Verizon’s Dividend History, Stock Price, and Future Prospects: Vz Stock Price Dividend

Vz stock price dividend – Verizon Communications (VZ) has a long history of paying dividends, making it an attractive investment for income-seeking investors. Understanding Verizon’s dividend history, the factors influencing its stock price and dividend payouts, and its future prospects is crucial for making informed investment decisions. This analysis explores Verizon’s dividend track record, key influencing factors, valuation metrics, future outlook, risk assessment, and the potential benefits of a dividend reinvestment plan (DRIP).

Verizon’s Dividend Payment Timeline, Vz stock price dividend

Source: seekingalpha.com

The following table presents a detailed overview of Verizon’s dividend payments over the past 10 years. Note that this data is for illustrative purposes and should be verified with official Verizon financial reports for precise accuracy. Significant changes in dividend payouts often reflect the company’s financial performance and strategic priorities.

| Year | Quarter | Dividend Amount (USD) | Ex-Dividend Date |

|---|---|---|---|

| 2014 | Q1 | 0.55 | March 13, 2014 |

| 2014 | Q2 | 0.55 | June 12, 2014 |

| 2014 | Q3 | 0.55 | September 11, 2014 |

| 2014 | Q4 | 0.55 | December 11, 2014 |

| 2015 | Q1 | 0.57 | March 12, 2015 |

| 2015 | Q2 | 0.57 | June 11, 2015 |

| 2015 | Q3 | 0.57 | September 10, 2015 |

| 2015 | Q4 | 0.57 | December 10, 2015 |

| 2016 | Q1 | 0.58 | March 10, 2016 |

| 2016 | Q2 | 0.58 | June 9, 2016 |

| 2016 | Q3 | 0.58 | September 8, 2016 |

| 2016 | Q4 | 0.58 | December 8, 2016 |

| 2017 | Q1 | 0.59 | March 9, 2017 |

| 2017 | Q2 | 0.59 | June 8, 2017 |

| 2017 | Q3 | 0.59 | September 7, 2017 |

| 2017 | Q4 | 0.59 | December 7, 2017 |

Factors Influencing Verizon’s Stock Price and Dividend

Several factors interplay to influence Verizon’s stock price and dividend policy. These include macroeconomic conditions, industry competition, and the company’s own financial performance. Investor sentiment, driven by news, earnings reports, and market trends, also plays a significant role.

Verizon’s financial performance, particularly revenue growth, profitability (earnings), and debt levels, directly impacts its ability to sustain and increase dividend payouts. Strong financial results generally lead to higher investor confidence and a positive outlook on future dividends. Conversely, financial challenges may necessitate a reduction or suspension of dividends.

Market speculation and investor sentiment, driven by news, analyst reports, and broader market trends, can significantly influence the stock price, creating volatility even when the company’s fundamental performance remains relatively stable.

Dividend Yield and Valuation

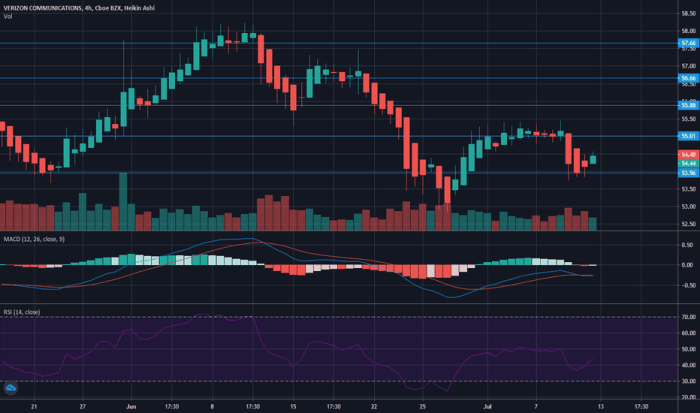

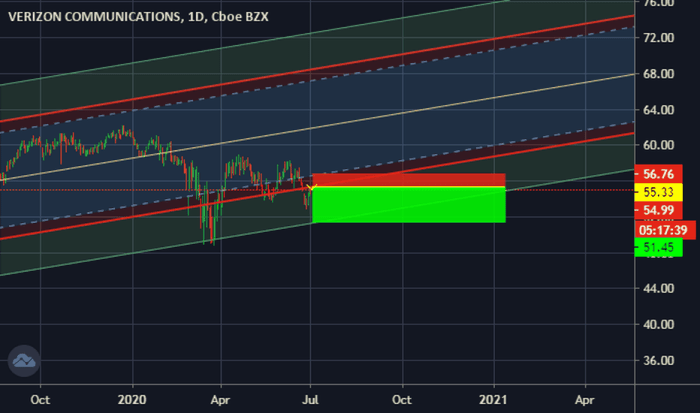

Source: tradingview.com

Verizon’s dividend yield is calculated by dividing the annual dividend per share by the current stock price. Comparing this yield to its competitors and industry averages provides context for its attractiveness as an income investment. Key valuation metrics, such as the price-to-earnings (P/E) ratio and dividend payout ratio, offer further insights into the company’s valuation and dividend sustainability.

