Vanguard S&P 500 ETF (VOO): A Comprehensive Analysis

Source: etfvest.com

Voo etf stock price – The Vanguard S&P 500 ETF (VOO) is a popular choice for investors seeking broad market exposure. This analysis delves into VOO’s characteristics, performance, risk factors, and its role within a diversified investment strategy.

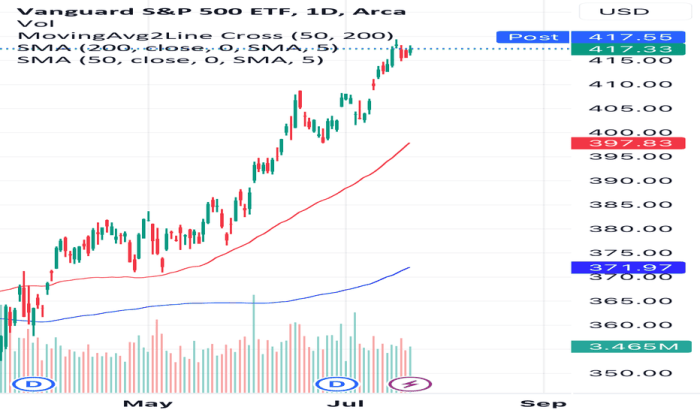

VOO ETF Overview

Source: tradingview.com

The Vanguard S&P 500 ETF (VOO) is an exchange-traded fund that tracks the S&P 500 index, aiming to provide investors with a diversified portfolio mirroring the performance of 500 large-cap U.S. companies. Its investment objective is to closely match the S&P 500’s total return, including dividends. The strategy involves passively managing the fund by holding a portfolio of stocks that closely mirrors the index’s composition.

VOO has demonstrated strong historical performance, largely mirroring the growth of the S&P 500. Key milestones include consistent growth over the long term, although experiencing periods of significant decline mirroring broader market corrections, such as the 2008 financial crisis and the COVID-19 market crash in 2020. Recovery from these events highlights the fund’s resilience. Specific performance figures should be obtained from reliable financial sources for accurate representation.

| ETF Name | Expense Ratio | AUM (Approximate) | Inception Date |

|---|---|---|---|

| VOO | 0.03% | $300 Billion+ | September 2010 |

| IVV | 0.03% | $400 Billion+ | September 2000 |

| SPY | 0.09% | $400 Billion+ | January 1993 |

Note: AUM (Assets Under Management) and other figures are approximate and subject to change.

Factors Influencing VOO Stock Price

Several macroeconomic factors significantly impact VOO’s price. These include interest rate changes implemented by the Federal Reserve, inflation rates, economic growth (or contraction), and geopolitical events. Strong economic growth generally correlates with higher VOO prices, while recessionary periods tend to negatively impact the fund’s value.

The performance of specific sectors within the S&P 500 directly influences VOO. For example, strong performance in technology or healthcare sectors can boost VOO’s overall return, while underperformance in these or other significant sectors can negatively affect it. Key market indicators such as the Consumer Price Index (CPI), the Producer Price Index (PPI), and the unemployment rate provide valuable insights into the overall economic health and therefore influence VOO’s price fluctuations.

Long-term market trends tend to have a more substantial impact on VOO than short-term fluctuations. While daily or weekly price changes can be significant, the overall trajectory of the S&P 500 over years or decades tends to be upward, reflecting the long-term growth of the U.S. economy. Short-term trends, however, can be influenced by news events, investor sentiment, and speculation, leading to greater volatility.

VOO ETF Price Volatility and Risk

VOO’s historical volatility mirrors that of the S&P 500. It has experienced periods of significant price swings, particularly during market downturns. The inherent risks associated with investing in VOO include market risk (the potential for overall market declines), sector-specific risk (underperformance of specific sectors within the S&P 500), and inflation risk (the erosion of purchasing power due to inflation).

Diversification is crucial in mitigating these risks. By including VOO in a portfolio alongside other asset classes such as bonds, international stocks, or real estate, investors can reduce the overall portfolio’s volatility and improve its risk-adjusted returns. A hypothetical portfolio could include 60% VOO, 30% bonds, and 10% international stocks. This diversification reduces the impact of a potential downturn in the U.S.

stock market.

VOO ETF Trading and Investment Strategies

Several trading strategies can be employed with VOO. Buy-and-hold is a long-term strategy, suitable for investors with a long-term horizon and a higher risk tolerance. Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of price fluctuations, reducing the risk of investing a lump sum at a market peak. Other strategies, such as value investing or growth investing, can be applied to the broader market through VOO, but require additional market analysis beyond simply tracking the index.

