TSM’s Current Financial State and Market Position

Tsm stock price prediction 2024 – Taiwan Semiconductor Manufacturing Company (TSMC) currently holds a dominant position in the global semiconductor foundry market. Analyzing its financial performance, competitive landscape, and R&D investments provides crucial insight into its future prospects and potential stock price trajectory in 2024.

TSMC’s Financial Performance

TSMC consistently demonstrates strong financial performance. Revenue growth is typically driven by increased demand for advanced chips, particularly in areas like high-performance computing and mobile devices. Profit margins, while subject to fluctuations based on production costs and global economic conditions, generally remain healthy. Debt levels are relatively low, providing financial flexibility for future investments and acquisitions. Specific figures would require referencing recent financial reports.

TSMC’s Competitive Landscape and Market Share

TSMC’s primary competitors include Samsung and Intel. While Samsung is a strong competitor in certain advanced node technologies, TSMC currently maintains a significant lead in market share, particularly in the production of leading-edge chips. Intel is focusing on internal chip production but its foundry business is a growing challenger. The competitive landscape is dynamic, with ongoing innovation and capacity expansion playing key roles.

TSMC’s Recent R&D Investments and Potential Impact

TSMC consistently invests heavily in research and development, focusing on advancements in process technology (e.g., 3nm, 2nm nodes) and manufacturing efficiency. These investments are critical for maintaining its technological leadership and meeting the demands of its customers for more powerful and energy-efficient chips. The success of these R&D efforts directly impacts TSMC’s ability to command premium pricing and maintain its market dominance.

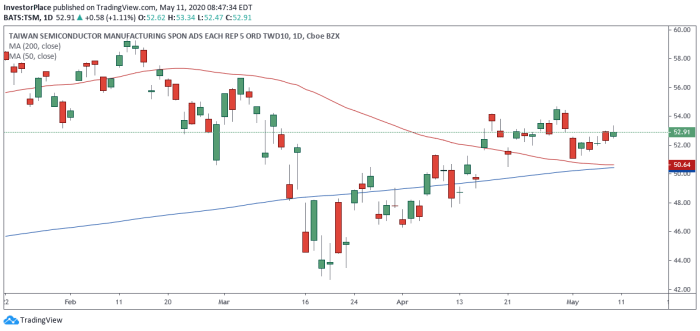

TSMC’s Performance Compared to Key Competitors

Source: investorplace.com

Compared to its key competitors, TSMC generally exhibits superior performance in terms of market share, technological leadership, and profitability. However, competitive pressures remain significant, necessitating continuous innovation and investment. Direct comparisons require detailed analysis of publicly available financial data from each company.

Factors Influencing TSM Stock Price: Tsm Stock Price Prediction 2024

Several macroeconomic, geopolitical, and technological factors will significantly influence TSMC’s stock price in 2024. Understanding these factors is crucial for accurate prediction.

Macroeconomic Factors

Global economic growth, inflation rates, and interest rate adjustments significantly influence semiconductor demand and overall investor sentiment. A robust global economy generally translates to higher demand for TSMC’s products, positively impacting its stock price. Conversely, economic downturns or increased inflation can negatively affect investor confidence and reduce demand.

Geopolitical Events and Trade Policies

Geopolitical tensions, particularly those involving US-China relations and regional conflicts, can disrupt supply chains and impact investor confidence. Trade policies, including tariffs and export controls, can also affect TSMC’s operations and profitability. The ongoing geopolitical landscape presents both risks and opportunities for TSMC.

Technological Advancements and Industry Trends

Source: thestreet.com

Advancements in semiconductor technology, such as the development of more advanced nodes and new chip architectures, drive demand and influence TSMC’s competitive position. Industry trends, including the growth of AI, 5G, and IoT, create opportunities for TSMC but also present challenges in terms of capacity expansion and technological innovation.

Summary of Factors Influencing TSM Stock Price

Source: simplywall.st

| Factor | Impact | Likelihood | Potential Effect on Stock Price |

|---|---|---|---|

| Global Economic Growth | Positive correlation | High | Positive |

| Inflation | Negative correlation | Medium | Negative |

| Interest Rates | Negative correlation (generally) | Medium | Negative |

| Geopolitical Instability | Uncertain, potentially negative | Medium | Negative or uncertain |

| Technological Advancements | Positive correlation | High | Positive |

TSMC’s Production Capacity and Supply Chain

TSMC’s production capacity and supply chain resilience are crucial for meeting global demand and maintaining its market leadership. Understanding its expansion plans and potential vulnerabilities is key to assessing its future performance.

TSMC’s Production Capacity and Expansion Plans

TSMC is continuously expanding its production capacity through significant investments in new fabs and advanced manufacturing technologies. These expansion plans are aimed at meeting the growing demand for advanced semiconductors and maintaining its technological edge. Specific details on capacity expansion can be found in their investor relations materials.

