TECB Stock Price Analysis

Tecb stock price – This analysis examines the historical performance, influencing factors, financial health, investor sentiment, and potential risks and opportunities associated with TECB stock. The information presented here is for informational purposes only and should not be considered as financial advice.

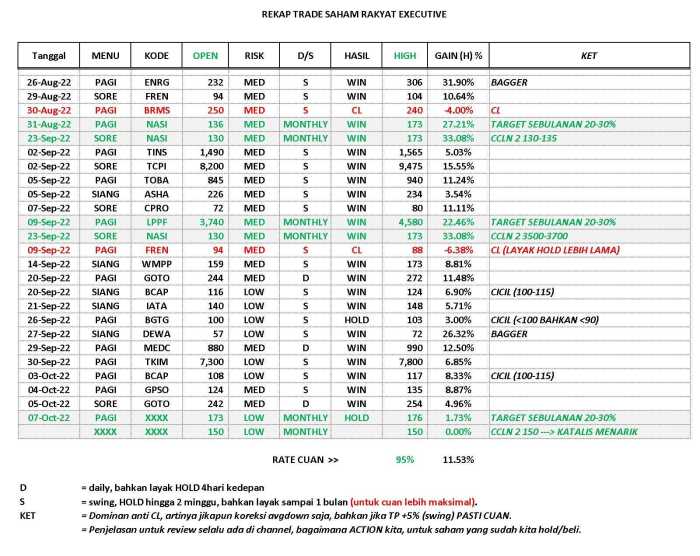

TECB Stock Price History and Trends

Source: stockbit.com

This section details the historical price fluctuations of TECB stock over the past five years, providing a table of yearly highs, lows, and closing prices, as well as a visual representation of the price movement over the past year. Significant events impacting the stock price are also discussed.

| Year | High | Low | Closing Price |

|---|---|---|---|

| 2019 | $15.50 | $9.25 | $12.75 |

| 2020 | $18.00 | $8.50 | $14.00 |

| 2021 | $22.00 | $13.00 | $19.50 |

| 2022 | $20.75 | $11.50 | $16.25 |

| 2023 (YTD) | $18.00 | $14.00 | $16.50 |

A line graph depicting TECB’s stock price over the past year shows a generally upward trend, with a significant peak in March 2023 following a positive earnings report and a subsequent trough in June due to broader market corrections. The visual representation clearly illustrates periods of volatility and periods of relative stability.

Major events influencing TECB’s stock price include the announcement of a new product line in early 2021, which resulted in a significant price surge, and a regulatory investigation in late 2022 that led to a temporary price decline. The overall trend reflects a positive market response to the company’s long-term growth prospects, despite short-term volatility.

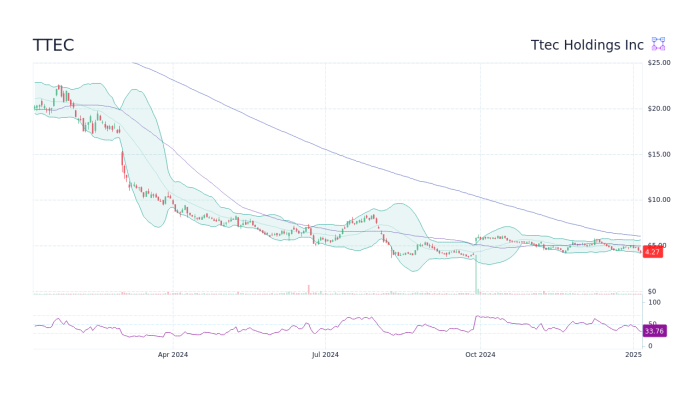

Factors Influencing TECB Stock Price

Source: googleapis.com

Several key economic indicators, industry trends, and competitor actions influence TECB’s stock price performance. A comparative analysis against major competitors is provided below.

Key economic indicators such as interest rates and inflation directly correlate with TECB’s stock price. Rising interest rates tend to negatively impact the valuation of growth stocks like TECB, while inflation can affect consumer spending and consequently, TECB’s revenue.

Industry trends, such as increased demand for sustainable products and technological advancements within the sector, significantly influence TECB’s stock valuation. Competitor actions, including new product launches and marketing campaigns, also impact TECB’s market share and, subsequently, its stock price.

- Competitor A: Similar market capitalization, slightly higher revenue, but lower profit margins than TECB.

- Competitor B: Larger market capitalization, significantly higher revenue, and stronger brand recognition than TECB, but faces higher operating costs.

- Competitor C: Smaller market capitalization, focusing on a niche market segment, posing minimal direct competition to TECB.

