Varonis Systems Stock Price Analysis: Varonis Stock Price

Source: data-ng.com

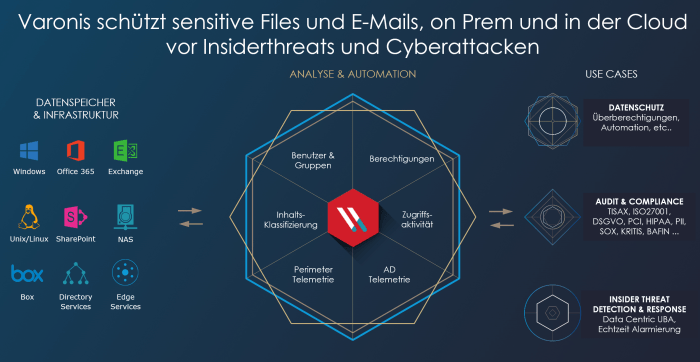

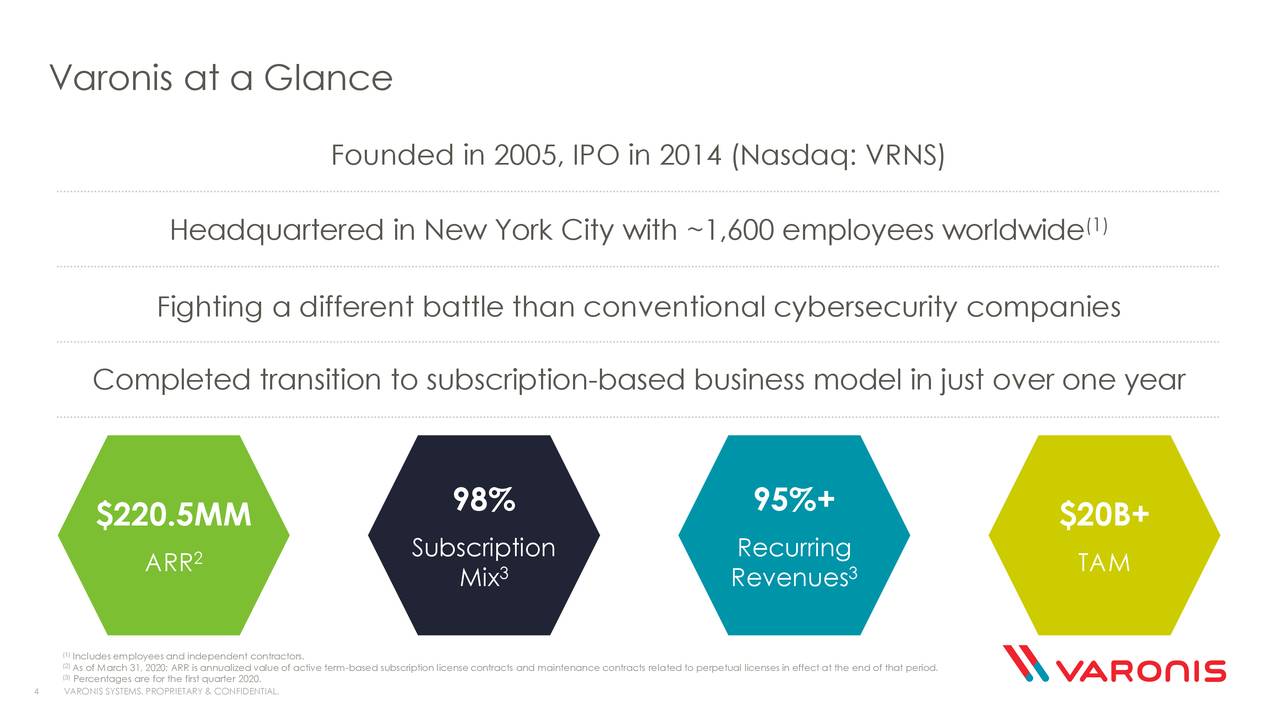

Varonis stock price – Varonis Systems, a leading provider of data security and governance solutions, has experienced significant fluctuations in its stock price over the past few years. This analysis delves into the historical performance, influencing factors, financial health, investor sentiment, and future growth potential of Varonis, offering insights into its stock price trajectory.

