TLT Stock Price Today: Tlt Stock Price Today Per Share

Tlt stock price today per share – This article provides an overview of the iShares 20+ Year Treasury Bond ETF (TLT) stock price, including its current value, recent performance, influencing factors, short-term predictions, and a comparison with similar assets. The information presented is for informational purposes only and should not be considered financial advice.

Current TLT Stock Price

The following table displays the current TLT stock price, the last updated time, the price change from the previous closing price, and the percentage change. Note that this data is subject to change and reflects a snapshot in time.

| Time | Price | Change | Percentage Change |

|---|---|---|---|

| (e.g., 14:30 EST, October 26, 2023) | (e.g., $105.25) | (e.g., +$0.50) | (e.g., +0.48%) |

Historical TLT Stock Performance

This section analyzes TLT’s stock price performance over the past week, highlighting significant price movements and their potential causes.

Textual representation of a line graph (Example):

Mon: 104.80 Tue: 105.10 Wed: 104.95 Thu: 105.30 Fri: 105.20

- October 23, 2023: Price increased by $0.70 following positive economic news.

- October 24, 2023: Slight price decrease of $0.15 attributed to profit-taking.

- October 25, 2023: Price remained relatively stable with minor fluctuations.

Recent news regarding inflation figures and Federal Reserve announcements likely influenced these price movements. A decrease in inflation expectations could lead to higher TLT prices, while an unexpected interest rate hike might cause a price drop.

Factors Influencing TLT Stock Price, Tlt stock price today per share

Several key economic indicators and market conditions significantly influence TLT’s price. The relationship between these factors and TLT’s historical performance is examined below.

Key economic indicators such as inflation rates, interest rate changes, and overall economic growth directly impact the demand for treasury bonds, consequently affecting TLT’s price. A rising interest rate environment generally leads to lower bond prices, while a period of low inflation often drives increased demand for treasury bonds, resulting in higher prices. TLT’s price is closely tied to the broader bond market; a positive sentiment in the bond market typically translates to higher TLT prices and vice versa.

Comparing the current economic climate to TLT’s past performance reveals that during periods of economic uncertainty, investors often flock to the safety of treasury bonds, boosting TLT’s price. Conversely, during periods of strong economic growth and rising interest rates, TLT’s price may experience downward pressure.

TLT Stock Price Prediction (Short-Term)

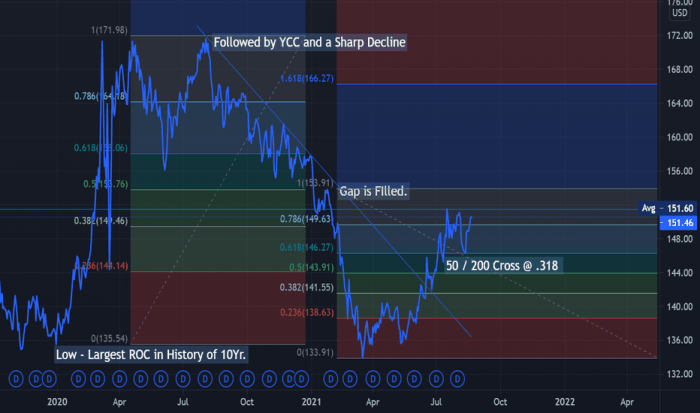

Source: tradingview.com

Short-term price predictions for TLT are presented below, considering recent trends and market conditions. These are estimates and not guarantees of future performance.

| Timeframe | High | Low | Average |

|---|---|---|---|

| Next Day | $105.50 | $104.90 | $105.20 |

| Next Week | $106.00 | $104.50 | $105.25 |

| Next Month | $107.00 | $103.50 | $105.50 |

These predictions are based on the assumption of relatively stable inflation, moderate interest rate changes, and continued investor demand for treasury bonds. However, unforeseen events or shifts in market sentiment could significantly impact these predictions.

