Sun Hydrogen Stock Price Analysis

Sun hydrogen stock price – This analysis delves into the intricacies of Sun Hydrogen’s business model, financial performance, market position, and future prospects, ultimately aiming to provide a comprehensive understanding of factors influencing its stock price.

Sun Hydrogen’s Business Model

Sun Hydrogen focuses on the production and distribution of green hydrogen, a clean energy source produced through electrolysis powered by renewable energy. Its primary revenue streams derive from the sale of hydrogen to industrial clients and potentially future partnerships with energy companies seeking to integrate green hydrogen into their operations. A key competitive advantage lies in its proprietary electrolysis technology, which claims higher efficiency and lower production costs compared to competitors.

This technological edge is protected by patents and trade secrets, forming a significant barrier to entry for new players. A SWOT analysis reveals Sun Hydrogen’s strengths in its innovative technology and growing market demand for green hydrogen, while weaknesses include its relatively small scale of operations and dependence on government subsidies. Opportunities abound in expanding into new markets and forming strategic alliances, while threats include competition from established energy companies and potential fluctuations in the price of renewable energy sources.

Factors Influencing Sun Hydrogen Stock Price

Several macroeconomic and industry-specific factors significantly impact Sun Hydrogen’s stock price. Interest rate hikes, for instance, can reduce investor appetite for growth stocks like Sun Hydrogen, leading to price declines. Similarly, inflation affecting production costs can squeeze profit margins. Government regulations, such as subsidies for green hydrogen production or stricter emissions standards, can greatly influence the company’s profitability and, subsequently, its stock price.

Competitor actions, such as new product launches or aggressive pricing strategies, also impact market share and stock valuation. Positive news, like successful pilot projects or securing major contracts, generally boosts investor confidence and the stock price, while negative news can have the opposite effect.

| Company Name | Stock Symbol | Current Price (Illustrative) | Year-to-Date Performance (Illustrative) |

|---|---|---|---|

| Sun Hydrogen | SUNH | $15.50 | +25% |

| Competitor A | COMP A | $22.00 | +18% |

| Competitor B | COMP B | $10.75 | +10% |

| Competitor C | COMP C | $18.25 | +20% |

Note: The above data is illustrative and should not be considered investment advice. Actual figures may vary.

Financial Performance and Valuation

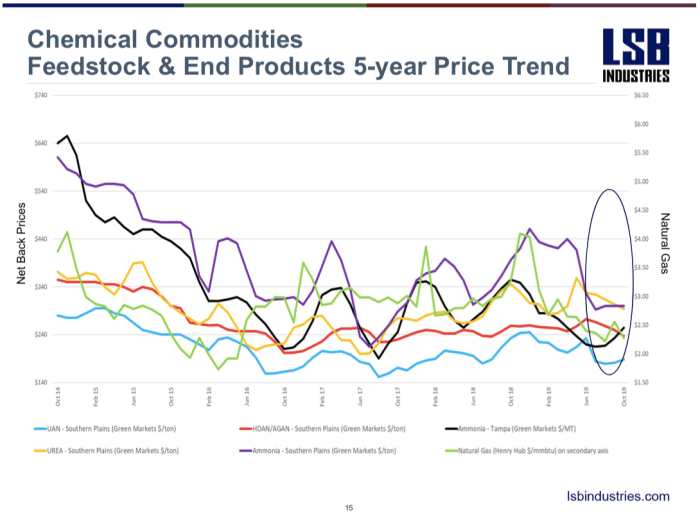

Source: ammoniaenergy.org

A detailed analysis of Sun Hydrogen’s financial statements, including the income statement, balance sheet, and cash flow statement, is crucial for understanding its financial health. Key profitability ratios, such as gross profit margin and net profit margin, indicate the company’s efficiency in generating profits. Liquidity ratios, such as the current ratio and quick ratio, assess its ability to meet short-term obligations.

Solvency ratios, like the debt-to-equity ratio, show its long-term financial stability. Valuation methods, including discounted cash flow (DCF) analysis and price-to-earnings (P/E) ratio comparisons with industry benchmarks, provide insights into whether the stock is overvalued or undervalued.

