Tesla Aftermarket Stock Performance Overview

Tesla aftermarket stock price – The Tesla aftermarket stock market, while separate from the official Nasdaq-listed shares, offers a unique perspective on investor sentiment and speculative trading activity surrounding the electric vehicle giant. Understanding its historical performance, influencing factors, and discrepancies with the official market price provides valuable insights into the dynamics of this niche market.

Historical Trends and Influencing Factors

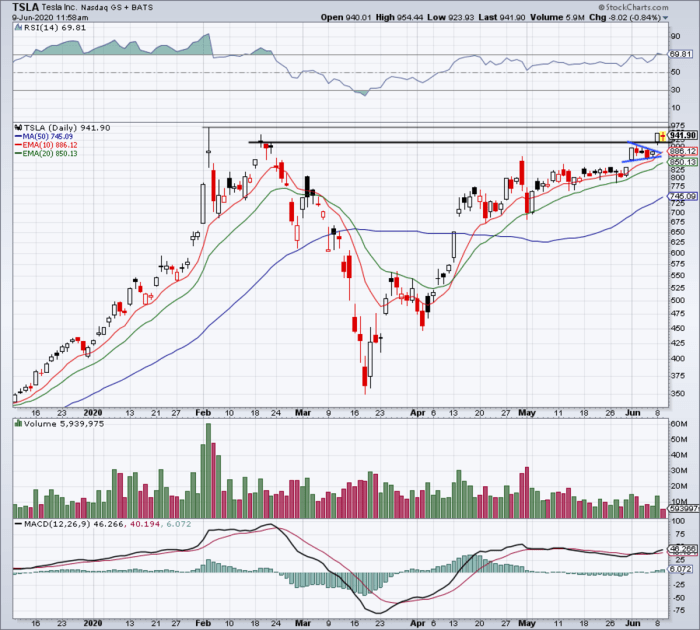

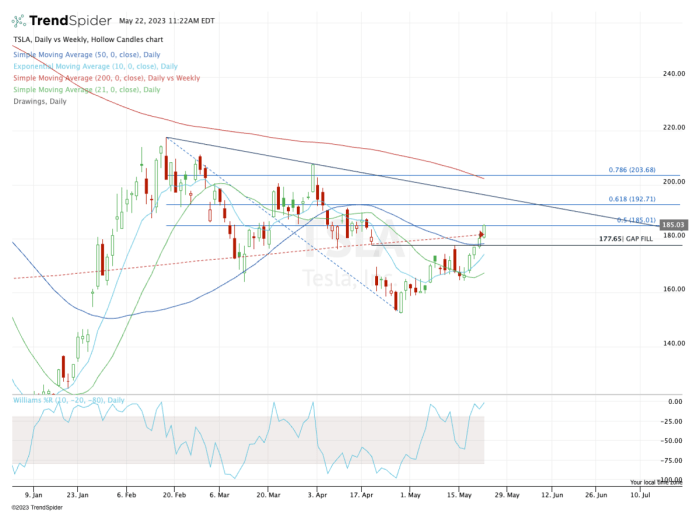

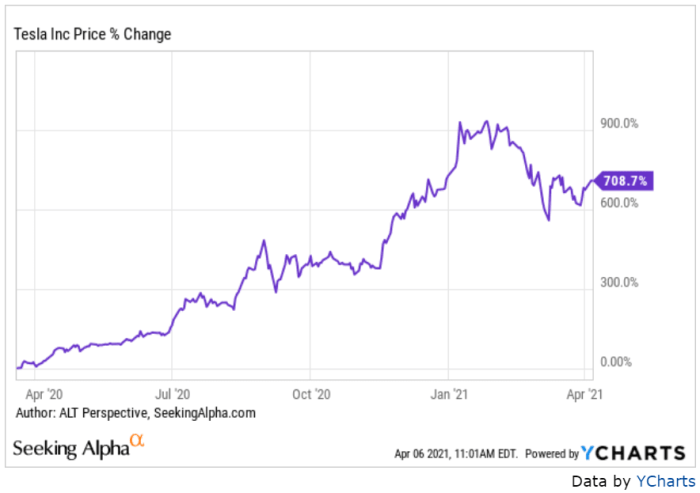

Tesla’s aftermarket stock price has historically mirrored, albeit with amplified volatility, the trends observed in the official stock market. Significant product launches, such as the Model 3 and Cybertruck unveilings, have often led to short-term price surges in the aftermarket. Conversely, negative news, regulatory challenges, or disappointing financial reports have resulted in sharp declines. The aftermarket, being more susceptible to speculation, often exhibits greater price swings than the official market.

