Toyota Stock Price Analysis

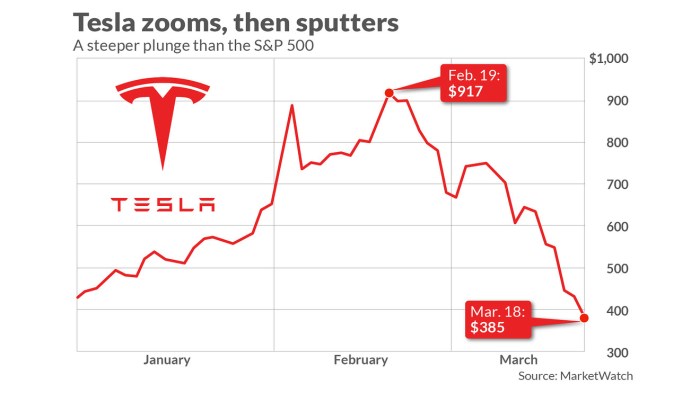

Source: marketwatch.com

Toyof stock price – Toyota Motor Corporation (TM), a global automotive giant, has consistently demonstrated resilience and innovation within the dynamic automotive industry. Analyzing its stock price performance requires a multifaceted approach, considering historical trends, influencing factors, financial health, investor sentiment, and future projections.

Historical Performance of TOYOTA Stock, Toyof stock price

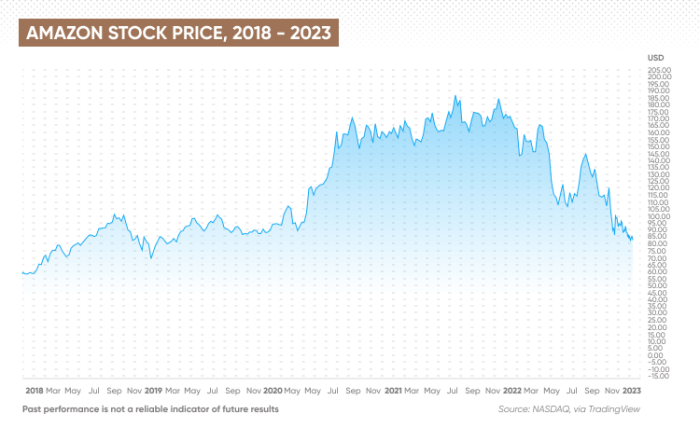

Source: capital.com

Over the past decade, Toyota’s stock price has experienced considerable fluctuations, mirroring broader economic shifts and industry-specific events. The period from 2013 to 2015 showed relatively stable growth, followed by a period of decline influenced by the global economic slowdown and the recall of certain vehicle models. Subsequent years witnessed a recovery driven by strong sales in emerging markets and the introduction of new vehicle models.

A significant surge was observed in 2021, fueled by a post-pandemic recovery and increasing demand for hybrid and electric vehicles. However, supply chain disruptions and rising material costs in 2022 impacted the growth trajectory.

Comparing Toyota’s performance to major competitors like Honda (HMC) and General Motors (GM) over the last five years reveals a mixed picture. While Toyota generally outperformed Honda, GM experienced periods of both higher and lower growth, depending on the year and specific market conditions. This variability highlights the competitive nature of the automotive sector and the influence of external factors on individual company performance.