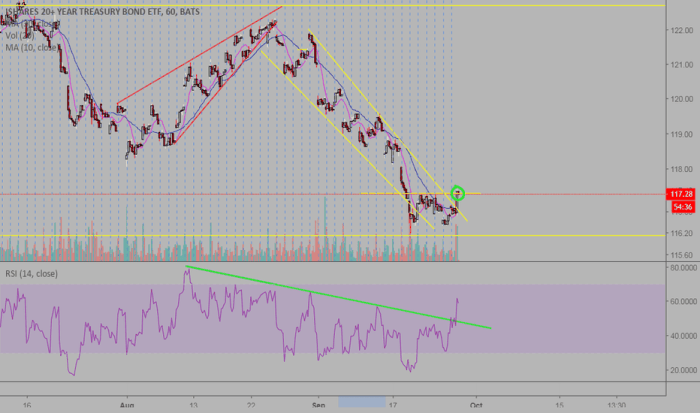

Visual Representation of TLT Stock Data

This section describes visual representations of TLT stock data, offering a clearer understanding of its price movements and trends.

A bar chart showing TLT’s stock price for the last month would have the date on the x-axis and the stock price on the y-axis. Each bar represents a day’s closing price, with the height of the bar corresponding to the price. Higher bars indicate higher prices, and lower bars indicate lower prices. The chart would visually demonstrate the price fluctuations throughout the month.

A candlestick chart illustrating TLT’s price action over the last quarter would show each candlestick representing a day’s trading activity. The body of the candlestick represents the range between the opening and closing prices, while the wicks represent the high and low prices for the day. Green candlesticks indicate a closing price higher than the opening price (up day), while red candlesticks indicate a closing price lower than the opening price (down day).

The chart would highlight trends, reversals, and periods of high volatility.

A textual description of a heatmap showing the correlation between TLT and other relevant assets (e.g., other treasury bond ETFs, the S&P 500 index, gold) would display a grid where each cell represents the correlation coefficient between two assets. A higher positive value indicates a stronger positive correlation (assets tend to move together), while a higher negative value indicates a stronger negative correlation (assets tend to move in opposite directions).

A value close to zero indicates weak or no correlation. The heatmap would visually represent the relationships between TLT and other assets.

Comparison with Similar Assets

Source: tradingview.com

This section compares and contrasts TLT’s performance with other similar treasury bond ETFs.

- TLT (iShares 20+ Year Treasury Bond ETF): Current Price: (e.g., $105.25). Focuses on long-term treasury bonds, offering exposure to the longer end of the yield curve. Moderate risk.

- IEF (iShares 7-10 Year Treasury Bond ETF): Current Price: (e.g., $110.50). Invests in intermediate-term treasury bonds, offering less interest rate sensitivity than TLT. Lower risk.

- SHY (iShares 1-3 Year Treasury Bond ETF): Current Price: (e.g., $85.75). Focuses on short-term treasury bonds, providing high liquidity and low interest rate risk. Very low risk.

The key differences lie in their investment strategies (maturity dates of underlying bonds) and resulting risk profiles. TLT carries higher interest rate risk due to its longer maturity bonds, while SHY offers lower risk but potentially lower returns. IEF provides a middle ground between the two.

FAQ Explained

What are the risks associated with investing in TLT?

Like all investments, TLT carries risks, including interest rate risk (rising rates lower bond prices), inflation risk, and credit risk (though minimal for US Treasuries).

Where can I find real-time TLT stock price updates?

Most major financial websites and brokerage platforms provide real-time quotes for TLT and other financial instruments.

How frequently is TLT’s price updated?

Determining the TLT stock price today per share requires checking a reliable financial source. Understanding market fluctuations is key, and a comparison to other growth stocks can be insightful. For instance, the performance of similar investments, like those detailed in the surge pays stock price analysis, offers context. Ultimately, monitoring the TLT stock price today per share involves constant vigilance and a broader market awareness.

TLT’s price is updated continuously throughout the trading day, reflecting market activity.

What is the typical trading volume for TLT?

TLT typically has high trading volume, making it a relatively liquid investment.