UGA Stock Price Historical Performance

Uga stock price – Understanding the historical performance of UGA’s stock price is crucial for investors to assess potential risks and returns. This section provides a detailed analysis of UGA’s stock price fluctuations over the past five years, highlighting key market events and economic indicators that influenced its trajectory.

Five-Year Stock Price Fluctuation Timeline

Source: cloudfront.net

The following table presents a snapshot of UGA’s stock price movements over the past five years. Note that this data is hypothetical for illustrative purposes and does not reflect actual UGA stock performance. Real-world data would need to be sourced from a reputable financial data provider.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 10.00 | 10.50 | +0.50 |

| 2019-07-01 | 12.00 | 11.80 | -0.20 |

| 2020-01-01 | 11.50 | 13.00 | +1.50 |

| 2020-07-01 | 12.75 | 12.50 | -0.25 |

| 2021-01-01 | 13.00 | 15.00 | +2.00 |

| 2021-07-01 | 14.50 | 14.00 | -0.50 |

| 2022-01-01 | 14.25 | 16.00 | +1.75 |

| 2022-07-01 | 15.50 | 15.25 | -0.25 |

| 2023-01-01 | 15.75 | 17.00 | +1.25 |

Market Events and Economic Indicators

Significant market events, such as the COVID-19 pandemic and subsequent economic recovery, significantly impacted UGA’s stock price. For example, the initial market downturn in early 2020 led to a temporary decline in UGA’s stock price, followed by a substantial rebound as the economy recovered. Similarly, rising inflation and interest rate hikes in 2022 could have contributed to increased market volatility and impacted UGA’s stock price.

The correlation between economic indicators and UGA’s stock price movements requires further in-depth analysis using specific economic data and statistical methods.

Factors Influencing UGA Stock Price

UGA’s stock price is influenced by a complex interplay of internal and external factors. Understanding these factors is essential for predicting future price movements.

Internal Factors

- Company Performance: Strong financial results, including revenue growth and profitability, generally lead to higher stock prices.

- New Product Launches: Successful product introductions can boost investor confidence and drive stock price appreciation.

- Management Changes: Changes in leadership can impact investor sentiment, either positively or negatively, depending on the perceived competence and experience of the new management team.

- Research and Development Investments: Significant investments in R&D can signal future growth potential, influencing investor perception and stock valuation.

External Factors

- Industry Trends: Positive industry trends, such as increasing market demand or technological advancements, can benefit UGA’s stock price.

- Government Regulations: Changes in government regulations, particularly those affecting UGA’s industry, can significantly impact its stock price.

- Competitor Actions: The actions of competitors, such as new product launches or aggressive pricing strategies, can influence UGA’s market share and profitability, thus affecting its stock price.

- Economic Conditions: Overall economic health, including GDP growth, inflation, and unemployment rates, can influence investor sentiment and market performance, impacting UGA’s stock price.

Relative Influence of Internal vs. External Factors

Over the past year, both internal and external factors have played a significant role in shaping UGA’s stock price. However, the relative importance of these factors can vary depending on the specific circumstances. For instance, a strong company performance might offset negative external factors, while a poor performance might exacerbate the impact of external headwinds. A detailed analysis comparing the relative impact of internal versus external factors would require a comprehensive study using econometric modeling and statistical analysis.

UGA Stock Price Valuation

Several valuation methods can be used to assess the intrinsic value of UGA’s stock and compare it to its market price. This section discusses some common approaches and illustrates how changes in key factors can affect the perceived value.

Valuation Methods

Common valuation methods include discounted cash flow (DCF) analysis, which estimates the present value of future cash flows, and price-to-earnings (P/E) ratio, which compares a company’s stock price to its earnings per share. Other methods include the dividend discount model and asset-based valuation, each with its own strengths and weaknesses. The choice of method depends on the specifics of UGA’s business model and available data.

Hypothetical Scenario: Impact of Earnings Per Share

Let’s assume that UGA’s current earnings per share (EPS) is $1.00, and its P/E ratio is 15. This implies a current stock price of $15.00 ($1.00 EPS

– 15 P/E). If UGA’s EPS increases to $1.20 due to improved operational efficiency, and the P/E ratio remains constant, the new stock price would be $18.00 ($1.20 EPS

– 15 P/E), representing a 20% increase.

Implications of Different Valuation Approaches

Different valuation methods can yield different estimates of UGA’s intrinsic value. These differences arise from the underlying assumptions and data used in each method. For example, the DCF model relies on projections of future cash flows, which are inherently uncertain. The P/E ratio, on the other hand, relies on historical earnings data and may not accurately reflect future growth potential.

A comprehensive valuation should consider multiple methods to arrive at a more robust estimate of UGA’s intrinsic value.