Incorporating VOO into a long-term investment plan requires understanding one’s risk tolerance and financial goals. VOO’s high liquidity (due to its large trading volume) makes it easy to buy and sell shares. Calculating potential returns depends on the investment time horizon and the assumed rate of return. For example, a $10,000 investment with a 7% annual return over 10 years would yield approximately $19,671 (assuming compounding).

This is just an illustration; actual returns will vary.

VOO ETF and its Place in a Portfolio, Voo etf stock price

VOO plays a crucial role in a diversified portfolio by providing broad market exposure to large-cap U.S. stocks. It serves as a core holding, providing a stable foundation for growth.

- Sample Portfolio Allocation: 60% VOO (US Large-Cap Stocks), 20% Bonds (Fixed Income), 10% International Stocks, 10% Real Estate

Benefits of using VOO as a core holding include diversification, low expense ratio, and ease of trading. Drawbacks include its susceptibility to overall market fluctuations and its limited exposure to smaller companies or international markets. Adjusting VOO allocation depends on individual risk tolerance and financial goals. Conservative investors might allocate a smaller percentage to VOO, while more aggressive investors might allocate a larger percentage.

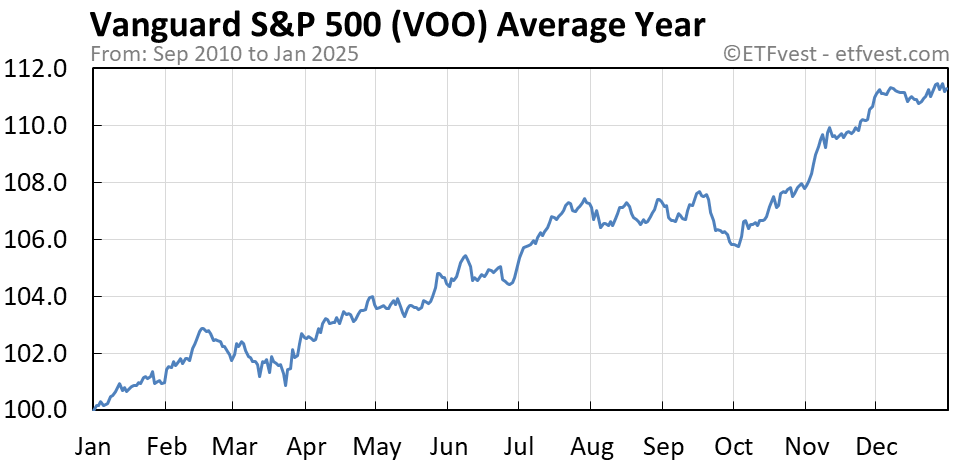

Visual Representation of VOO Price History

Source: thoughtfulfinance.com

A five-year chart of VOO’s price history would typically display a line graph, with the x-axis representing time and the y-axis representing the price per share. The line itself would show the price fluctuations over the period. Significant upward trends would be easily identifiable as sustained periods of price increase, while downward trends would reflect market corrections or bear markets.

Key turning points, such as market highs and lows, would be visually prominent. The visual representation allows investors to quickly grasp the overall trend, volatility, and potential risk associated with VOO.

By examining the slope of the line, one can observe the rate of price changes. Steeper slopes indicate periods of rapid growth or decline. The overall shape of the line reveals the overall trend, whether it is upward (bullish), downward (bearish), or sideways (consolidation). Visual inspection allows for an intuitive understanding of historical performance and potential future price movements, although it’s crucial to remember past performance is not indicative of future results.

Common Queries: Voo Etf Stock Price

What is the minimum investment required to buy VOO?

Monitoring the VOO ETF stock price requires a keen eye on market trends. Understanding the performance of individual pharmaceutical companies, such as the fluctuations reflected in the tonix pharmaceuticals stock price , can offer insights into broader sector health, indirectly influencing the overall VOO ETF performance. Ultimately, a diversified portfolio approach helps mitigate risk associated with individual stock volatility, including both VOO and more specialized investments.

The minimum investment depends on your brokerage. Many brokers allow fractional shares, meaning you can buy a portion of a share, so there’s often no minimum beyond the cost of one share or a fraction thereof.

How often does the VOO ETF distribute dividends?

VOO typically distributes dividends quarterly.

Are there any tax implications for investing in VOO?

Yes, dividends received from VOO are taxable as ordinary income. Capital gains realized upon selling VOO shares are also taxable.

How does VOO compare to other S&P 500 ETFs in terms of trading volume?

VOO generally boasts high trading volume, ensuring liquidity and ease of buying and selling.