Aftermarket vs. Official Stock Market Price Discrepancies

The aftermarket price frequently deviates from the official stock market price. These discrepancies are primarily driven by factors such as liquidity differences, the prevalence of speculative trading, and the lack of stringent regulatory oversight in the aftermarket. The official stock price reflects a more balanced assessment of the company’s fundamental value, while the aftermarket price can be heavily influenced by short-term market sentiment and individual investor behavior.

Yearly Highs and Lows of Aftermarket Tesla Stock Price

The following table illustrates the yearly highs and lows of a hypothetical Tesla aftermarket stock price. Note that obtaining precise historical data for aftermarket trading is challenging due to the decentralized nature of these markets. The data below serves as a representative example.

| Year | High | Low | Change (%) |

|---|---|---|---|

| 2020 | $800 | $400 | 100% |

| 2021 | $1200 | $700 | 71.4% |

| 2022 | $1000 | $500 | 100% |

| 2023 | $1500 | $800 | 87.5% |

Factors Affecting Aftermarket Tesla Stock Prices

Numerous factors contribute to the volatility and price fluctuations observed in Tesla’s aftermarket stock. These factors encompass company-specific events, investor sentiment, and broader macroeconomic conditions.

Impact of News and Events

Positive news, such as successful product launches, record-breaking deliveries, or expansion into new markets, tends to boost aftermarket prices. Conversely, negative news, such as production delays, safety recalls, or regulatory setbacks, often leads to significant price drops. Financial reports, particularly earnings announcements, also play a crucial role in shaping investor sentiment and driving price movements.

Investor Sentiment and Speculation

The aftermarket is particularly susceptible to the influence of investor sentiment and speculation. Tesla, being a high-growth, high-profile company, attracts significant speculative investment. This can lead to rapid price increases during periods of optimism and equally sharp declines during periods of uncertainty or negative sentiment. Social media trends and online forums can also significantly impact investor sentiment and trading activity in the aftermarket.

Influence of Macroeconomic Factors

Broader macroeconomic conditions, such as interest rate changes, inflation rates, and overall economic growth, also impact the aftermarket. Rising interest rates, for instance, can reduce investor appetite for riskier assets like Tesla’s aftermarket stock, leading to price declines. Similarly, periods of high inflation can erode investor confidence and negatively impact stock prices.

Volatility Comparison: Aftermarket vs. Official Market

The aftermarket price of Tesla stock typically exhibits significantly higher volatility than the official stock market price. This is because the aftermarket lacks the same level of regulatory oversight and liquidity as the official exchanges, making it more susceptible to speculative trading and rapid price swings. The official market price, while still subject to fluctuations, tends to reflect a more stable and balanced assessment of the company’s fundamental value.

Aftermarket Trading Platforms and Participants

Source: thestreet.com

Tesla aftermarket stock trading occurs on various platforms, attracting a diverse range of participants. Understanding these platforms and participants is crucial for assessing the risks and opportunities associated with aftermarket trading.

Trading Platforms and Participant Profiles, Tesla aftermarket stock price

- Platforms: Over-the-counter (OTC) markets, online forums, and peer-to-peer trading networks are common platforms for aftermarket Tesla stock trading. The specific platforms vary significantly in terms of regulation, liquidity, and transparency.

- Participants: The aftermarket attracts a mix of individual investors, often characterized by higher risk tolerance and a focus on short-term gains, as well as some institutional investors seeking less regulated, potentially higher-return opportunities. However, the participation of institutional investors is generally lower compared to the official market.

- Regulations and Risks: Aftermarket trading is typically less regulated than official stock market trading. This lack of regulation exposes investors to higher risks, including fraud, manipulation, and difficulty in enforcing contracts. Liquidity can also be a significant concern, making it challenging to buy or sell shares quickly at desired prices.

