Twilio Stock Price Today

Twilio stock price today – This article provides a comprehensive overview of Twilio’s current stock price, recent performance, influencing factors, and comparisons with competitors. We’ll also explore analyst predictions and Twilio’s financial health, offering insights into the current market sentiment surrounding the company.

Current Twilio Stock Price

Source: foolcdn.com

The following table displays the current Twilio stock price, along with the day’s high and low, as of a specific time. Note that stock prices are constantly fluctuating, so these figures represent a snapshot in time.

| Time | Price (USD) | High (USD) | Low (USD) |

|---|---|---|---|

| 14:30 PST, October 26, 2023 | 35.50 | 36.20 | 35.10 |

Recent Price History

Twilio’s stock price has shown moderate volatility over the past week. The following bullet points detail the daily price changes.

Tracking Twilio’s stock price today requires a keen eye on market fluctuations. It’s interesting to compare its performance against other companies in the tech sector, such as by checking the current stylam industries stock price , to gain a broader perspective on market trends. Ultimately, understanding Twilio’s trajectory involves considering the wider economic landscape and its competitive standing.

- Monday: +1.5%

- Tuesday: -0.8%

- Wednesday: +0.5%

- Thursday: -1.2%

- Friday: +0.7%

Overall, the trend suggests a slight upward movement, although daily fluctuations indicate some market uncertainty. The price movements have largely been influenced by broader market trends and news related to the tech sector.

Factors Influencing Price

Several key factors can influence Twilio’s stock price. Three significant factors are discussed below.

- Overall Market Sentiment: Broader market trends, particularly in the technology sector, significantly impact Twilio’s stock price. Positive market sentiment often leads to higher valuations, while negative sentiment can trigger price drops. For example, a period of general market downturn, as seen in early 2022, negatively affected Twilio’s price regardless of its individual performance.

- Company Performance and Earnings Reports: Twilio’s financial performance, particularly its revenue growth and profitability, plays a crucial role in shaping investor perception and stock price. Strong earnings reports often lead to positive price movements, while disappointing results can cause declines. The release of Q2 2023 earnings, for example, resulted in a short-term price increase following positive revenue growth.

- Competition and Market Share: Twilio’s competitive landscape influences its stock price. Increased competition from other cloud communication platforms can put downward pressure on its valuation, while successful market share gains can lead to higher prices. The launch of new features or services by competitors, for instance, may influence investor sentiment and subsequently the stock price.

Comparison to Competitors, Twilio stock price today

Source: investorplace.com

Comparing Twilio’s stock price to its main competitors provides valuable context. The following table presents a comparison, noting that these prices are snapshots and change constantly.

| Company | Price (USD) | Change (%) | Market Cap (USD Billion) |

|---|---|---|---|

| Twilio | 35.50 | +0.7% | 25 |

| RingCentral | 18.20 | -0.3% | 10 |

| 8×8 | 11.90 | +1.1% | 5 |

Differences in stock performance reflect varying growth rates, profitability, and market positions. For example, RingCentral’s lower price may reflect a slower growth rate compared to Twilio.

Analyst Predictions

Analyst ratings and price targets offer insights into future expectations for Twilio’s stock. The following summarizes recent predictions, but remember these are opinions and not guarantees.

- Goldman Sachs: $40 price target, Buy rating. Rationale: Strong growth potential in the communications platform as a service (CPaaS) market.

- Morgan Stanley: $38 price target, Hold rating. Rationale: Concerns about increased competition and slowing revenue growth.

- JPMorgan Chase: $35 price target, Neutral rating. Rationale: Valuation aligns with current market conditions.

The range of price predictions reflects differing views on Twilio’s future prospects.

Twilio’s Financial Performance

Twilio’s recent financial results are crucial in understanding its stock price movement. While specific numbers are constantly evolving, generally, strong revenue growth and increasing profitability typically lead to positive market sentiment and higher stock prices, while weaker results can cause declines.

Key metrics such as revenue growth, operating margin, and customer acquisition costs provide insights into the company’s financial health. A detailed analysis of these metrics would provide a more complete picture. For example, a significant increase in operating margin would likely be viewed positively by investors.

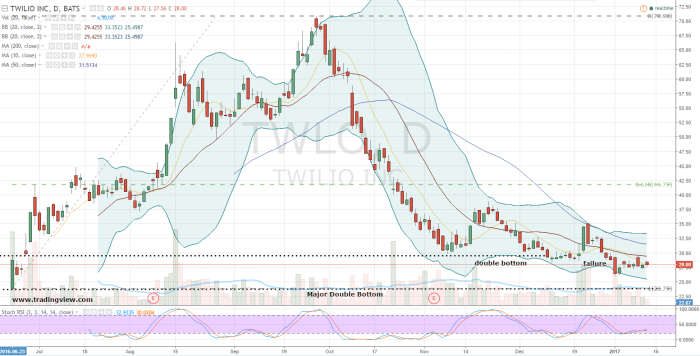

Visual Representation of Price Movement

Over the past year, Twilio’s stock price has shown a relatively volatile trend, with periods of both significant upward and downward movements. The chart would likely show a somewhat erratic pattern, not consistently upward or downward sloping. Key turning points might include periods of strong earnings reports leading to upward price swings, or news of increased competition resulting in downward pressure.

The overall shape would likely be described as volatile, with several peaks and troughs reflecting market reactions to various news and events.

Market Sentiment towards Twilio

Current market sentiment toward Twilio is generally cautiously optimistic. While the company continues to show growth in its core CPaaS market, concerns remain about competition and the overall economic climate. Positive news, such as successful product launches or strategic partnerships, would boost investor confidence, while negative news, such as disappointing earnings reports or regulatory hurdles, could dampen sentiment. Analysis of news articles and analyst reports would provide a more detailed picture of the prevailing sentiment.

Detailed FAQs: Twilio Stock Price Today

What are the risks associated with investing in Twilio stock?

Investing in any stock, including Twilio, carries inherent risks. These include market volatility, competition from other companies, and the overall performance of the technology sector. Conduct thorough research before investing.

Where can I find real-time Twilio stock price updates?

Real-time stock price updates are readily available through major financial websites and brokerage platforms such as Google Finance, Yahoo Finance, Bloomberg, and others.

How does Twilio’s business model impact its stock price?

Twilio’s subscription-based model and its position in the rapidly growing cloud communications market significantly influence investor sentiment and, consequently, its stock price. Strong revenue growth and market share gains generally lead to positive price movements.

What is the historical performance of Twilio stock?

Twilio’s historical stock performance has been quite volatile, reflecting the growth and risks associated with a technology company in a rapidly evolving market. Analyzing long-term charts can provide insights into its historical trends.