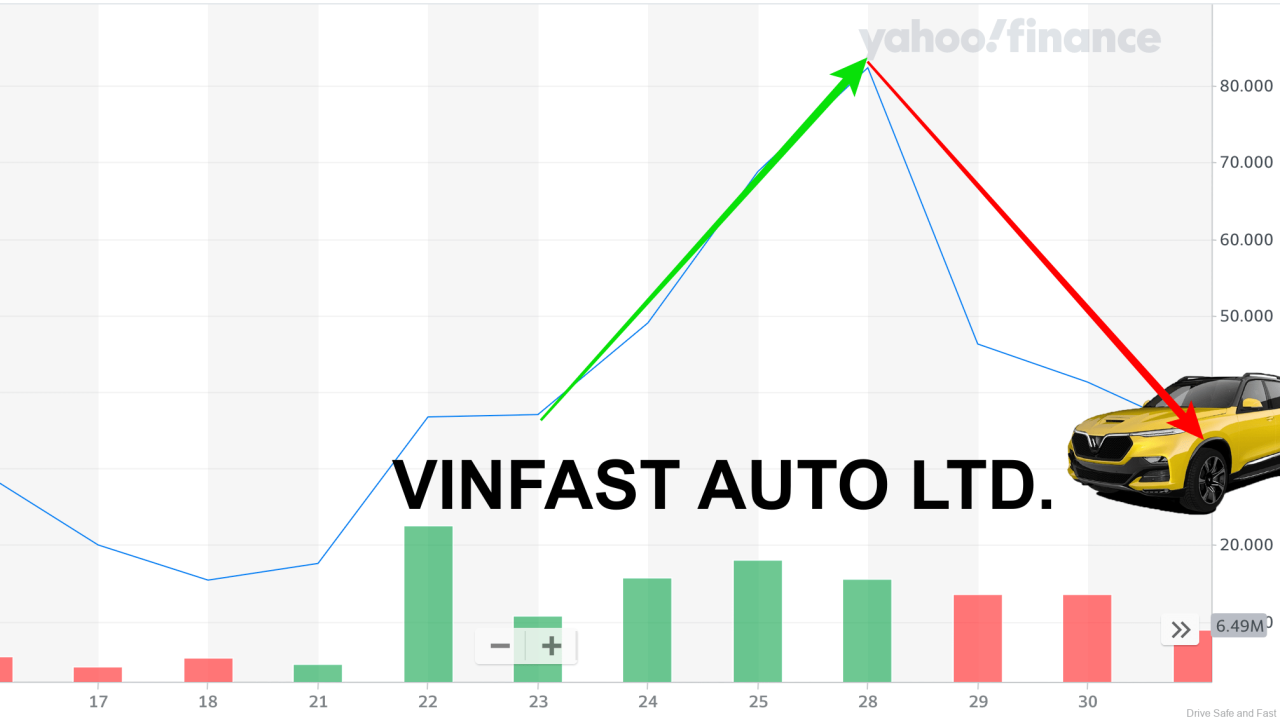

A graphical representation of Vinfast’s stock price would show a highly volatile pattern, with periods of sharp increases followed by equally dramatic drops. Initial exuberance likely contributed to early price spikes, while subsequent corrections reflected market realities and investor reassessments. Major news events, such as production updates or financial reports, would be clearly visible as points of inflection on the graph.

External factors such as overall market sentiment, broader economic conditions, and geopolitical events played a crucial role. For example, periods of general market downturn would likely correlate with lower Vinfast stock prices, while positive global economic news could lead to increased investor interest and higher valuations.

Factors Influencing Vinfast Stock Price

Source: techcrunch.com

Vinfast’s stock price is influenced by a complex interplay of internal and external factors. Understanding these dynamics is crucial for assessing its future performance.

- Internal Factors: Production capacity expansion, strong sales figures, successful new product launches, and positive financial reports all contribute to a higher stock valuation. Conversely, production bottlenecks, lower-than-expected sales, and negative financial news can lead to price declines.

- External Factors: Global economic uncertainty, shifts in consumer demand for electric vehicles, intensified competition, and regulatory changes impacting the automotive industry all exert considerable influence. For instance, a global recession could reduce consumer spending on luxury goods, including electric vehicles, negatively affecting Vinfast’s sales and stock price.