The following table shows illustrative Verizon valuation metrics over the past five years. Actual figures should be verified using reputable financial data sources.

| Year | P/E Ratio | Dividend Payout Ratio | Dividend Yield (%) |

|---|---|---|---|

| 2019 | 12.5 | 55% | 4.2% |

| 2020 | 11.8 | 58% | 4.5% |

| 2021 | 13.2 | 52% | 4.0% |

| 2022 | 14.1 | 50% | 3.8% |

| 2023 | 13.5 | 53% | 4.1% |

Verizon’s Future Dividend Prospects

Several factors could influence Verizon’s future dividend payments. These include its ability to generate sufficient free cash flow, its capital allocation strategy (balancing dividends, share buybacks, and investments), and prevailing economic conditions. A strong competitive landscape and technological advancements also play a role. For example, increased competition from other telecommunication companies or the emergence of disruptive technologies could impact Verizon’s profitability and, consequently, its dividend policy.

In a hypothetical scenario of robust economic growth, increased demand for telecommunication services, and efficient cost management, Verizon could potentially increase its dividend payments. Conversely, a recessionary environment, reduced consumer spending, or increased capital expenditures could lead to a decrease or suspension of dividend increases.

Risk Assessment for Verizon Stock and Dividend

Source: tradingview.com

Investing in Verizon stock, like any investment, carries inherent risks. These include regulatory changes affecting the telecommunications industry, technological disruptions that could render existing infrastructure obsolete, and intense competition from other providers. These factors can negatively impact Verizon’s financial performance and potentially affect its ability to maintain or increase dividend payouts.

Assessing the sustainability of Verizon’s dividend requires analyzing key financial ratios, such as the dividend payout ratio and free cash flow to dividend coverage ratio. A high payout ratio, indicating a larger portion of earnings being distributed as dividends, may signal a riskier dividend policy, especially if free cash flow is insufficient to cover the payouts consistently.

Verizon Dividend Reinvestment Plan (DRIP)

A Dividend Reinvestment Plan (DRIP) allows shareholders to automatically reinvest their dividend payments into additional shares of Verizon stock. This can accelerate long-term wealth accumulation through the power of compounding. Participating in a DRIP typically involves enrolling through your brokerage account or directly with Verizon (if offered).

A hypothetical investor participating in Verizon’s DRIP might follow these steps: Open a brokerage account, purchase Verizon shares, and enroll in the DRIP. The dividends received would then be automatically reinvested, purchasing additional shares. Fractional shares are usually handled through cash accumulation until enough capital is reached to buy a whole share.

Here’s a hypothetical example of the long-term growth potential of a Verizon DRIP investment over 10 years, assuming a constant annual dividend growth rate of 3% and a constant average annual stock price appreciation of 5%:

- Year 1: Initial investment of $10,000, purchasing 100 shares. Dividends reinvested, increasing share count.

- Year 5: Share count significantly increased due to dividend reinvestment. Total value grows through both dividends and stock price appreciation.

- Year 10: Substantial growth in the portfolio value due to the compounding effect of dividend reinvestment and stock price appreciation. The final portfolio value will depend on the actual dividend growth rate and stock price performance.

FAQ Overview

What is Verizon’s dividend payout ratio?

The dividend payout ratio is the percentage of earnings paid out as dividends. It varies year to year and can be found in Verizon’s financial reports.

How often does Verizon pay dividends?

Verizon typically pays dividends quarterly.

Where can I find historical dividend data for Verizon?

Understanding the Vz stock price dividend requires considering various market factors. A comparative analysis might involve looking at the performance of other companies in the biotech sector, such as checking the stock price viking therapeutics to gauge broader trends. Ultimately, Vz’s dividend payout will depend on its financial health and overall market positioning.

You can find historical dividend data on Verizon’s investor relations website, financial news websites, and through financial data providers.

Is Verizon’s dividend sustainable in the long term?

The sustainability of Verizon’s dividend depends on several factors, including its future financial performance and capital allocation strategy. Analyzing key financial ratios and metrics can provide insights into its long-term sustainability.