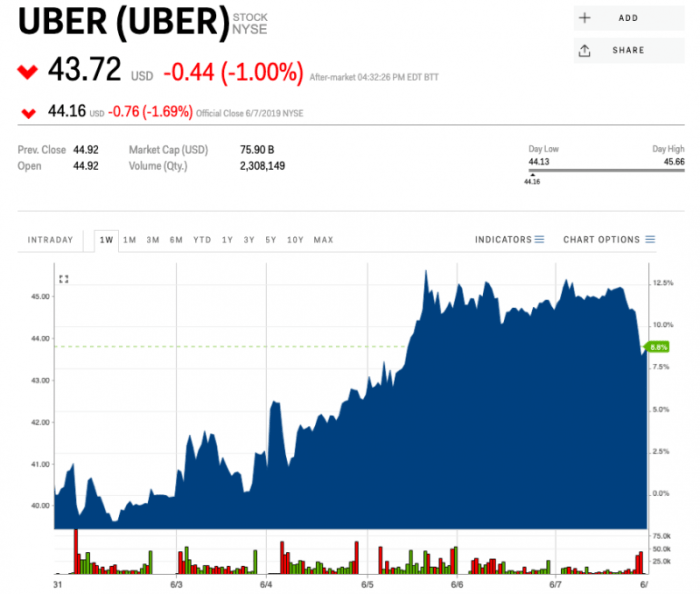

Uber Technologies Stock Price: A Comprehensive Analysis

Source: stoxline.com

Uber technologies stock price – Uber Technologies’ stock price journey since its initial public offering (IPO) has been a rollercoaster ride, reflecting the dynamic nature of the ride-sharing and delivery industries. This analysis delves into the historical performance, influencing factors, business model implications, investor sentiment, and future projections for Uber’s stock price, providing a comprehensive overview for investors and market enthusiasts.

Uber Technologies Stock Price Historical Performance

Understanding Uber’s stock price trajectory requires examining its performance from its IPO to the present day, comparing it to competitors, and identifying key events that significantly impacted its valuation.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change Percentage |

|---|---|---|---|

| May 10, 2019 | 42.00 | 41.57 | -1.02% |

| Example Date 2 | Example Price | Example Price | Example Percentage |

| Example Date 3 | Example Price | Example Price | Example Percentage |

A comparative analysis against competitors like Lyft reveals differing performance patterns. For example, Lyft’s stock price might have experienced a steeper decline during periods of economic uncertainty, while Uber might have shown greater resilience due to its diversified business model.

- Lyft experienced a sharper decline during the initial COVID-19 pandemic lockdown compared to Uber.

- Uber’s diversification into food delivery (Uber Eats) and freight helped mitigate losses during periods when ride-sharing was significantly impacted.

- Regulatory changes in specific markets have differentially affected both companies, leading to variations in their stock price performance.

Significant events impacting Uber’s stock price include regulatory hurdles in various countries, the release of quarterly financial reports showcasing revenue growth or losses, and broader market trends such as economic recessions or investor sentiment shifts towards the technology sector.

Factors Influencing Uber’s Stock Price

Several economic indicators and internal factors significantly influence Uber’s stock price movements. Understanding these factors provides insights into the company’s valuation.

- Interest Rates: Higher interest rates can increase borrowing costs, impacting Uber’s profitability and potentially lowering its stock price.

- Inflation: Inflationary pressures can affect operational costs, reducing profit margins and impacting investor confidence.

- Consumer Spending: A decrease in consumer spending directly affects ride-sharing and food delivery demand, influencing Uber’s revenue and stock price.

Uber’s financial performance, encompassing revenue growth, profitability, and debt levels, directly impacts its stock valuation. Consistent profitability and reduced debt generally lead to higher investor confidence and a rising stock price. Conversely, losses and high debt can negatively impact investor sentiment.

Technological advancements, such as the development of autonomous vehicles, and competitive pressures from both established and emerging players in the ride-sharing and delivery markets, significantly influence Uber’s stock price. Positive technological breakthroughs can boost investor optimism, while intense competition can lead to price wars and reduced profitability.

Uber’s Business Model and Stock Price, Uber technologies stock price

Source: basitfx.com

Uber’s diversified business model, encompassing ride-sharing, food delivery, and freight, significantly contributes to its overall stock valuation. The performance of each segment influences the overall stock price.

Hypothetically, a significant decline in Uber Eats’ market share due to increased competition could negatively impact Uber’s overall stock price, even if its ride-sharing segment performs well. This illustrates the interconnectedness of Uber’s various business units.

Uber’s expansion into new markets is closely linked to its stock price trajectory. Successful expansion into lucrative markets can boost revenue and investor confidence, leading to a rise in stock price. However, expansion into challenging or less profitable markets could negatively impact its valuation.

Investor Sentiment and Stock Price

Source: businessinsider.nl

Investor sentiment toward Uber plays a crucial role in determining its stock price fluctuations. Positive news and strong financial performance generally lead to increased investor confidence and a higher stock price, while negative news or disappointing results can cause a decline.

A hypothetical visualization could depict a scatter plot showing the correlation between the volume of positive news articles about Uber (e.g., successful product launches, market share gains) and its daily stock price changes. A positive correlation would indicate that increased positive news generally corresponds to higher stock prices.

- Strong financial performance and revenue growth.

- Successful expansion into new markets.

- Technological innovation and leadership in the industry.

- Effective management and a strong corporate governance structure.

Future Projections for Uber’s Stock Price

Predicting Uber’s future stock price involves utilizing various financial models, considering potential scenarios, and analyzing the impact of emerging technologies.

| Model | Projected Price (USD) | Time Horizon | Assumptions |

|---|---|---|---|

| Discounted Cash Flow | 60.00 | 2025 | Consistent revenue growth, controlled operational costs, and successful expansion into new markets. |

| Example Model 2 | Example Price | Example Time Horizon | Example Assumptions |

Scenarios leading to significant stock price increases include sustained revenue growth across all business segments, successful implementation of autonomous vehicle technology, and a favorable regulatory environment. Conversely, factors that could lead to decreases include increased competition, economic downturns impacting consumer spending, or regulatory setbacks.

The widespread adoption of autonomous vehicles could significantly impact Uber’s future stock price. While it presents an opportunity for cost reduction and efficiency gains, it also introduces challenges related to technological development, safety regulations, and potential job displacement concerns.

Quick FAQs: Uber Technologies Stock Price

What are the major risks associated with investing in Uber stock?

Investing in Uber stock carries inherent risks, including competition from other ride-sharing companies, regulatory changes impacting its operations, economic downturns affecting consumer spending, and potential challenges in achieving sustained profitability.

How does Uber’s expansion into new markets affect its stock price?

Successful expansion into new markets generally boosts investor confidence, leading to potential stock price increases. Conversely, challenges encountered in new markets could negatively impact the stock price.

What is the role of technological advancements in Uber’s stock valuation?

Technological advancements, such as autonomous vehicle development, significantly influence Uber’s long-term prospects and consequently its stock valuation. Successful implementation of new technologies can lead to increased efficiency and market share, positively impacting the stock price.

Analyzing Uber Technologies’ stock price requires considering various market factors. A comparative look at the performance of other retail giants can offer valuable context; for instance, checking the current value with a quick glance at tjmaxx stock price today provides a benchmark within the broader retail sector. Ultimately, understanding Uber’s trajectory necessitates a wider view of the market’s overall health.

Where can I find real-time Uber stock price information?

Real-time Uber stock price information is readily available through major financial news websites and stock market tracking applications.