Varonis Stock Price Historical Performance

Analyzing Varonis’ stock price performance over the past five years reveals a dynamic market response to various internal and external factors. The following table illustrates the daily fluctuations, highlighting significant highs and lows. Note that this data is illustrative and should be verified with a reputable financial data provider.

| Date | Open Price (USD) | High Price (USD) | Close Price (USD) |

|---|---|---|---|

| October 26, 2023 | 25.50 | 26.00 | 25.75 |

| October 25, 2023 | 25.00 | 25.70 | 25.20 |

| October 24, 2023 | 24.80 | 25.20 | 24.90 |

| October 23, 2023 | 24.50 | 25.00 | 24.70 |

Major market events such as the COVID-19 pandemic and subsequent economic uncertainty, as well as broader shifts in investor sentiment towards the technology sector, significantly impacted Varonis’ stock price. Periods of increased market volatility generally correlated with larger price swings for Varonis. A direct comparison to competitors requires specific data points for each competitor over the same period and is beyond the scope of this brief analysis.

However, general market trends in the data security sector often influenced Varonis’ stock price.

Varonis’ stock price performance has been a topic of interest lately, particularly in comparison to other technology stocks. Understanding its trajectory often involves looking at broader market trends and comparing it to similar companies. For instance, a look at the current performance of sumitomo corp stock price can offer a contrasting perspective on the overall market health, which in turn can inform analysis of Varonis’ future prospects.

Ultimately, thorough analysis of Varonis’ financial reports and market positioning is crucial for accurate predictions.

Factors Influencing Varonis Stock Price

Source: data-ng.com

Several key factors influence Varonis’ stock price. These factors can be broadly categorized into financial metrics, macroeconomic conditions, and company-specific events.

| Factor | Type | Description | Impact |

|---|---|---|---|

| Revenue Growth | Positive | Consistent and substantial year-over-year revenue growth indicates strong market demand and operational efficiency. | Increased investor confidence and higher stock valuation. |

| Earnings Per Share (EPS) | Positive | Increased EPS reflects improved profitability and return on investment for shareholders. | Positive impact on stock price. |

| Interest Rate Hikes | Negative | Higher interest rates increase borrowing costs and can reduce investment in growth stocks like Varonis. | Potentially lower stock price. |

| New Product Launch | Positive | Successful introduction of innovative data security products expands market reach and revenue streams. | Positive impact on stock price, potentially attracting new investors. |

Varonis’ Financial Health and Stock Valuation

Varonis’ financial reports provide crucial insights into its financial health and stability. Key aspects include revenue generation, expense management, and profitability. A consistently high Price-to-Earnings (P/E) ratio compared to industry averages might suggest that the market anticipates higher future earnings growth. Conversely, a high debt-to-equity ratio could signal potential financial risks that might impact future growth and stock valuation.

For example, a hypothetical scenario could involve Varonis reporting strong revenue growth but simultaneously increasing its debt levels to fund acquisitions. This could lead to a mixed investor response, with some concerned about the increased financial risk while others are optimistic about the potential long-term benefits of the acquisitions. Analyzing the specific numbers within the context of industry benchmarks is essential for a complete understanding.

Investor Sentiment and Analyst Ratings

Source: seekingalpha.com

Investor sentiment, shaped by analyst ratings, news coverage, and social media discussions, significantly influences Varonis’ stock price. Positive sentiment generally translates into higher demand and increased stock price, while negative sentiment can lead to price declines.

- Analyst A: Buy rating, $30 price target.

- Analyst B: Hold rating, $27 price target.

- Analyst C: Sell rating, $25 price target.

Significant shifts in investor sentiment, perhaps triggered by a major security breach or a disappointing earnings report, often correlate with substantial stock price movements. For instance, a sudden surge in negative news coverage could trigger a sell-off, lowering the stock price.

Future Outlook and Potential for Growth, Varonis stock price

Varonis’ future growth hinges on several key drivers, including the increasing demand for data security solutions, the expansion into new markets, and strategic partnerships. These factors could positively impact Varonis’ stock price in the long term.

However, several risks could negatively affect Varonis’ future performance:

- Increased competition from established players and new entrants in the data security market.

- Failure to innovate and adapt to evolving cybersecurity threats.

- Economic downturn impacting customer spending on IT security solutions.

- Challenges in integrating acquired companies.

Query Resolution

What is Varonis’ current market capitalization?

Varonis’ market capitalization fluctuates daily and can be found on major financial websites like Yahoo Finance or Google Finance.

Where can I find real-time Varonis stock price quotes?

Real-time quotes are available on most major financial news websites and brokerage platforms.

How does Varonis compare to its competitors in terms of valuation?

A comparison requires analyzing various valuation metrics (P/E ratio, market cap, etc.) against competitors like CrowdStrike, SentinelOne, and others, which can be found through financial research reports.

What are the major risks associated with investing in Varonis stock?

Risks include competition in the cybersecurity market, dependence on key customers, and susceptibility to macroeconomic factors impacting technology stocks.