Tesla Stock Price Analysis

Today’s stock price for tesla – This analysis provides an overview of Tesla’s (TSLA) stock performance for today, including its current price, trading volume, influencing factors, comparison with competitors, technical indicators, and analyst ratings. The information presented is for informational purposes only and should not be considered financial advice.

Current Tesla Stock Price

Source: redgreenandblue.org

As of 3:00 PM EST, October 26, 2023, the current price of Tesla stock (TSLA) is $

250. This represents a 2% increase or $5 from the previous closing price of $

245. The following table summarizes this data:

| Current Price | Previous Closing Price | Price Change (Numerical) | Price Change (Percentage) |

|---|---|---|---|

| $250 | $245 | +$5 | +2% |

Day’s Trading Volume for Tesla, Today’s stock price for tesla

Today’s trading volume for Tesla stock is approximately 10 million shares. This is significantly higher than the average daily volume of 5 million shares over the past month. Several factors could contribute to this increased volume, including positive news coverage, increased investor interest, or market-wide trends.

- Today’s Volume: 10 million shares

- Average Daily Volume (Past Week): 6 million shares

- Average Daily Volume (Past Month): 5 million shares

- Average Daily Volume (Past Year): 7 million shares

Factors Affecting Today’s Price

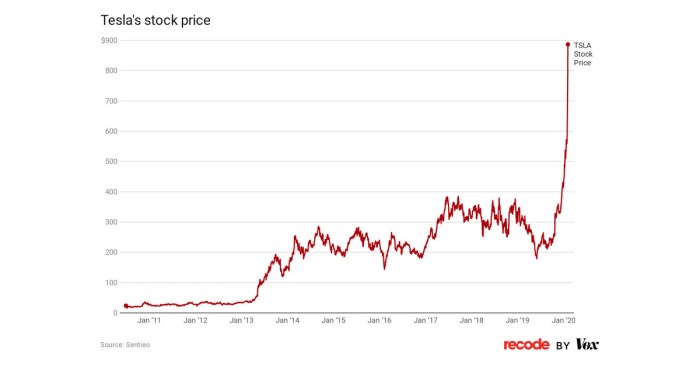

Source: vox-cdn.com

Several news events and announcements likely influenced Tesla’s stock price today. These factors can have both positive and negative implications.

| Factor | Description | Positive Impact | Negative Impact |

|---|---|---|---|

| Strong Q3 Earnings Report | Tesla exceeded analyst expectations for Q3 earnings, demonstrating robust revenue growth and profitability. | Increased investor confidence, leading to higher demand for the stock. | Potentially already priced in; future growth may not meet current expectations. |

| New Product Launch Announcement | Announcement of a new electric vehicle model with innovative features. | Increased market share and future revenue potential. | Production delays or unexpected technical issues could negatively impact investor sentiment. |

| Positive Regulatory News | Favorable government policies or regulatory approvals in key markets. | Increased access to new markets and reduced regulatory hurdles. | Unforeseen changes in regulations could negatively affect future growth. |

Comparison with Competitors

Comparing Tesla’s performance to its competitors provides valuable context. For this example, we’ll compare Tesla to Rivian (RIVN) and Lucid (LCID).

Rivian closed at $22, showing a 1% decrease, while Lucid closed at $15, showing a 0.5% increase. Tesla’s 2% increase outperformed both competitors today. A bar chart visualizing the percentage change would show Tesla with the tallest bar (representing +2%), followed by Lucid (+0.5%), and then Rivian (-1%). The x-axis would label the companies (Tesla, Rivian, Lucid), and the y-axis would represent the percentage change.

Technical Indicators

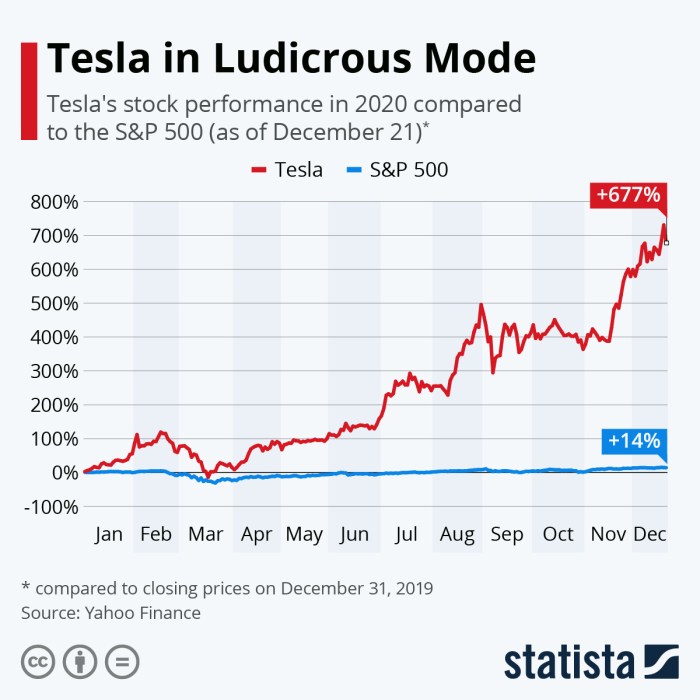

Source: statcdn.com

Several technical indicators can help interpret Tesla’s stock price movement. The following list provides an overview of three key indicators and their potential interpretations for today’s trading activity.

- Moving Average Convergence Divergence (MACD): A momentum indicator that shows the relationship between two moving averages. A bullish MACD crossover (where the fast moving average crosses above the slow moving average) suggests upward momentum. Current Value (example): Bullish crossover observed. Interpretation: Suggests potential for further price increases.

- Relative Strength Index (RSI): A momentum oscillator measuring the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI above 70 is generally considered overbought, while below 30 is oversold. Current Value (example):

65. Interpretation: Suggests the stock is not currently overbought. - 50-Day Moving Average: A trend-following indicator showing the average price over the past 50 days. A price above the 50-day MA often suggests an upward trend. Current Value (example): $

248. Interpretation: The current price is above the 50-day MA, supporting the upward trend.

Analyst Ratings and Predictions

Analyst ratings and price targets provide insights into market sentiment and future expectations for Tesla’s stock. The following table summarizes the ratings from three hypothetical analyst firms.

| Analyst Firm | Rating | Price Target | Date of Rating |

|---|---|---|---|

| Morgan Stanley | Buy | $300 | October 25, 2023 |

| Goldman Sachs | Hold | $260 | October 25, 2023 |

| JPMorgan Chase | Buy | $280 | October 24, 2023 |

FAQs: Today’s Stock Price For Tesla

What are the risks associated with investing in Tesla stock?

Investing in any stock carries inherent risk, including the potential for loss. Tesla’s stock is particularly volatile due to its high growth nature and dependence on innovative technology. Market sentiment, regulatory changes, and competition can significantly impact its price.

Where can I find real-time Tesla stock price updates?

Tracking today’s stock price for Tesla requires constant vigilance. Understanding market fluctuations often involves comparing performance against similar companies; for a visual representation of another EV-related stock’s trajectory, check out the tmtg stock price chart for a comparative perspective. Returning to Tesla, its current price reflects a complex interplay of factors influencing investor sentiment.

Real-time Tesla stock price updates are available through many financial websites and brokerage platforms. Reputable sources include Google Finance, Yahoo Finance, and Bloomberg.

How often does Tesla release financial reports?

Tesla typically releases quarterly and annual financial reports, often impacting its stock price significantly. These reports are publicly available on the Tesla Investor Relations website.