- Gross Profit Margin: Indicates the profitability of sales after deducting the cost of goods sold.

- Net Profit Margin: Shows the percentage of revenue remaining after all expenses are deducted.

- Current Ratio: Measures the company’s ability to pay its short-term liabilities with its current assets.

- Debt-to-Equity Ratio: Shows the proportion of a company’s financing from debt compared to equity.

- Price-to-Earnings Ratio (P/E): Compares a company’s stock price to its earnings per share.

Investor Sentiment and Market Outlook

Currently, investor sentiment towards Sun Hydrogen is cautiously optimistic, driven by the growing global focus on renewable energy and the potential for significant growth in the green hydrogen sector. However, concerns remain regarding the company’s relatively small size and the inherent risks associated with investing in a nascent technology. Analyst ratings and price targets vary, reflecting the uncertainty surrounding the future of the hydrogen energy market.

Some experts project significant growth in Sun Hydrogen’s stock price based on optimistic scenarios, while others adopt a more conservative outlook.

A projected stock price trajectory might show a gradual upward trend under a positive scenario, with accelerating growth as the company gains market share and achieves profitability. A moderate scenario might depict slower growth with some periods of stagnation, while a pessimistic scenario could show a downward trend due to unforeseen challenges or setbacks.

Risks and Opportunities, Sun hydrogen stock price

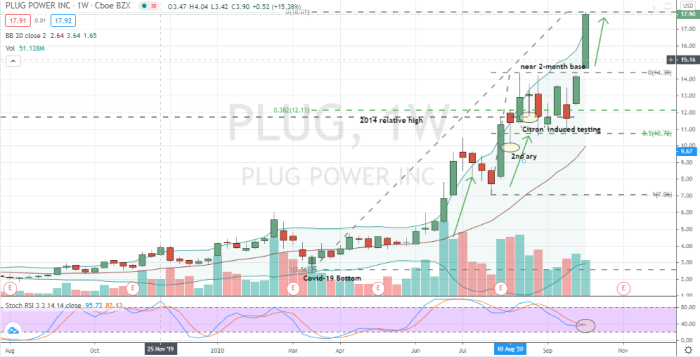

Source: investorplace.com

Investing in Sun Hydrogen carries several risks. Technological risks include the possibility of unforeseen technical challenges in scaling up production or unexpected performance issues. Regulatory risks stem from potential changes in government policies or subsidies that could negatively impact the company’s profitability. Market risks encompass competition from established players and fluctuations in demand for green hydrogen. However, Sun Hydrogen also has significant growth opportunities.

Expansion into new geographic markets, strategic partnerships with major energy companies, and technological advancements could significantly boost revenue and profitability. The company can mitigate risks through robust risk management practices, continuous technological innovation, and strategic diversification.

FAQ Insights

What are the main risks associated with investing in Sun Hydrogen?

Investing in Sun Hydrogen carries risks associated with the early-stage nature of the hydrogen energy sector, including technological hurdles, regulatory uncertainty, competition, and market volatility.

Tracking the Sun Hydrogen stock price requires a keen eye on the renewable energy sector. However, understanding broader tech market trends is also crucial; for example, the performance of companies like Super Micro Computer, whose stock price you can check here: stock price super micro computer , often reflects investor sentiment towards related technologies. This broader market perspective can provide valuable context when analyzing the Sun Hydrogen stock price fluctuations.

How does Sun Hydrogen’s valuation compare to its competitors?

A detailed comparison of Sun Hydrogen’s valuation metrics (e.g., P/E ratio, market capitalization) to its competitors requires a comprehensive financial analysis and is beyond the scope of this brief overview. Such a comparison would be presented in a more detailed report.

What is the current analyst consensus on Sun Hydrogen’s stock?

Analyst opinions vary and are subject to change. Refer to current financial news and analyst reports for the most up-to-date consensus on Sun Hydrogen’s stock.