Risks and Challenges Related to TSMC’s Supply Chain

TSMC’s supply chain faces risks from geopolitical instability, natural disasters, and potential disruptions to the supply of critical materials. The concentration of manufacturing in Taiwan presents a significant geopolitical risk. Mitigating these risks requires diversification of suppliers and geographical locations, as well as robust risk management strategies.

TSMC’s Strategies for Mitigating Supply Chain Risks

TSMC employs various strategies to mitigate supply chain risks, including diversification of suppliers, strategic partnerships, and investment in advanced technologies to improve manufacturing efficiency and reduce reliance on specific suppliers. These efforts are crucial for ensuring stable production and meeting customer demand.

TSMC’s Supply Chain Flowchart

A simplified representation of TSMC’s supply chain would start with raw material suppliers (silicon wafers, chemicals, etc.), followed by equipment manufacturers (for fabrication tools), then TSMC’s fabrication plants, followed by testing and packaging facilities, and finally delivery to customers. Key vulnerabilities lie in the geopolitical concentration of manufacturing and potential disruptions to raw material supply.

Demand for Semiconductors and TSM’s Product Portfolio

The demand for semiconductors across various sectors directly impacts TSMC’s revenue and profitability. Analyzing this demand and TSMC’s product portfolio alignment is crucial for evaluating its future prospects.

Projected Semiconductor Demand in 2024

The demand for semiconductors in 2024 is projected to remain robust, driven by growth in several key sectors. High-performance computing (HPC), data centers, automotive electronics, and 5G infrastructure are expected to continue driving significant demand. However, the pace of growth may vary depending on macroeconomic conditions and technological advancements.

TSMC’s Product Portfolio and Market Alignment

TSMC offers a diverse product portfolio, catering to a wide range of applications. Its portfolio includes chips for smartphones, high-performance computing, automotive, and other sectors. The company’s ability to provide advanced process technologies and cater to diverse customer needs is a key factor in its success.

Predicting the TSM stock price for 2024 involves considering numerous factors, including global economic trends and the semiconductor industry’s overall health. Understanding the sensitivity of stock prices to various market influences is crucial; for a deeper dive into this, check out this insightful resource on stock price sens. Ultimately, accurate TSM stock price prediction for 2024 requires a comprehensive analysis of these interconnected elements.

Impact of Emerging Technologies on Demand for TSMC’s Products

Emerging technologies such as AI, 5G, and IoT are expected to drive significant demand for advanced semiconductors in the coming years. TSMC’s investments in advanced process technologies and its focus on these high-growth markets position it well to capitalize on these opportunities.

Comparison of TSMC’s Key Product Offerings and Market Growth Potential

- High-Performance Computing (HPC): High growth potential due to increasing demand for AI and data center applications.

- Mobile Devices: Steady growth, although the pace may moderate compared to previous years.

- Automotive: Strong growth potential driven by the increasing adoption of advanced driver-assistance systems (ADAS) and electric vehicles.

- Internet of Things (IoT): Significant growth potential, driven by the proliferation of connected devices.

TSMC’s Growth Strategies and Innovation

TSMC’s sustainable growth and competitive advantage rely heavily on its strategic initiatives and innovation pipeline. Analyzing these aspects helps understand its long-term prospects.

TSMC’s Strategies for Sustainable Growth

TSMC’s growth strategies focus on technological leadership, capacity expansion, strategic partnerships, and diversification of customer base. These strategies aim to ensure sustainable growth and resilience in a dynamic market environment.

TSMC’s Approach to Innovation, Tsm stock price prediction 2024

TSMC’s approach to innovation centers on continuous investment in R&D, focusing on advancements in process technology, materials science, and manufacturing techniques. This commitment to innovation is essential for maintaining its technological leadership and meeting the demands of its customers.

Contribution of R&D to Long-Term Profitability

TSMC’s substantial R&D investments contribute significantly to its long-term profitability by enabling it to offer leading-edge technologies, command premium pricing, and maintain its dominant market position. This translates into higher revenue and improved profit margins.

TSMC’s Innovation Pipeline

TSMC’s innovation pipeline can be visualized as a multi-stage process, starting with basic research, followed by applied research, process development, and finally, high-volume manufacturing. Each stage involves significant investment and collaboration with partners. The successful completion of each stage leads to the introduction of new, advanced process technologies that drive revenue growth.

Detailed FAQs

What are the biggest risks facing TSM in 2024?

Geopolitical instability, particularly US-China relations, and potential supply chain disruptions represent major risks. Furthermore, a global economic slowdown could significantly impact demand for semiconductors.

How does TSM compare to its main competitors?

TSM holds a leading position in the foundry market, but faces competition from Intel and Samsung. A comparative analysis of market share, technological capabilities, and financial performance is needed for a complete assessment.

What is TSM’s dividend policy?

TSM’s dividend policy should be reviewed directly from their investor relations materials for the most up-to-date information. This policy is a key factor for many investors.

What are the key technological advancements impacting TSM?

Advancements in AI, 5G, and the Internet of Things (IoT) are driving demand for advanced semiconductor technologies, which is directly beneficial to TSM’s business.