Comparison with Other Automaker Aftermarket Stocks

Source: thestreet.com

Comparing Tesla’s aftermarket stock performance to that of other major automakers provides valuable context and helps assess its relative risk and reward profile.

Price Performance and Influencing Factors

While precise aftermarket data for other automakers is scarce, a general comparison can be made. Tesla’s aftermarket stock, due to its higher growth potential and strong brand recognition, often exhibits greater volatility than that of more established automakers. Factors influencing price movements, however, share similarities: news events, financial performance, and macroeconomic conditions all play a role. However, the degree of impact may vary based on the specific company and its market position.

Liquidity and Trading Volume

Tesla’s aftermarket stock generally exhibits lower liquidity and trading volume compared to its official stock on the Nasdaq. This is because the aftermarket is less regulated and has a smaller pool of participants. The liquidity of other automaker’s aftermarket stocks would also be comparatively lower than their official exchange listings.

Yearly Returns Comparison Chart

A hypothetical chart comparing the yearly returns of Tesla’s aftermarket stock to those of Ford and General Motors could be constructed. The chart would display a line graph with three lines, each representing the yearly percentage change in the aftermarket stock price for each company. The y-axis would represent the percentage return, and the x-axis would represent the year.

Such a chart would visually illustrate the relative performance and volatility of Tesla’s aftermarket stock compared to its competitors. Note that this would be a simplified representation, as obtaining accurate aftermarket data for all three companies would be challenging.

Risks and Opportunities in Aftermarket Tesla Stock Trading: Tesla Aftermarket Stock Price

Investing in Tesla’s aftermarket stock presents both significant risks and potential opportunities for profit. Understanding these risks and opportunities, and implementing appropriate risk mitigation strategies, is crucial for successful participation in this market.

Potential Risks and Opportunities

Source: googleusercontent.com

The primary risks associated with aftermarket Tesla stock trading include the lack of regulatory oversight, illiquidity, price manipulation, and the inherent volatility of the market. However, the potential for high returns, driven by Tesla’s growth trajectory and the speculative nature of the aftermarket, also exists. Successful trading requires a thorough understanding of the market dynamics, risk tolerance, and a well-defined trading strategy.

Risk Mitigation Strategies

Risk mitigation strategies include diversifying investments, limiting exposure to a single stock, conducting thorough due diligence, and setting stop-loss orders to limit potential losses. Careful monitoring of market trends and news events is also crucial for informed decision-making.

High-Risk, High-Reward Scenarios

A scenario illustrating high risk and high reward could involve investing a significant portion of one’s portfolio in Tesla’s aftermarket stock based on anticipation of a major product launch. If the launch is successful and exceeds expectations, the potential returns could be substantial. However, if the launch is poorly received or encounters unforeseen setbacks, the losses could be equally significant.

Conversely, a conservative approach involving small, diversified investments would minimize risk but also limit potential returns.

The Tesla aftermarket stock price fluctuates wildly, reflecting investor sentiment and broader market trends. Understanding these fluctuations often requires comparing it to the performance of other sectors; for instance, a look at the stock price PLM provides a contrasting perspective on growth in a different industry. Ultimately, though, the Tesla aftermarket stock price remains a key indicator of the electric vehicle market’s health.

User Queries

What are the legal implications of trading Tesla aftermarket stock?

The legality varies depending on jurisdiction and the specific platform used. Always ensure compliance with all applicable securities laws and regulations before engaging in aftermarket trading.

How does the liquidity of Tesla’s aftermarket stock compare to the official market?

Aftermarket liquidity is generally lower than the official stock market, meaning it may be harder to buy or sell shares quickly without significantly impacting the price.

Are there any tax implications for profits from aftermarket Tesla stock?

Yes, profits from aftermarket stock trading are generally taxable income and subject to capital gains taxes. Consult a tax professional for specific advice.

What are some common scams related to aftermarket Tesla stock?

Be wary of unsolicited investment offers, promises of guaranteed returns, and high-pressure sales tactics. Thoroughly research any platform or broker before investing.