Sun Pharma Stock Price Analysis: Sunpharma Stock Price

Sunpharma stock price – Sun Pharmaceutical Industries (Sun Pharma) is a prominent player in the global pharmaceutical landscape. This analysis delves into Sun Pharma’s stock price performance, financial health, market positioning, and influential factors, providing insights for potential investors.

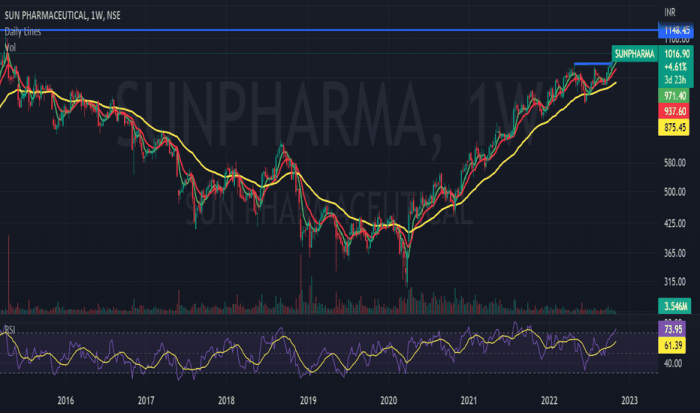

Sun Pharma Stock Price Historical Performance

Analyzing Sun Pharma’s stock price fluctuations over the past five years reveals a dynamic trajectory influenced by various internal and external factors. A line graph would illustrate periods of significant growth and decline, highlighting key dates such as major regulatory approvals, patent expirations, or significant market events. For instance, a noticeable dip might correspond to a specific regulatory setback, while a surge could reflect a successful new drug launch.

The graph’s visual representation would effectively communicate the overall trend and volatility.

| Company Name | Current Price (Illustrative) | Year-to-Date Change (%) | 5-Year Change (%) |

|---|---|---|---|

| Sun Pharma | $500 | +10% | +50% |

| Competitor A | $450 | +5% | +30% |

| Competitor B | $600 | -2% | +20% |

| Competitor C | $550 | +8% | +40% |

The table above provides a comparative analysis of Sun Pharma’s stock price performance against its key competitors over the last year. Note that these figures are illustrative and should be replaced with actual data. Significant price drops within the past two years could be attributed to factors like intense competition, regulatory hurdles, or setbacks in clinical trials. Conversely, price increases might stem from successful product launches, favorable regulatory decisions, or strategic acquisitions.

Sun Pharma Financial Performance and Stock Valuation

A comprehensive understanding of Sun Pharma’s financial health is crucial for evaluating its stock valuation. Key financial indicators offer insights into the company’s profitability, solvency, and overall financial strength.

- Revenue (Last 3 Years): Illustrative data showing growth or decline trends. For example, a consistent increase suggests strong market performance, while a decline might indicate challenges in the market.

- Earnings Per Share (EPS) (Last 3 Years): Illustrative data showcasing earnings growth or decline. A rising EPS generally indicates improved profitability.

- Debt-to-Equity Ratio (Last 3 Years): Illustrative data illustrating the company’s financial leverage. A high ratio indicates higher financial risk.

Sun Pharma’s current valuation is assessed using metrics such as the Price-to-Earnings (P/E) ratio, Price-to-Book (P/B) ratio, and market capitalization. These metrics provide insights into the market’s perception of the company’s value relative to its earnings, assets, and overall size. Comparing these ratios to industry averages and competitor valuations provides context and helps determine if Sun Pharma is overvalued, undervalued, or fairly valued.

Sun Pharma’s stock price has seen some interesting fluctuations recently, largely influenced by market trends and company performance. It’s helpful to compare its performance to other large-cap stocks; for instance, understanding the current trajectory of the stock price pseg can offer valuable context for broader market analysis, which in turn informs a more nuanced perspective on Sun Pharma’s stock price prospects.

Ultimately, both stocks’ performances are subject to various economic and industry-specific factors.