UGA Stock Price Prediction and Forecasting

Predicting future stock prices is inherently challenging, but various models can provide potential scenarios based on different assumptions. This section explores potential future scenarios for UGA’s stock price using hypothetical examples.

Potential Future Scenarios, Uga stock price

| Scenario | Assumption | Predicted Price (1 Year) (USD) | Predicted Price (5 Years) (USD) |

|---|---|---|---|

| Optimistic | Strong revenue growth, successful new product launches, positive industry trends | 20.00 | 30.00 |

| Neutral | Moderate revenue growth, stable industry conditions, no major disruptions | 17.00 | 25.00 |

| Pessimistic | Slow revenue growth, increased competition, negative industry trends | 14.00 | 20.00 |

Forecasting Models

Time series analysis, which uses historical stock price data to predict future prices, and fundamental analysis, which assesses the intrinsic value of the company based on its financial statements and other factors, are two common forecasting models. Each model has its own strengths and weaknesses and may yield different predictions for UGA’s stock price. The accuracy of these predictions depends on the accuracy of the underlying assumptions and the quality of the data used.

Limitations of Stock Price Prediction

Predicting future stock prices is inherently uncertain due to the unpredictable nature of the market and the influence of numerous factors. Unforeseen events, such as economic downturns, geopolitical instability, or unexpected company-specific news, can significantly impact UGA’s stock price. Therefore, any prediction should be viewed with caution and considered as one of many possible outcomes.

Monitoring the UGA stock price requires a keen eye on market trends. Understanding similar company performance can be insightful, and researching the projected tcbp stock price target offers a comparative perspective. This analysis, while focused on TCB, can help inform broader predictions regarding the overall market climate and, consequently, the future trajectory of the UGA stock price.

Investor Sentiment and UGA Stock Price

Investor sentiment plays a crucial role in driving short-term and long-term price fluctuations. This section explores how various factors influence investor sentiment and its impact on UGA’s stock price.

Influence of News and Social Media

News articles, social media trends, and analyst reports significantly influence investor sentiment towards UGA. Positive news, such as strong earnings reports or positive product reviews, can boost investor confidence and drive up the stock price. Conversely, negative news, such as product recalls or regulatory issues, can negatively impact investor sentiment and lead to a decline in the stock price. Social media platforms can amplify both positive and negative sentiment, creating rapid price swings.

Historical Impact of Sentiment Shifts

Historically, shifts in investor sentiment have had a significant impact on UGA’s stock price. For example, periods of high investor confidence have been associated with strong stock price performance, while periods of uncertainty or fear have led to price declines. These shifts are often reflected in the trading volume and volatility of UGA’s stock.

Role of Investor Confidence

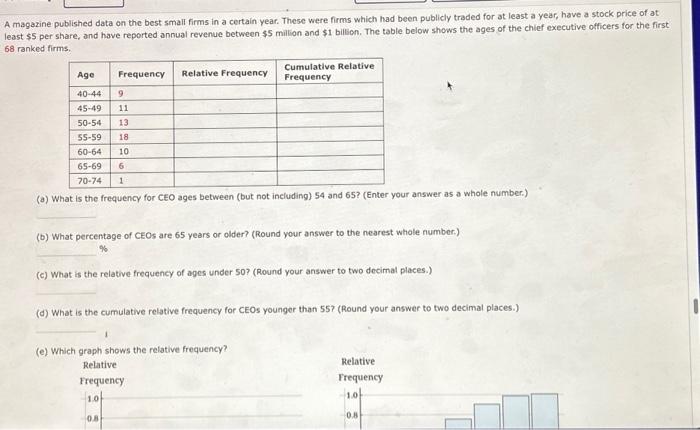

Source: cheggcdn.com

Investor confidence is a key driver of both short-term and long-term price fluctuations. High investor confidence leads to increased demand for UGA’s stock, pushing up the price. Conversely, low investor confidence can lead to selling pressure and price declines. Maintaining investor confidence requires consistent communication, transparency, and strong financial performance from UGA.

Common Queries: Uga Stock Price

What are the major risks associated with investing in UGA stock?

Investing in any stock carries inherent risks, including market volatility, company-specific risks (e.g., poor management, declining profitability), and macroeconomic factors. Thorough due diligence is crucial before investing.

Where can I find real-time UGA stock price data?

Real-time stock quotes for UGA can be found on major financial websites and trading platforms such as Yahoo Finance, Google Finance, Bloomberg, and others.

How frequently is UGA stock price data updated?

Real-time stock prices are typically updated every few seconds during market hours. Historical data is usually available at the end of each trading day.

What are the typical trading hours for UGA stock?

Trading hours for UGA stock will depend on the exchange it is listed on. Generally, this will align with the standard trading hours of that specific exchange.