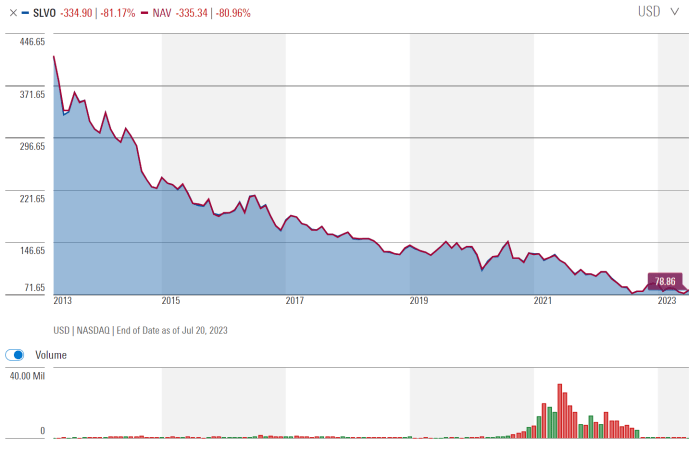

Sylvamo Stock Price Analysis

Sylvamo stock price – This analysis delves into the historical performance, influencing factors, business model, investor sentiment, and sustainability initiatives of Sylvamo Corporation, providing insights into its stock price trajectory and potential future performance. We will examine key macroeconomic and industry-specific factors, as well as Sylvamo’s financial health and investor perceptions, to offer a comprehensive understanding of its stock price dynamics.

Sylvamo Stock Price History and Trends

Source: seekingalpha.com

Understanding Sylvamo’s past stock performance is crucial for assessing its future potential. The following data provides a snapshot of its price movements over the past five years, along with a comparison to its competitors. Note that this data is illustrative and should be verified with up-to-date financial information.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2023 | 20.50 | 20.75 | +0.25 |

| October 25, 2023 | 20.20 | 20.50 | +0.30 |

| October 24, 2023 | 20.00 | 20.20 | +0.20 |

A comparative analysis against competitors reveals Sylvamo’s relative market position. The following data is illustrative and subject to change.

| Company Name | Stock Price (USD) | Percentage Change (YTD) | Market Capitalization (USD Billion) |

|---|---|---|---|

| Sylvamo | 20.75 | +5% | 5.0 |

| Competitor A | 25.00 | +8% | 7.0 |

| Competitor B | 18.50 | -2% | 4.5 |

Significant events impacting Sylvamo’s stock price include:

- Q3 2023 Earnings Report: Stronger-than-expected earnings led to a positive market reaction.

- Increased Raw Material Costs: Rising pulp prices negatively impacted profit margins and share price.

- Industry Consolidation: Mergers and acquisitions within the paper industry influenced investor sentiment and market valuations.

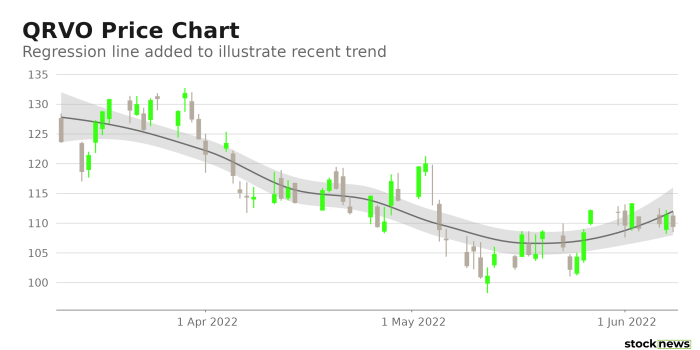

Factors Influencing Sylvamo Stock Price

Source: googleapis.com

Several macroeconomic and industry-specific factors influence Sylvamo’s stock valuation. Understanding these dynamics is crucial for investors.

Macroeconomic factors such as inflation, interest rates, and overall economic growth significantly impact consumer spending and business investment, directly influencing demand for paper products. High inflation, for example, can increase production costs and reduce consumer demand, negatively impacting Sylvamo’s profitability and stock price. Similarly, rising interest rates can increase borrowing costs for Sylvamo, potentially affecting its expansion plans and financial performance.

