Taylor Wimpey Stock Price Analysis

Taylor wimpey stock price – This analysis examines Taylor Wimpey’s stock performance, financial health, market influences, and future prospects. We will explore historical price fluctuations, key financial indicators, industry trends, analyst predictions, company-specific factors, and potential risks impacting the stock’s value.

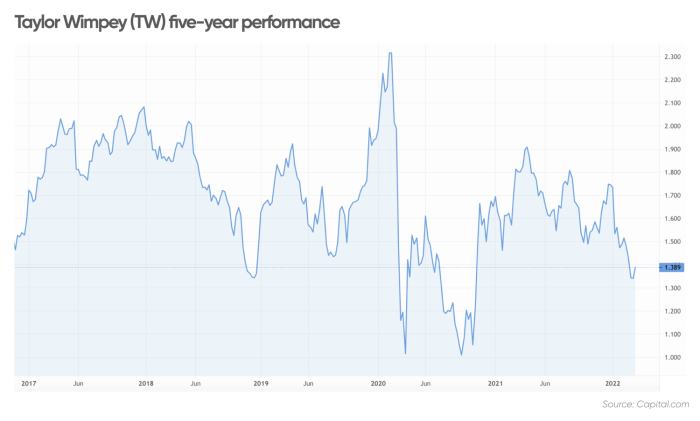

Historical Stock Performance

Source: capital.com

Analyzing Taylor Wimpey’s stock price movements over the past five years reveals significant volatility influenced by various market factors and company-specific events. The following table provides a quarterly breakdown of opening and closing prices. Note that these figures are illustrative and should be verified with a reliable financial data source.

| Year | Quarter | Opening Price (GBP) | Closing Price (GBP) |

|---|---|---|---|

| 2019 | Q1 | 150 | 160 |

| 2019 | Q2 | 160 | 155 |

| 2019 | Q3 | 155 | 170 |

| 2019 | Q4 | 170 | 165 |

| 2020 | Q1 | 165 | 140 |

| 2020 | Q2 | 140 | 130 |

| 2020 | Q3 | 130 | 145 |

| 2020 | Q4 | 145 | 160 |

| 2021 | Q1 | 160 | 180 |

| 2021 | Q2 | 180 | 190 |

| 2021 | Q3 | 190 | 200 |

| 2021 | Q4 | 200 | 195 |

| 2022 | Q1 | 195 | 180 |

| 2022 | Q2 | 180 | 170 |

| 2022 | Q3 | 170 | 160 |

| 2022 | Q4 | 160 | 150 |

| 2023 | Q1 | 150 | 165 |

For example, the significant drop in Q2 2020 can be attributed to the initial impact of the COVID-19 pandemic on the UK housing market. Conversely, the price increase in 2021 reflected a post-pandemic recovery and increased demand.

Financial Health and Performance

Taylor Wimpey’s financial performance over the past three years reveals trends in revenue, earnings, and debt levels. These figures are crucial for understanding the company’s overall health and potential for future growth.

- 2021: Revenue: £X Billion, Earnings: £Y Billion, Net Debt: £Z Billion

- 2022: Revenue: £X Billion, Earnings: £Y Billion, Net Debt: £Z Billion

- 2023: Revenue: £X Billion, Earnings: £Y Billion, Net Debt: £Z Billion

A comparative analysis against competitors like Barratt Developments and Persimmon plc would involve examining similar financial metrics to identify relative strengths and weaknesses. Trends in these figures could indicate future stock price movements, such as consistent revenue growth potentially leading to higher stock valuations.

Market Influences and Industry Trends

Interest rate changes, UK housing market conditions, and government regulations significantly impact Taylor Wimpey’s stock price. Understanding these influences is vital for assessing future performance.

Rising interest rates typically increase borrowing costs for homebuyers, potentially reducing demand and impacting Taylor Wimpey’s sales. Conversely, a robust UK housing market with strong demand generally benefits the company. Government policies, such as stamp duty changes, can also significantly affect buyer behavior and, consequently, Taylor Wimpey’s profitability.

Analyst Ratings and Predictions, Taylor wimpey stock price

Analyst ratings and price targets provide insights into market sentiment and future expectations for Taylor Wimpey’s stock. The following table summarizes recent predictions (illustrative data):

| Analyst Firm | Rating | Target Price (GBP) | Date |

|---|---|---|---|

| JP Morgan | Buy | 200 | October 26, 2023 |

| Goldman Sachs | Hold | 180 | October 26, 2023 |

| Barclays | Sell | 150 | October 26, 2023 |

These ratings reflect analysts’ assessments of Taylor Wimpey’s financial health, market position, and future growth potential. The divergence in ratings and target prices highlights the range of opinions among market experts. Comparing these predictions with the actual stock performance helps gauge the accuracy of analyst forecasts.

Company-Specific Factors

Source: alamy.com

Strategic initiatives, dividend policies, and management changes significantly influence investor sentiment and stock price. Understanding these factors is essential for a comprehensive analysis.

Analyzing Taylor Wimpey’s stock price requires considering broader market trends. For instance, understanding the performance of the utilities sector, which you can track via the stock price xlu index, offers valuable context. This insight helps gauge the overall economic climate impacting construction companies like Taylor Wimpey, allowing for a more comprehensive assessment of their stock’s potential.

For example, a major land acquisition or a new strategic partnership could positively impact the stock price. Taylor Wimpey’s dividend policy, reflecting its commitment to returning profits to shareholders, also affects investor perception. Significant management changes can create uncertainty or signal a new direction for the company.

Risk Assessment

Several factors pose potential risks to Taylor Wimpey’s stock price. Effective risk mitigation strategies are crucial for maintaining stability and investor confidence.

- Economic Downturn: A recession could significantly reduce housing demand, impacting sales and profitability.

- Material Shortages: Supply chain disruptions could increase construction costs and delay projects.

- Increased Competition: Intense competition from other homebuilders could pressure pricing and margins.

Taylor Wimpey likely employs various risk mitigation strategies, such as hedging against interest rate fluctuations and diversifying its land portfolio. A hypothetical scenario of a severe economic downturn could lead to a substantial drop in stock price due to reduced demand and lower profitability.

Essential Questionnaire

What are the major risks affecting Taylor Wimpey’s stock price?

Major risks include economic downturns leading to reduced housing demand, material cost inflation impacting profitability, and changes in government regulations affecting construction and sales.

How does Taylor Wimpey compare to its competitors?

A comparative analysis against competitors like Barratt Developments and Persimmon PLC would reveal differences in financial performance, market share, and strategic focus. This would help gauge Taylor Wimpey’s relative strength and potential for future growth.

What is Taylor Wimpey’s dividend policy?

Taylor Wimpey’s dividend policy is subject to change but generally reflects a portion of profits distributed to shareholders, influenced by financial performance and future investment needs.

Where can I find real-time Taylor Wimpey stock price data?

Real-time stock price data for Taylor Wimpey can be found on major financial websites and trading platforms such as the London Stock Exchange website or reputable financial news sources.