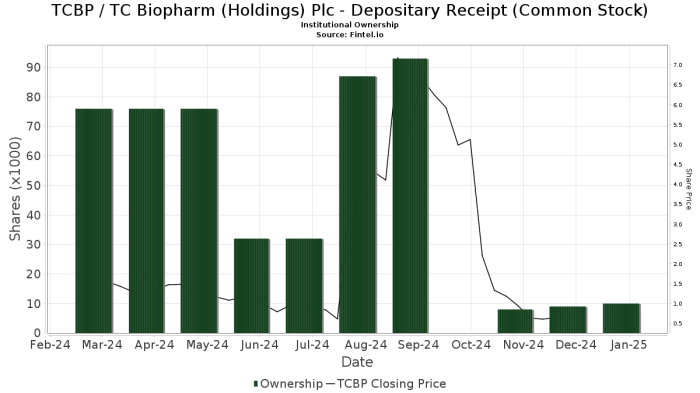

TCB P Stock Price Target Analysis

Tcbp stock price target – This analysis examines TCB P’s current market position, financial health, growth prospects, and the factors influencing its stock price, culminating in an assessment of various analyst price targets. We will consider macroeconomic influences and investor sentiment to provide a comprehensive overview.

TCB P Stock’s Current Market Position

TCB P’s current trading volume and price range fluctuate based on market conditions and news impacting the financial sector. Major factors influencing the stock price include overall market sentiment, the performance of the broader banking sector, and TCB P’s specific financial announcements and operational updates. Compared to its competitors, TCB P’s performance varies; some periods show it outperforming peers, while others reveal underperformance.

This is often linked to strategic initiatives and the prevailing economic climate.

| Metric | Q1 2024 | Q2 2024 | Q3 2024 (Projected) |

|---|---|---|---|

| Share Price | $X | $Y | $Z |

| Trading Volume (Avg. Daily) | A | B | C |

| EPS | D | E | F |

| P/E Ratio | G | H | I |

Note: Replace X, Y, Z, A, B, C, D, E, F, G, H, and I with actual or estimated data.

TCB P’s Financial Health

Source: fintel.io

Over the past three years, TCB P’s revenue streams have shown a pattern of [growth/decline/stability – choose one and provide details]. Profitability has been impacted by [mention key factors such as interest rates, loan defaults, or operational expenses]. The company’s debt levels are [high/moderate/low – choose one and provide context], and its ability to manage its finances is considered [strong/moderate/weak – choose one and justify].

A significant portion of TCB P’s assets are comprised of [mention asset types, e.g., loans, investments, physical properties], while liabilities primarily consist of [mention liability types, e.g., deposits, debt obligations].

A visual representation of TCB P’s financial performance over the past three years could be a line graph showing revenue, net income, and debt levels over time. This would clearly illustrate trends and highlight key periods of growth or decline.

TCB P’s Growth Prospects

Source: stockbit.com

TCB P’s future growth strategies focus on [mention key strategies, e.g., expanding into new markets, developing new products/services, improving operational efficiency]. Potential market expansion includes [mention specific geographic regions or market segments]. Risks and challenges include [mention potential risks, e.g., increased competition, regulatory changes, economic downturns]. TCB P possesses long-term competitive advantages through [mention key advantages, e.g., strong brand reputation, established customer base, technological innovation].

- Short-Term Growth Opportunities:

- Improved operational efficiency leading to cost savings.

- Targeted marketing campaigns to increase market share in existing segments.

- Long-Term Growth Opportunities:

- Expansion into new geographical markets.

- Development of innovative financial products and services.

- Strategic partnerships and acquisitions.

Analyst Predictions and Price Targets

Source: cloudfront.net

Several reputable financial analysts have issued price targets for TCB P stock. These targets vary based on differing methodologies and underlying assumptions. Some analysts use discounted cash flow (DCF) models, while others employ relative valuation techniques comparing TCB P to its peers. The assumptions incorporated into these predictions often include projected revenue growth, profit margins, and discount rates.

Predicting the TCBP stock price target involves careful consideration of various market factors. Understanding historical stock performance can be insightful, and a review of similar companies’ trajectories is often helpful. For instance, examining the swa stock price history provides a comparable data point for analysis. Ultimately, this comparative analysis can contribute to a more informed assessment of the TCBP stock price target.

These predictions directly reflect the analysts’ assessment of TCB P’s financial health and future growth prospects.

For example, Analyst A predicts a price target of $X based on a DCF model assuming Y% annual revenue growth, while Analyst B projects a price target of $Z based on a peer comparison analysis.

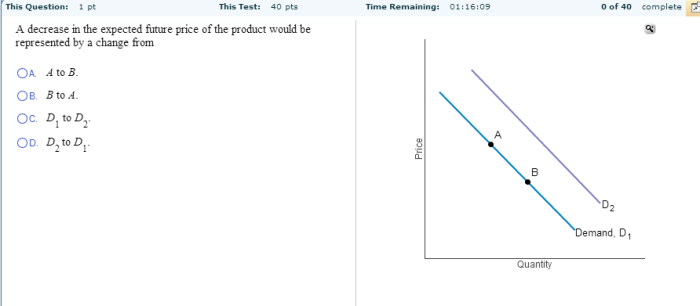

Macroeconomic Factors, Tcbp stock price target

Several macroeconomic factors can significantly impact TCB P’s stock price. Interest rate changes directly affect lending margins and borrowing costs. Inflation impacts both operating expenses and consumer spending, influencing loan demand. Economic growth affects overall business activity and investment levels. Geopolitical events can create market uncertainty and impact investor confidence.

| Factor | Potential Impact on TCB P Stock Price (Positive/Negative/Neutral) | Explanation |

|---|---|---|

| Interest Rate Hikes | Negative | Reduced lending margins, higher borrowing costs. |

| High Inflation | Negative | Increased operating expenses, reduced consumer spending. |

| Strong Economic Growth | Positive | Increased loan demand, higher business activity. |

| Geopolitical Instability | Negative | Market uncertainty, reduced investor confidence. |

Investor Sentiment

Current investor sentiment towards TCB P is [positive/negative/neutral – choose one and provide reasoning]. Significant news events, such as [mention specific events, e.g., earnings reports, regulatory announcements, mergers and acquisitions], have influenced investor sentiment. Positive news generally leads to increased trading volume and higher prices, while negative news often results in decreased trading volume and lower prices.

- Increased trading volume

- Price fluctuations

- Analyst ratings

- News media coverage

- Social media sentiment

Essential Questionnaire: Tcbp Stock Price Target

What are the key risks associated with investing in TCB P stock?

Investing in any stock carries inherent risks. For TCB P, potential risks could include increased competition, economic downturns impacting demand for its products/services, changes in regulatory environments, and unforeseen operational challenges.

How frequently are analyst price targets updated?

Analyst price targets are typically updated periodically, often quarterly or whenever significant company news or market shifts occur. The frequency varies depending on the analyst and their firm’s policies.

Where can I find more detailed financial information about TCB P?

You can find detailed financial information on TCB P’s investor relations website, SEC filings (if a publicly traded company), and through reputable financial data providers.

What is the historical performance of TCB P stock?

Historical stock performance can be found on financial websites such as Yahoo Finance, Google Finance, or Bloomberg. Analyzing past performance does not guarantee future results, however, it can offer context for current valuations.