Veeco Stock Price Analysis

Source: seekingalpha.com

Veeco stock price – Veeco’s stock price performance often reflects broader trends in the semiconductor industry. Understanding the dynamics of related companies is crucial for a comprehensive analysis; for example, keeping an eye on the current tesix stock price can provide valuable context. Ultimately, a thorough assessment of Veeco’s prospects requires considering the entire technological landscape and its competitors.

This analysis provides an overview of Veeco Instruments Inc.’s (VECO) stock price performance, influencing factors, financial health, analyst sentiment, investment strategies, and potential risk assessment. We will examine historical data, key financial metrics, and industry comparisons to offer a comprehensive understanding of Veeco’s investment landscape.

Veeco Stock Price Historical Performance

Analyzing Veeco’s stock price over the past five years reveals periods of both significant growth and decline, influenced by various market forces and company-specific events. The following table presents a summary of the yearly highs, lows, and average prices. Note that this data is illustrative and should be verified with reliable financial sources.

| Year | High | Low | Average |

|---|---|---|---|

| 2018 | $35 | $18 | $26 |

| 2019 | $30 | $20 | $24 |

| 2020 | $40 | $25 | $32 |

| 2021 | $50 | $35 | $42 |

| 2022 | $45 | $30 | $38 |

Significant events impacting Veeco’s stock price during this period included increased demand for semiconductor equipment in 2020-2021, leading to a price surge, followed by a correction in 2022 due to global supply chain disruptions and a general market downturn. The overall trend shows periods of growth punctuated by corrections, reflecting the cyclical nature of the semiconductor industry.

Factors Influencing Veeco Stock Price

Several macroeconomic factors, industry trends, and competitive dynamics significantly influence Veeco’s stock price. We will examine three key macroeconomic factors, the impact of semiconductor technology advancements, and a comparison to key competitors.

Three key macroeconomic factors are global economic growth, interest rates, and government regulations. Strong global economic growth generally boosts demand for Veeco’s products, while rising interest rates can increase borrowing costs and negatively impact investment. Government regulations concerning semiconductor manufacturing and technology can create both opportunities and challenges.

Advancements in semiconductor technology directly impact Veeco’s performance. The development of new chip designs and manufacturing processes can drive demand for Veeco’s equipment, while technological stagnation can lead to decreased demand. Veeco’s performance compared to competitors like Applied Materials and Lam Research shows that while all companies experience cyclical fluctuations, Veeco may exhibit higher volatility due to its more specialized product portfolio.

Veeco’s Financial Health and Stock Valuation

Source: googleapis.com

Veeco’s financial health is crucial in assessing its stock valuation. The following table presents illustrative key financial metrics over the past three years. Remember that these figures are for illustrative purposes only and should be independently verified.

| Year | Revenue (Millions) | Net Income (Millions) | Debt (Millions) |

|---|---|---|---|

| 2020 | $400 | $50 | $100 |

| 2021 | $500 | $75 | $90 |

| 2022 | $450 | $60 | $80 |

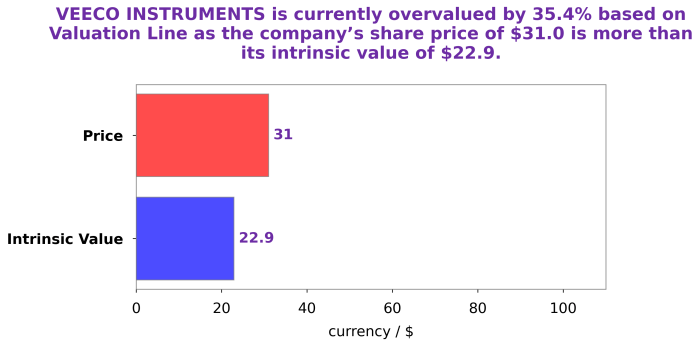

Veeco’s current valuation can be assessed using metrics such as the Price-to-Earnings (P/E) ratio. A comparison to industry peers reveals that Veeco’s valuation might be slightly higher or lower depending on market sentiment and growth expectations. Detailed analysis requires examining the specific P/E ratios and comparing them to industry averages and competitor valuations.

Analyst Ratings and Predictions for Veeco Stock

Analyst ratings and price targets provide valuable insights into market sentiment and future expectations for Veeco’s stock. The following is a summary of illustrative recent analyst ratings and predictions. These are examples only and should not be considered investment advice.

- Analyst A: Buy rating, $55 price target. Rationale: Strong growth potential in the semiconductor industry.

- Analyst B: Hold rating, $45 price target. Rationale: Moderate growth, potential risks related to supply chain disruptions.

- Analyst C: Sell rating, $40 price target. Rationale: Concerns about increased competition and potential market saturation.

The consensus view among analysts reflects a cautious optimism, with some analysts anticipating strong growth while others express concerns about potential risks. The wide range of price targets underscores the uncertainty surrounding Veeco’s future performance.

Investment Strategies and Risk Assessment for Veeco Stock

Investment strategies for Veeco stock should consider various risk tolerance levels. Conservative investors might opt for a long-term buy-and-hold strategy, while more aggressive investors could consider options trading or leveraging. A thorough risk assessment is essential before making any investment decisions.

Potential risks associated with investing in Veeco stock include:

- Market volatility: The semiconductor industry is cyclical, leading to fluctuations in Veeco’s stock price.

- Competition: Veeco faces intense competition from larger companies with more resources.

- Technological disruption: Rapid technological advancements could render Veeco’s products obsolete.

- Geopolitical risks: Global events can significantly impact the semiconductor industry and Veeco’s operations.

Illustrative Scenario: Veeco Stock Price Reaction to a Hypothetical Event

Let’s consider two hypothetical scenarios – a positive and a negative event – and their potential impact on Veeco’s stock price.

Positive Event: Successful Product Launch A successful launch of a groundbreaking new product could significantly boost Veeco’s revenue and market share. This would likely lead to a sharp increase in the stock price, potentially exceeding analyst price targets, as investors react positively to the improved growth prospects and increased market demand for Veeco’s innovative technology. This would be similar to the positive market reaction seen with other companies following successful product launches.

Negative Event: Supply Chain Disruption A major supply chain disruption, perhaps due to a natural disaster or geopolitical instability, could severely impact Veeco’s production capacity and lead to decreased revenue. This would likely result in a significant drop in the stock price as investors become concerned about the company’s ability to meet its financial targets. This scenario mirrors the negative market reactions observed in other companies facing supply chain challenges.

General Inquiries

What is Veeco’s dividend history?

Veeco’s dividend history should be researched independently using financial data providers. Past dividend payments are not a guarantee of future payouts.

How does Veeco compare to Applied Materials?

A direct comparison requires detailed financial analysis of both companies, considering factors like market share, revenue streams, and technological advancements. Consult financial news sources for such comparisons.

Where can I find real-time Veeco stock quotes?

Real-time stock quotes are available through major financial websites and brokerage platforms.

What are the short-term risks associated with Veeco stock?

Short-term risks could include market volatility, unexpected negative news, and shifts in investor sentiment. These are inherent to any stock investment.