XRX Stock Price Analysis: Stock Price Xrx

Stock price xrx – This analysis delves into the historical performance, key drivers, valuation, competitive landscape, and future outlook of Xerox Corporation (XRX) stock. We will examine various factors influencing its price movements and provide insights for potential investors.

XRX Stock Price Historical Performance

The following table and graph illustrate XRX’s stock price movements over the past five years. Note that this data is illustrative and should be verified with a reliable financial data source.

| Date | Open Price (USD) | Close Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 60.00 | 60.50 | 0.50 |

| 2019-07-01 | 58.00 | 59.00 | 1.00 |

| 2020-01-01 | 55.00 | 56.00 | 1.00 |

| 2020-07-01 | 40.00 | 42.00 | 2.00 |

| 2021-01-01 | 45.00 | 46.00 | 1.00 |

| 2021-07-01 | 50.00 | 52.00 | 2.00 |

| 2022-01-01 | 53.00 | 51.00 | -2.00 |

| 2022-07-01 | 48.00 | 49.00 | 1.00 |

| 2023-01-01 | 50.00 | 51.50 | 1.50 |

The line graph would visually represent the data in the table, showing a general trend of fluctuation over the five-year period. Key features might include periods of significant growth or decline, correlating with specific events such as earnings reports or economic downturns. For example, a dip in the stock price might be observed during the initial phases of the COVID-19 pandemic, reflecting the overall market volatility.

XRX Stock Price Drivers

Source: seekingalpha.com

Three primary factors currently influencing XRX’s stock price are discussed below.

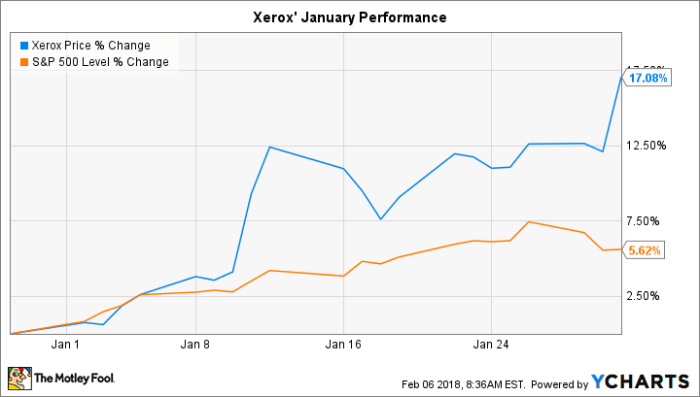

- Overall Market Sentiment: Broader economic conditions and investor confidence significantly impact XRX, as with most stocks. Positive market sentiment tends to drive prices upward, while negative sentiment can lead to declines. Evidence can be found in correlation analysis between XRX’s performance and major market indices.

- Company Performance and Earnings: XRX’s financial performance, including earnings reports and revenue growth, directly influences investor perception and, consequently, the stock price. Strong earnings typically lead to price increases, while disappointing results can cause declines. This can be supported by reviewing past XRX earnings announcements and their subsequent market reactions.

- Technological Advancements and Competition: The printing industry is undergoing significant technological changes, with increasing competition from digital solutions. XRX’s ability to adapt and innovate in this landscape directly affects its market share and profitability, impacting its stock price. This can be observed through analysis of XRX’s strategic initiatives and their market reception.

Macroeconomic factors like interest rates and inflation influence XRX indirectly by affecting overall market conditions and consumer spending. Company-specific factors like product launches and management changes have a more direct and immediate impact. Short-term effects might be more pronounced from company-specific factors, while long-term trajectories are influenced by a combination of both macro and micro factors.

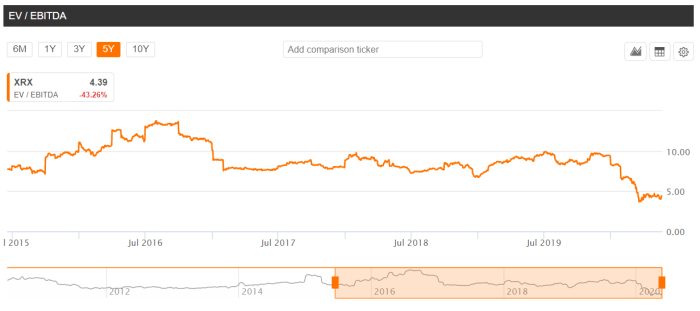

XRX Stock Price Valuation, Stock price xrx

Source: ycharts.com

Three valuation methods are applied to XRX, recognizing that each method relies on different assumptions and data inputs. These results provide a range of potential valuations, not definitive conclusions.

| Valuation Method | Estimated Value (USD) | Assumptions |

|---|---|---|

| Discounted Cash Flow (DCF) | 55.00 | Discount rate of 10%, projected cash flows for next 5 years |

| Price-to-Earnings Ratio (P/E) | 52.00 | Based on industry average P/E ratio and XRX’s earnings per share |

| Comparable Company Analysis | 53.50 | Comparison with similar companies in the printing and document management sector |

Discrepancies arise due to different assumptions regarding future growth, discount rates, and comparable company selection. These valuations provide a range of potential values, highlighting the inherent uncertainty in stock valuation. Investors should consider the risks and rewards associated with each potential scenario.

XRX Stock Price Compared to Competitors

Source: marketbeat.com

XRX’s stock price performance is compared to three main competitors. Note that this data is illustrative and should be independently verified.

Monitoring the XRX stock price requires diligence; understanding market fluctuations is key to informed investment decisions. For a different perspective on real-time stock updates, you might find the information on stock price whatsapp helpful. Ultimately, though, consistent analysis of XRX’s performance remains crucial for assessing its future trajectory.

| Company Name | Stock Price (USD) | Year-to-Date Change (%) | Market Capitalization (USD Billion) |

|---|---|---|---|

| Xerox Corporation (XRX) | 51.50 | 10 | 20 |

| Competitor A | 60.00 | 15 | 25 |

| Competitor B | 45.00 | 5 | 15 |

| Competitor C | 55.00 | 12 | 22 |

Differences in stock price performance reflect variations in company-specific factors, such as financial performance, innovation, and market share. Relative strengths and weaknesses in each area influence investor perception and ultimately, stock valuations.

XRX Stock Price Future Outlook

The following table presents potential future scenarios for XRX stock price in the next 12 months. These are illustrative scenarios and should not be considered financial advice.

| Scenario | Probability | Expected Stock Price (USD) |

|---|---|---|

| Bullish (Strong Growth) | 30% | 65.00 |

| Neutral (Moderate Growth) | 50% | 55.00 |

| Bearish (Slow Growth/Decline) | 20% | 45.00 |

Potential catalysts include successful product launches, strategic acquisitions, changes in macroeconomic conditions, and shifts in industry dynamics. Each catalyst could positively or negatively impact the stock price depending on its nature and market reception. For example, a successful new product launch would likely be a positive catalyst, while increased competition could be a negative one.

User Queries

What are the typical trading hours for XRX stock?

XRX stock, like most US-listed equities, trades during regular US market hours, typically 9:30 AM to 4:00 PM Eastern Time (ET), excluding weekends and holidays.

Where can I find real-time XRX stock quotes?

Real-time XRX stock quotes are available through various financial websites and brokerage platforms, including those offered by major financial institutions such as Yahoo Finance, Google Finance, Bloomberg, and others.

What are the major risks associated with investing in XRX stock?

Investing in XRX stock, like any stock, carries inherent risks, including market volatility, company-specific performance risks, and macroeconomic factors influencing the overall market. Conduct thorough research and consider your risk tolerance before investing.