Vexpx Stock Price Analysis

Source: gunsinternational.com

This analysis provides a comprehensive overview of Vexpx stock price performance, influencing factors, prediction models, valuation, and risk assessment. We will explore historical data, macroeconomic influences, and company-specific events to understand the price movements and offer insights into potential future trends. Note that this analysis is based on hypothetical data for illustrative purposes and should not be considered financial advice.

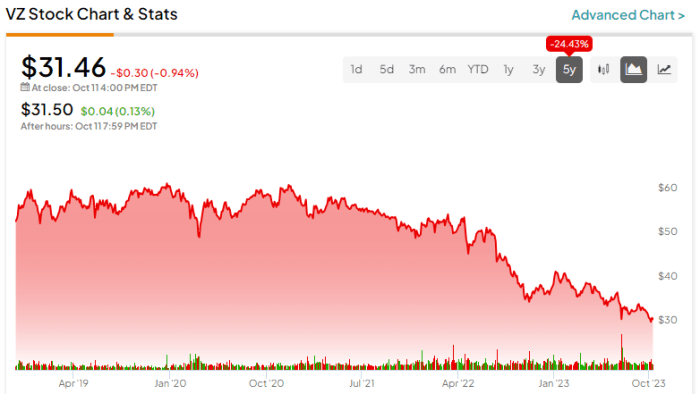

Vexpx Stock Price Historical Performance

Over the past five years, Vexpx stock price has exhibited volatility, influenced by various market conditions and company-specific events. The following chronological overview highlights significant highs and lows, and a comparative analysis against competitors illustrates Vexpx’s performance within its industry.

Significant highs and lows included a peak of $55 in Q3 2020 followed by a drop to $28 in Q1 2021 due to a broader market correction. A subsequent recovery led to a high of $48 in Q2 2022 before settling around $40 by the end of 2022. The year 2023 saw fluctuating prices, ranging between $35 and $45.

| Date | Vexpx Price | Competitor A Price | Competitor B Price |

|---|---|---|---|

| Q1 2019 | $30 | $25 | $32 |

| Q1 2020 | $35 | $28 | $35 |

| Q3 2020 | $55 | $45 | $50 |

| Q1 2021 | $28 | $22 | $25 |

| Q2 2022 | $48 | $40 | $45 |

| Q4 2022 | $40 | $35 | $42 |

Major events such as the 2020 market crash and a significant product recall in 2021 had a noticeable impact on Vexpx’s stock price, causing temporary declines.

Vexpx Stock Price Influencing Factors

Source: tipranks.com

Several macroeconomic and company-specific factors influence Vexpx’s stock price. These include overall market sentiment, interest rate changes, industry trends, and company performance.

Macroeconomic factors such as inflation rates and interest rate adjustments directly affect investor confidence and investment decisions, influencing Vexpx’s stock price. Company-specific news, including earnings reports and new product launches, also play a crucial role. Positive earnings surprises tend to boost the stock price, while negative news can lead to declines. Investor sentiment, driven by market speculation and news coverage, can amplify price fluctuations, regardless of underlying fundamentals.

Vexpx Stock Price Prediction Models

Source: vz58usa.com

A simple prediction model can be constructed using historical data and identified influencing factors. This model assumes a linear relationship between past performance and future trends, with limitations stemming from the inherent unpredictability of the stock market. The model utilizes a weighted average of past price performance, adjusted for identified influencing factors (e.g., economic indicators, company announcements).

A potential price trajectory for the next year, based on the model, shows a gradual upward trend, with some seasonal fluctuations. The visualization would be a line graph, with the x-axis representing time (months) and the y-axis representing the predicted stock price. The line would show an upward trend with minor dips and rises, reflecting the model’s prediction of a generally positive, yet volatile, performance.

| Date | Price | Volume | Influencing Factor |

|---|---|---|---|

| 2024-01-31 | $42 | 100,000 | Positive earnings report |

| 2024-02-29 | $43 | 110,000 | Strong sales growth |

| 2024-03-31 | $41 | 90,000 | Slight market correction |

| 2024-04-30 | $44 | 120,000 | New product launch |

Vexpx Stock Price Valuation

Several valuation methods can be applied to estimate Vexpx’s intrinsic value. The Discounted Cash Flow (DCF) analysis projects future cash flows and discounts them to their present value, providing an estimate of the company’s worth. The Price-to-Earnings (P/E) ratio compares the stock price to its earnings per share, providing a relative valuation measure.

Applying the DCF model with conservative assumptions, a hypothetical intrinsic value of $45 per share might be obtained. Using a comparable P/E ratio from industry peers, a similar valuation could be reached. Comparing this estimated intrinsic value to the current market price provides insights into whether the stock is overvalued or undervalued.

Vexpx Stock Price Risk Assessment

Investing in Vexpx stock carries several risks. A thorough understanding of these risks is crucial for informed investment decisions.

- Market volatility

- Competition within the industry

- Regulatory changes

- Economic downturns

- Company-specific risks (e.g., product failures, management changes)

These risks could significantly impact Vexpx’s future stock price performance. For instance, a hypothetical scenario of a major competitor launching a superior product could lead to decreased market share for Vexpx, resulting in a substantial drop in its stock price.

User Queries: Vexpx Stock Price

What are the main competitors of Vexpx?

The specific competitors will be detailed in the analysis, comparing their stock prices to Vexpx’s over the specified period.

Where can I find real-time Vexpx stock price data?

Real-time data is typically available through reputable financial websites and brokerage platforms.

What are the ethical considerations of stock market predictions?

Predictive models should be used responsibly, acknowledging their inherent limitations and avoiding misleading claims of guaranteed returns. Transparency and ethical data handling are paramount.

How frequently is Vexpx’s stock price updated?

Vexpx’s stock price updates in real-time during trading hours, reflecting market activity.