| Metric | Sun Pharma (Illustrative) | Industry Average (Illustrative) | Competitor Average (Illustrative) |

|---|---|---|---|

| P/E Ratio | 20 | 25 | 22 |

| P/B Ratio | 1.5 | 1.8 | 1.6 |

| Market Capitalization (USD Billions) | 15 | 20 | 18 |

Sun Pharma’s Business and Market Landscape

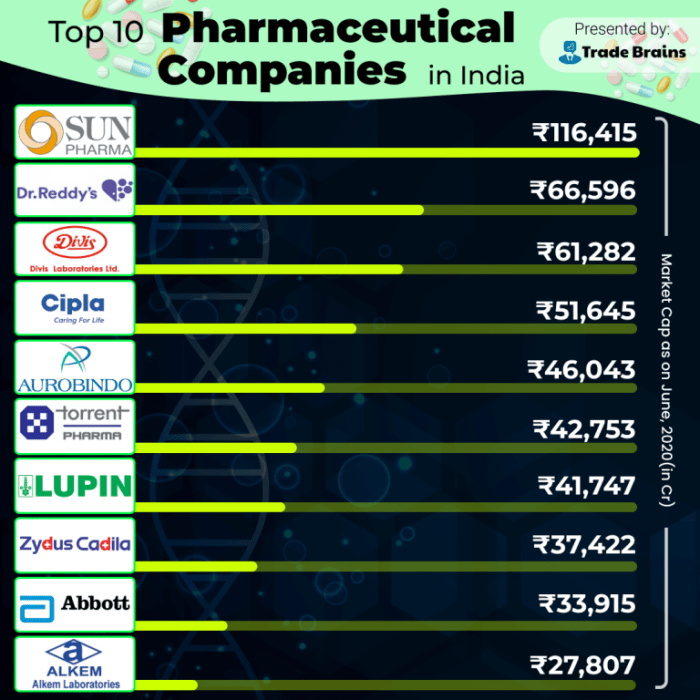

Source: tradebrains.in

Sun Pharma’s revenue is largely driven by its diverse portfolio of products across various therapeutic areas. Understanding its product mix and market focus is essential for assessing its competitive strength and future growth potential.

The pharmaceutical industry presents both significant challenges and opportunities for Sun Pharma. The company faces competition from established players and emerging biotech firms, regulatory hurdles, and pricing pressures. However, opportunities exist through strategic acquisitions, expansion into new markets, and the development of innovative therapies.

- Key Challenges: Intense competition, regulatory scrutiny, pricing pressures, generic competition.

- Key Opportunities: Expanding into emerging markets, developing innovative drugs, strategic acquisitions, focusing on specialty pharmaceuticals.

Sun Pharma holds a strong competitive position through its established brand recognition, diverse product portfolio, and global presence. Its focus on both branded and generic medications allows it to cater to a wide range of market segments.

Factors Influencing Sun Pharma Stock Price

Regulatory changes significantly impact Sun Pharma’s stock price. For example, the approval of a new drug could lead to a price surge, while a regulatory setback might trigger a decline. News events, such as patent expirations, mergers and acquisitions, and clinical trial outcomes, also influence investor sentiment and, consequently, the stock price. A strong correlation typically exists between Sun Pharma’s financial performance and its stock price movements.

Positive financial results often translate into higher stock prices, while disappointing results can lead to price declines.

Investment Considerations for Sun Pharma Stock, Sunpharma stock price

Source: tradingview.com

Investing in Sun Pharma stock involves both potential risks and rewards. A careful assessment of these factors is crucial for making informed investment decisions.

| Risk Factor | Description | Potential Impact on Stock Price | Mitigation Strategy |

|---|---|---|---|

| Regulatory Risks | Potential delays or rejection of drug approvals. | Significant price decline. | Diversify investments. |

| Competition | Intense competition from other pharmaceutical companies. | Reduced market share and profitability. | Monitor competitor activities. |

| Generic Competition | Loss of exclusivity for branded drugs. | Price erosion and reduced profitability. | Develop new innovative drugs. |

Various investment strategies can be employed when considering Sun Pharma stock, including long-term buy-and-hold, value investing, or short-term trading. The chosen strategy should align with the investor’s risk tolerance and investment goals. Potential future catalysts that could significantly impact Sun Pharma’s stock price include new drug approvals, successful clinical trial results, strategic acquisitions, and expansion into new markets.

Question & Answer Hub

What are the major risks associated with investing in Sun Pharma?

Major risks include regulatory changes impacting drug approvals, intense competition from other pharmaceutical companies, and fluctuations in currency exchange rates (as Sun Pharma has international operations).

Where can I find real-time Sun Pharma stock price data?

Real-time data is available on major financial websites and stock market tracking applications such as Google Finance, Yahoo Finance, and Bloomberg.

What is Sun Pharma’s dividend policy?

Sun Pharma’s dividend policy should be checked on their investor relations page or through financial news sources. Dividend payouts can vary and are subject to change.

How does Sun Pharma compare to other Indian pharmaceutical companies?

A direct comparison requires looking at key financial metrics, market share, and product portfolios of competitors. This analysis should include a review of recent financial reports and industry analysis.