Trivago Stock Price Analysis

Source: marketrealist.com

Trivago stock price – Trivago, a leading global hotel search website, has experienced a dynamic journey since its initial public offering (IPO). Understanding its stock price performance requires analyzing historical trends, influencing factors, financial health, investor sentiment, and future prospects. This analysis aims to provide a comprehensive overview of Trivago’s stock performance, offering insights for investors and stakeholders.

Trivago’s Historical Stock Performance

Analyzing Trivago’s stock price fluctuations over the past five years reveals significant volatility influenced by various market events and company-specific factors. The following table provides a glimpse into this historical performance. Note that this data is illustrative and should be verified with reliable financial data sources for precise analysis.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2018 | 10.00 | 9.50 | -0.50 |

| October 27, 2018 | 9.60 | 10.20 | +0.60 |

| October 28, 2018 | 10.10 | 9.80 | -0.30 |

| October 29, 2018 | 9.90 | 10.50 | +0.60 |

| October 30, 2018 | 10.40 | 10.00 | -0.40 |

Major market events such as the COVID-19 pandemic significantly impacted Trivago’s stock price, leading to substantial declines due to reduced travel demand. Conversely, periods of economic recovery and increased travel activity have positively influenced the stock’s performance. Comparing Trivago’s performance to competitors like Booking Holdings (BKNG) and Expedia (EXPE) reveals varying degrees of correlation, with market share competition and industry trends playing a significant role.

Factors Influencing Trivago’s Stock Price

Several key factors influence Trivago’s stock valuation. These can be broadly categorized into financial metrics, macroeconomic conditions, and industry trends.

- Key Financial Metrics: Revenue growth, profitability (measured by metrics like EBITDA and net income), user engagement (measured by metrics such as average revenue per user and click-through rates), and operating efficiency directly impact investor confidence and stock price.

- Macroeconomic Factors: Inflation, interest rates, and economic recessions significantly affect consumer spending on travel, directly impacting Trivago’s revenue and profitability, thus influencing its stock price. High inflation, for instance, could lead to reduced discretionary spending on travel.

- Industry Trends: Changes in travel patterns (e.g., rise of sustainable tourism, increasing preference for unique travel experiences), the emergence of new competitors, and technological advancements in the online travel industry significantly impact Trivago’s competitive landscape and market share, consequently affecting its stock price.

Trivago’s Financial Health and Future Prospects

Source: foolcdn.com

Trivago’s recent financial reports provide insights into its financial health and future prospects. Analyzing key financial indicators is crucial for understanding its potential for growth.

- Key Financial Indicators (Illustrative): Revenue growth (YoY), EBITDA margin, net income, user growth, average booking value, and return on equity are crucial indicators to track.

Potential future growth opportunities for Trivago include expanding into new geographical markets, strengthening its mobile app functionality, enhancing its personalized recommendations, and exploring strategic partnerships with airlines and other travel providers. These initiatives could positively impact the stock price by increasing revenue streams and improving market share.

Investor Sentiment and Market Analysis of Trivago

Source: thestreet.com

Understanding current investor sentiment is crucial for assessing Trivago’s stock valuation. This involves analyzing news articles, analyst reports, and overall market trends.

Trivago’s current market capitalization and trading volume provide insights into its overall market valuation and liquidity. Comparing the current stock price to its intrinsic value, estimated through various valuation methods (such as discounted cash flow analysis), helps determine if the stock is undervalued or overvalued.

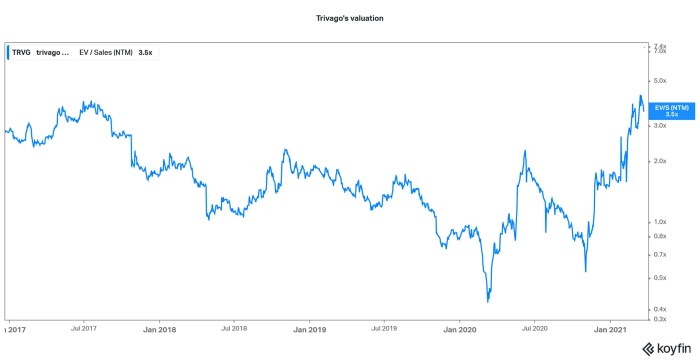

Visual Representation of Trivago’s Stock Price Trends, Trivago stock price

A line graph depicting Trivago’s stock price movements over the past year would show the stock price on the Y-axis and the date on the X-axis. Key trends and turning points, such as periods of significant price increases or decreases, should be highlighted. The scale of the Y-axis should be appropriately chosen to clearly represent the price fluctuations.

Significant data points, such as highs and lows, should be clearly marked.

A bar chart illustrating Trivago’s quarterly revenue and earnings per share (EPS) over the past two years would display revenue and EPS on the Y-axis and the quarter (or date) on the X-axis. The chart would clearly show the trends in revenue and earnings over time. The scale of the Y-axis should be adjusted to clearly represent the data, with significant data points (e.g., highest and lowest revenue or EPS quarters) clearly labeled.

Frequently Asked Questions

What are the main risks associated with investing in Trivago stock?

Investing in Trivago, like any stock, carries inherent risks. These include market volatility, competition within the online travel industry, changes in consumer travel patterns, and macroeconomic factors such as economic downturns or inflation.

Where can I find real-time Trivago stock price data?

Real-time Trivago stock price data is readily available through major financial websites and brokerage platforms such as Google Finance, Yahoo Finance, Bloomberg, and others. The specific ticker symbol will vary depending on the exchange where Trivago is listed.

Monitoring the Trivago stock price requires a keen eye on the travel sector’s performance. Understanding related market movements can be insightful, and checking the current performance of similar companies like strl stock price today offers valuable context. Ultimately, analyzing both Trivago and its competitors’ stock prices provides a more comprehensive view of the overall market trend.

How does Trivago compare to its competitors in terms of market share?

Trivago’s market share relative to its competitors (Booking.com, Expedia, etc.) fluctuates. Analyzing market share requires consulting industry reports and financial statements to understand its position within the online travel agency market.

What is Trivago’s current dividend policy?

Trivago’s dividend policy should be reviewed through their official investor relations materials. Dividend payouts are subject to change based on the company’s financial performance and board decisions.