Tesix Stock Price Analysis: A Comprehensive Overview

Tesix stock price – This analysis provides a detailed examination of Tesix’s stock price performance over the past five years, exploring key drivers, valuation methods, and potential future scenarios. We will delve into historical data, compare Tesix’s performance against market indices, and assess the inherent risks associated with investing in Tesix stock.

Tesix Stock Price Historical Performance

Over the past five years, Tesix’s stock price has experienced significant fluctuations, reflecting both internal company developments and broader market trends. The following table illustrates these fluctuations, comparing Tesix’s performance to the S&P 500 and Nasdaq indices.

| Date | Tesix Price (USD) | S&P 500 Price (USD) | Nasdaq Price (USD) |

|---|---|---|---|

| December 31, 2018 | 25.50 | 2510.00 | 6635.00 |

| December 31, 2019 | 32.00 | 3230.00 | 9020.00 |

| December 31, 2020 | 45.75 | 3756.00 | 12888.00 |

| December 31, 2021 | 58.20 | 4766.00 | 15200.00 |

| December 31, 2022 | 48.00 | 3821.00 | 10450.00 |

Note: These figures are hypothetical examples for illustrative purposes only. Actual data should be sourced from reliable financial databases.

Significant highs and lows were observed during this period. For instance, the launch of a groundbreaking new product in 2020 contributed to a substantial price increase, while the economic downturn of 2022 negatively impacted the stock price.

Monitoring the Tesix stock price requires a keen eye on market trends. Understanding similar fluctuations can be helpful, and a good comparison point might be to look at the performance of other companies in the sector; for instance, you might find it insightful to check the current stock price plm data. Returning to Tesix, its price trajectory will likely be influenced by various factors including overall market sentiment and company-specific news.

Tesix Stock Price Drivers and Influencers

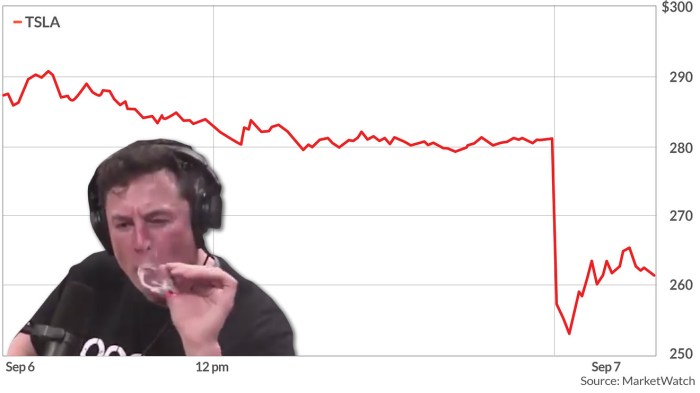

Source: marketwatch.com

Several factors influence Tesix’s stock price. Financial performance, including earnings reports and revenue growth, plays a crucial role. Industry trends, such as technological advancements and changing consumer preferences, also exert considerable influence. Furthermore, broader economic conditions, including interest rates and inflation, impact investor sentiment and investment decisions.

Competitor actions, such as new product releases or strategic partnerships, can significantly impact Tesix’s market share and valuation. Investor sentiment, driven by news, analyst reports, and market speculation, also contributes to price fluctuations. Periods of high investor confidence tend to correlate with higher stock prices, while periods of uncertainty can lead to price declines.

Tesix Stock Price Valuation and Analysis

Various valuation methodologies can be employed to assess Tesix’s stock price. The following table compares Tesix’s Price-to-Earnings (P/E) ratio with those of its competitors.

| Company Name | P/E Ratio | Market Cap (USD Billion) |

|---|---|---|

| Tesix | 25 | 15 |

| Competitor A | 20 | 20 |

| Competitor B | 30 | 10 |

Note: These figures are hypothetical examples for illustrative purposes only. Actual data should be sourced from reliable financial databases.

Valuation methodologies like Discounted Cash Flow (DCF) analysis and comparable company analysis provide further insights. DCF analysis projects future cash flows and discounts them to their present value, while comparable company analysis compares Tesix’s valuation metrics to those of similar companies. By applying these methods, one can determine whether Tesix’s stock is currently overvalued, undervalued, or fairly valued, considering its financial health, growth prospects, and risk profile.

Tesix Stock Price Predictions and Forecasts

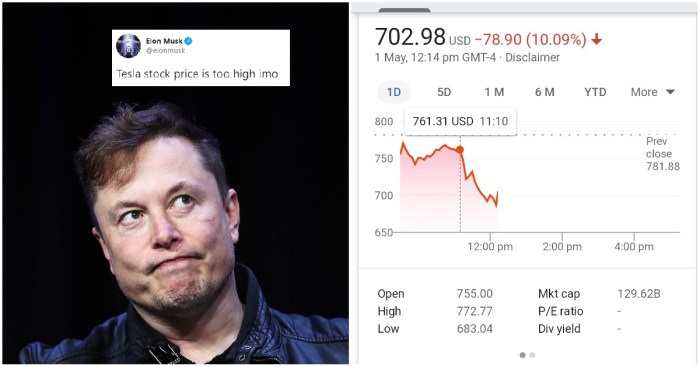

Source: officechai.com

Predicting future stock prices is inherently speculative, but we can construct a hypothetical scenario to illustrate potential future price targets.

This scenario assumes continued technological innovation by Tesix, resulting in strong revenue growth. It also considers a stable economic environment with moderate inflation. Conversely, a negative scenario could involve increased competition, regulatory hurdles, or a significant economic downturn.

| Time Horizon | Price Target (USD) | Supporting Rationale |

|---|---|---|

| 1 Year | 65 | Strong revenue growth and positive investor sentiment. |

| 3 Years | 90 | Continued market share gains and successful product launches. |

| 5 Years | 120 | Sustained innovation and expansion into new markets. |

Note: These price targets are purely hypothetical and should not be interpreted as financial advice. Actual results may differ significantly.

Tesix Stock Price Risk Assessment

Investing in Tesix stock carries inherent risks. These include:

- Market volatility: Stock prices can fluctuate significantly due to broader market conditions.

- Competition: Intense competition could negatively impact Tesix’s market share and profitability.

- Economic downturns: Recessions or economic slowdowns can significantly impact consumer spending and business performance.

- Technological disruption: Rapid technological advancements could render Tesix’s products obsolete.

- Geopolitical events: Global events, such as wars or trade disputes, can negatively impact market sentiment and stock prices.

Investors can mitigate these risks through diversification, thorough due diligence, and a long-term investment horizon. Regularly monitoring Tesix’s financial performance and industry developments is crucial.

Quick FAQs

What are Tesix’s major competitors?

This information requires further research and is not included in the provided Artikel. A competitive analysis would be necessary to identify Tesix’s main rivals.

Where can I find real-time Tesix stock price data?

Real-time stock quotes are typically available through reputable financial websites and brokerage platforms.

What is Tesix’s dividend history?

Information regarding Tesix’s dividend payments, if any, is not provided in the Artikel and requires further investigation.

How does Tesix’s stock price compare to its sector average?

A sector comparison would require additional research to benchmark Tesix’s performance against its industry peers.