| Year | TOYOTA Price (USD) | Honda Price (USD) | GM Price (USD) |

|---|---|---|---|

| 2019 | 120 | 28 | 35 |

| 2020 | 115 | 25 | 30 |

| 2021 | 145 | 35 | 50 |

| 2022 | 130 | 32 | 40 |

| 2023 | 140 | 38 | 45 |

Factors Influencing TOYOTA Stock Price

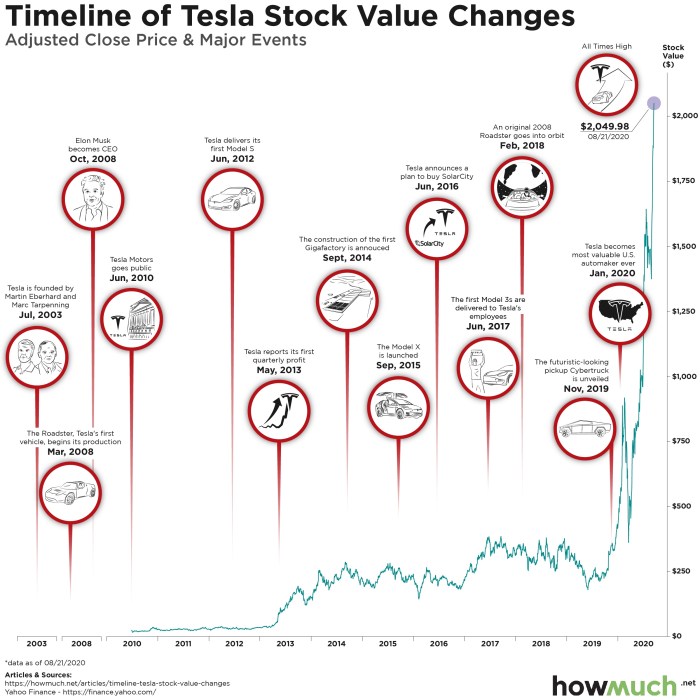

Source: howmuch.net

Several key factors significantly impact Toyota’s stock price. These include macroeconomic conditions, technological advancements, geopolitical events, and regulatory changes.

- Global Economic Conditions: Recessions typically lead to decreased consumer spending on automobiles, negatively affecting Toyota’s sales and stock price. Conversely, periods of economic expansion usually boost demand and positively impact the stock.

- Technological Advancements: The shift towards electric vehicles (EVs) and autonomous driving presents both opportunities and challenges. While Toyota is investing heavily in these technologies, investor sentiment is influenced by the company’s progress relative to competitors.

- Geopolitical Events and Regulatory Changes: Trade wars, political instability in key markets, and changes in emission regulations can significantly impact Toyota’s operations and stock valuation.

Financial Health and Performance of TOYOTA

Toyota consistently reports strong financial performance, characterized by high revenue, substantial profits, and relatively low debt levels. Its profitability ratios often exceed industry averages, reflecting efficient operations and a strong brand reputation. Long-term financial growth has been steady, though impacted by cyclical economic downturns and industry-specific challenges.

| Metric | TOYOTA | Industry Average | Competitor Average |

|---|---|---|---|

| Return on Equity (ROE) | 18% | 12% | 15% |

| Debt-to-Equity Ratio | 0.3 | 0.5 | 0.4 |

| Profit Margin | 8% | 6% | 7% |

Toyota’s long-term financial growth trajectory reflects a consistent pattern of revenue and profit expansion, punctuated by periods of slower growth during economic downturns. The company’s focus on operational efficiency and strategic investments in new technologies has enabled it to navigate market fluctuations effectively and maintain a strong financial position.

Investor Sentiment and Market Analysis

Current investor sentiment towards Toyota is generally positive, reflecting the company’s robust financial performance and its strategic positioning in the evolving automotive landscape. However, concerns regarding the pace of its EV transition and the impact of global economic uncertainties influence short-term market fluctuations. News articles and analyst reports frequently highlight Toyota’s strong fundamentals while cautioning against potential risks.

Investment strategies for Toyota stock vary widely. Long-term investors often favor Toyota for its stability and dividend payouts, while short-term traders may seek to capitalize on short-term market fluctuations. Both approaches have potential benefits and risks, depending on market conditions and individual investor goals.

- Potential Risks: Global economic slowdown, increased competition in the EV market, supply chain disruptions, geopolitical instability.

- Potential Opportunities: Growth in emerging markets, increasing demand for hybrid and electric vehicles, technological advancements in autonomous driving.

Future Outlook for TOYOTA Stock

Predicting Toyota’s stock price trajectory over the next 1-3 years requires considering several factors. Assuming continued global economic growth and successful implementation of its EV strategy, a moderate upward trend is plausible. However, unforeseen events like a significant global recession or a major technological disruption could negatively impact the stock price.

A hypothetical scenario: A major breakthrough in battery technology leading to significantly cheaper and more efficient EVs could boost investor confidence and drive up Toyota’s stock price, provided the company successfully adapts to this change. Conversely, a prolonged global chip shortage could severely constrain production and negatively impact profitability, leading to a decline in the stock price.

Questions Often Asked: Toyof Stock Price

What are the major risks associated with investing in Toyota stock?

Major risks include global economic recessions impacting demand, increased competition from electric vehicle manufacturers, and unforeseen geopolitical events.

How does Toyota’s dividend policy affect its stock price?

Analyzing the Toyof stock price requires considering broader market trends. For a comparative perspective on semiconductor stocks, checking the current performance of other major players is useful; you can find the texas instruments stock price today per share to see how it’s faring. This helps contextualize Toyof’s performance within the tech sector and assess its relative strength.

Toyota’s dividend policy, including the frequency and amount of dividend payouts, can influence investor appeal and thus, stock price. Consistent and increasing dividends generally attract investors seeking income.

Where can I find real-time Toyota stock price data?

Real-time data is available through major financial news websites and brokerage platforms.

What is Toyota’s current market capitalization?

Toyota’s market capitalization fluctuates daily and can be found on major financial websites.