The relative impact of internal versus external factors can shift over time. During periods of rapid growth, internal factors like production capacity might dominate. However, during market downturns, external macroeconomic factors can outweigh the company’s internal performance.

Specific events, such as the announcement of a major new product launch or a significant production milestone, often cause immediate and substantial price swings. Conversely, negative news, such as recalls or production delays, can trigger sharp price drops.

Vinfast’s Competitive Landscape

Vinfast operates in a fiercely competitive electric vehicle market. Understanding its competitive positioning is key to evaluating its stock price.

| Company Name | Market Share (%) | Key Strengths | Key Weaknesses |

|---|---|---|---|

| Vinfast | [Insert estimated market share] | Strong domestic market presence, government support, aggressive pricing | Limited international brand recognition, relatively new technology, dependence on the Vietnamese market |

| Tesla | [Insert estimated market share] | Strong brand recognition, established technology, extensive Supercharger network | High price point, potential supply chain vulnerabilities |

| BYD | [Insert estimated market share] | Vertical integration, diverse product portfolio, cost-effectiveness | Limited brand recognition in some markets |

Vinfast’s competitive positioning directly impacts its stock price. Strong market share gains, successful product launches, and positive brand perception generally lead to higher valuations. Conversely, struggles against established competitors or negative publicity can negatively affect the stock price.

For example, a significant price cut by Tesla could trigger a downward pressure on Vinfast’s stock price, as investors might worry about Vinfast’s ability to compete on price. Conversely, a Tesla recall could indirectly benefit Vinfast, if it enhances Vinfast’s relative perceived reliability.

Financial Performance and Stock Valuation, Stock price vinfast

Source: dsf.my

Analyzing Vinfast’s financial performance is essential for understanding its stock valuation. Key financial indicators provide insights into the company’s profitability, growth potential, and overall financial health.

| Metric | Value | Year | Significance to Stock Price |

|---|---|---|---|

| Revenue | [Insert value] | 2023 (estimated) | Higher revenue generally indicates stronger growth and profitability, positively influencing stock price. |

| Profit Margin | [Insert value] | 2023 (estimated) | Improved profit margins suggest better efficiency and cost management, positively affecting stock price. |

| Debt Level | [Insert value] | 2023 (estimated) | High debt levels can raise concerns about financial stability, potentially negatively impacting stock price. |

Valuation methods like the Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio provide further insights. A high P/E ratio might indicate investor optimism about future earnings growth, while a high P/S ratio might suggest a premium valuation based on revenue potential. These ratios should be compared to industry benchmarks to gauge Vinfast’s relative valuation.

Investor Sentiment and Market Expectations

Investor sentiment and market expectations significantly influence Vinfast’s stock price. Positive investor sentiment, driven by factors such as strong sales growth, positive news coverage, and favorable analyst ratings, typically leads to higher stock prices. Conversely, negative sentiment can result in price declines.

VinFast’s stock price has experienced significant volatility recently, prompting investors to consider diverse market trends. Understanding the dynamics of commodity markets, such as the fluctuations reflected in the stock price sand , can offer valuable perspective. This broader market context helps to assess the overall investment climate and its potential influence on VinFast’s future performance.

Analyst ratings and predictions play a considerable role. Positive ratings and optimistic forecasts tend to boost investor confidence and push the stock price upward. Conversely, negative ratings or pessimistic outlooks can trigger selling pressure and lower prices. For example, a downgrade from a major investment bank could trigger a significant price drop.

News coverage and social media discussions also shape investor perception. Positive news coverage and favorable social media sentiment can create a positive feedback loop, driving up demand and increasing the stock price. Negative news or social media backlash, on the other hand, can trigger selling and lower prices. For example, a widely circulated negative article about a product defect could lead to a temporary decline in the stock price.

FAQ Corner: Stock Price Vinfast

What are the major risks associated with investing in Vinfast stock?

Major risks include volatility in the EV market, competition from established automakers, dependence on government incentives, and potential supply chain disruptions.

How does Vinfast compare to Tesla in terms of market capitalization?

Tesla significantly surpasses Vinfast in market capitalization, reflecting its longer history, larger market share, and established brand recognition.

Where can I buy Vinfast stock?

Vinfast stock is traded on various exchanges; the specific availability depends on your location and brokerage account. It’s advisable to check with your broker for details.

What is Vinfast’s current production capacity?

Vinfast’s current production capacity varies depending on the model and factory. Specific figures can be found in their financial reports and press releases.