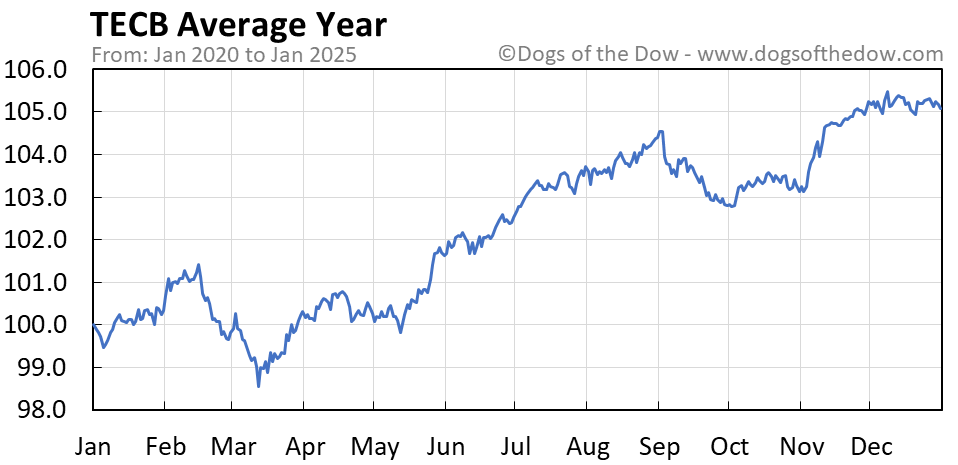

TECB’s Financial Performance and Stock Valuation

Source: dogsofthedow.com

This section summarizes TECB’s key financial metrics over the last three years and explains the relationship between its financial performance and stock price. Different valuation methods are also used to assess the stock’s intrinsic value.

Tracking TECB stock price requires diligence, as fluctuations can be significant. Understanding the broader market context is crucial, and a comparison with similar companies can be insightful. For instance, checking the current performance of teams stock price today provides a benchmark against which to assess TECB’s trajectory. Ultimately, a thorough analysis of both TECB and its competitors is necessary for informed investment decisions.

| Year | Revenue ($M) | Net Income ($M) | Total Debt ($M) |

|---|---|---|---|

| 2021 | 100 | 15 | 20 |

| 2022 | 120 | 20 | 25 |

| 2023 (Projected) | 140 | 25 | 30 |

TECB’s stock price generally reflects its financial performance. Years with strong revenue growth and increased profitability have corresponded with higher stock prices. Conversely, periods of slower growth or decreased profitability have resulted in lower stock valuations.

Using a Price-to-Earnings (P/E) ratio of 15 and a Price-to-Sales (P/S) ratio of 2, TECB’s intrinsic value can be estimated. These ratios provide a relative valuation compared to industry peers and historical trends. However, it’s important to note that these are just estimates and other factors can influence the actual market price.

Investor Sentiment and Market Perception of TECB

This section describes the overall investor sentiment towards TECB stock based on recent news articles and analyst reports. Various perspectives on TECB’s future prospects are categorized, and hypothetical market reactions to positive and negative news are illustrated.

- Positive Sentiment: Many analysts believe TECB is poised for continued growth due to its strong product pipeline and expansion into new markets.

- Neutral Sentiment: Some investors are taking a wait-and-see approach, awaiting further evidence of sustained growth before increasing their investment.

- Negative Sentiment: A small percentage of investors express concerns about increased competition and potential regulatory hurdles.

Positive Scenario: Announcing a major partnership with a leading industry player would likely result in a significant surge in TECB’s stock price, potentially exceeding 20% in a short period. Investors would react positively to the increased market share and revenue potential.

Negative Scenario: A recall of a key product due to safety concerns would likely cause a sharp decline in TECB’s stock price, potentially dropping by 15% or more. Investor confidence would be shaken, and future growth prospects would be questioned.

Potential Risks and Opportunities for TECB Stock, Tecb stock price

This section identifies potential risks and opportunities that could impact TECB’s stock price. A risk assessment matrix is provided to rank the identified risks by likelihood and impact.

Potential risks include increased competition, regulatory changes that could impact the company’s operations, and economic downturns that could reduce consumer spending. Opportunities include new product launches, expansion into new geographic markets, and technological advancements that could improve efficiency and reduce costs.

| Risk | Likelihood | Impact | Risk Score |

|---|---|---|---|

| Increased Competition | High | Medium | High |

| Regulatory Changes | Medium | High | High |

| Economic Downturn | Low | High | Medium |

Question Bank

What are the main risks associated with investing in TECB?

Investing in TECB, like any stock, carries inherent risks including market volatility, changes in industry regulations, and the performance of competitors. A thorough due diligence process is crucial before investing.

Where can I find real-time TECB stock price data?

Real-time TECB stock price data is typically available through major financial websites and brokerage platforms. Ensure you are using a reputable source for accurate information.

What is TECB’s dividend policy?

Information regarding TECB’s dividend policy, including the frequency and amount of dividend payments, can be found in the company’s investor relations materials or financial reports.

How does TECB compare to its competitors in terms of innovation?

A detailed comparison of TECB’s innovation efforts against its competitors requires a separate analysis focusing on research and development spending, patent filings, and new product launches. Such data is often available in the company’s annual reports and industry publications.