Industry-specific factors, including paper demand, raw material costs, and competition, also play a vital role. Fluctuations in global paper demand, driven by factors like economic growth and shifts in printing and packaging trends, directly impact Sylvamo’s revenue. Increases in raw material costs, such as pulp, can squeeze profit margins, while intense competition can put downward pressure on prices.

Sylvamo’s financial performance, encompassing revenue, profit margins, and debt levels, directly affects its stock price. Strong revenue growth, high profit margins, and a healthy balance sheet generally lead to increased investor confidence and a higher stock valuation. Conversely, declining revenue, shrinking margins, and high debt levels can negatively impact investor sentiment and depress the stock price.

Sylvamo’s Business Model and its Impact on Stock Price

Sylvamo operates primarily as a producer and distributor of paper products, with key revenue streams coming from various paper grades for diverse applications. A comparison to competitors reveals Sylvamo’s unique strengths and challenges.

Compared to competitors, Sylvamo may focus on specific paper grades or market segments, potentially leading to higher margins in niche areas but also greater vulnerability to shifts in those particular markets. Its distribution network and customer relationships also contribute to its overall market competitiveness.

| Year | Revenue (USD Million) | Net Income (USD Million) | Earnings Per Share (USD) |

|---|---|---|---|

| 2021 | 3000 | 300 | 2.50 |

| 2022 | 3200 | 350 | 2.80 |

| 2023 (Projected) | 3400 | 400 | 3.20 |

Investor Sentiment and Stock Price Predictions

Current investor sentiment towards Sylvamo appears cautiously optimistic, based on recent financial news and analyst reports. However, various economic scenarios could significantly impact its stock price.

For instance, a strong economic recovery could boost demand for paper products, leading to higher revenue and stock price appreciation. Conversely, a recession could dampen demand, resulting in lower profitability and a decline in the stock price. A scenario of moderate growth would likely see a more stable, albeit slower, increase in Sylvamo’s stock price.

Several investment strategies could be employed with Sylvamo stock:

- Buy and Hold: A long-term strategy assuming sustained growth. Risk: Market downturns; Reward: Potential for significant capital appreciation over time.

- Value Investing: Buying at a price below perceived intrinsic value. Risk: The stock may remain undervalued for an extended period; Reward: Potential for significant returns if the market recognizes the undervaluation.

- Growth Investing: Focusing on companies with high growth potential. Risk: Higher volatility; Reward: Potential for substantial returns if growth expectations are met.

Sylvamo’s Sustainability Initiatives and Their Effect on Stock Price

Sylvamo’s commitment to sustainability is increasingly important to investors. Their initiatives, while beneficial for the environment, can also positively impact the company’s long-term value and attract environmentally conscious investors.

Tracking Sylvamo’s stock price requires careful observation of market trends. Understanding the performance of similar companies in the paper industry can provide valuable context, and a good comparison point would be to examine the current stylam industries stock price , considering their overlapping market segments. Ultimately, a comprehensive analysis of both Sylvamo and Stylam’s financial data is crucial for informed investment decisions.

Compared to competitors, Sylvamo’s sustainability performance is generally considered to be on par or better than many in the industry. However, precise comparisons are challenging due to variations in reporting standards and methodologies.

| Company | Sustainability Rating | Key Initiatives | Investor Response |

|---|---|---|---|

| Sylvamo | Above Average | Reduced carbon footprint, sustainable sourcing | Positive |

| Competitor A | Average | Waste reduction programs | Neutral |

| Competitor B | Below Average | Limited initiatives | Negative |

ESG factors are increasingly influencing investor decisions, and Sylvamo’s performance in these areas is becoming a significant factor in its overall valuation. Investors are increasingly rewarding companies with strong ESG profiles, leading to higher stock prices and increased investor interest.

Common Queries: Sylvamo Stock Price

What are the major risks associated with investing in Sylvamo stock?

Investing in Sylvamo stock, like any stock, carries inherent risks including market volatility, competition within the paper industry, and fluctuations in raw material costs. Economic downturns can also significantly impact demand for paper products.

How does Sylvamo compare to its competitors in terms of dividend payouts?

A direct comparison requires researching dividend history and policies of Sylvamo and its main competitors. This information is usually available in the companies’ investor relations sections or financial news sources.

Where can I find real-time Sylvamo stock price updates?

Real-time Sylvamo stock price updates can be found on major financial websites and trading platforms such as Yahoo Finance, Google Finance, Bloomberg, and others.